Welcome to a brand new week traders! I did a full analysis of the latest CFTC COT Report for you and you can find it down below! I will be doing a lot of focusing on my trade plan this week and Forex testing my strategy. I encourage you to do the same. Practice makes a winning trader and that's pretty much about it. I recommend that any of you who are serious about learning Supply and Demand from someone I consider to be the best in the business, Alfonso Moreno, sign up at www.set-and-forget.com and join me and many others on our journey to learn how the market really moves. Take a look at my updated charts below for a sample of how we are killing it in the community! You can have it all if you trade like the institutions do. Money, freedom, the ability to travel anywhere at any time, nice homes and fast cars. All it takes is dedication and hard work! Don't you just love trading? You can be anywhere in the world and still be able to make $$$, but only if you trade alongside the institutions with Supply & Demand! The inspirational shots to the left are courtesy of @fiiyat on Instagram. Great profile you should follow!

Welcome to a brand new week traders! I did a full analysis of the latest CFTC COT Report for you and you can find it down below! I will be doing a lot of focusing on my trade plan this week and Forex testing my strategy. I encourage you to do the same. Practice makes a winning trader and that's pretty much about it. I recommend that any of you who are serious about learning Supply and Demand from someone I consider to be the best in the business, Alfonso Moreno, sign up at www.set-and-forget.com and join me and many others on our journey to learn how the market really moves. Take a look at my updated charts below for a sample of how we are killing it in the community! You can have it all if you trade like the institutions do. Money, freedom, the ability to travel anywhere at any time, nice homes and fast cars. All it takes is dedication and hard work! Don't you just love trading? You can be anywhere in the world and still be able to make $$$, but only if you trade alongside the institutions with Supply & Demand! The inspirational shots to the left are courtesy of @fiiyat on Instagram. Great profile you should follow!

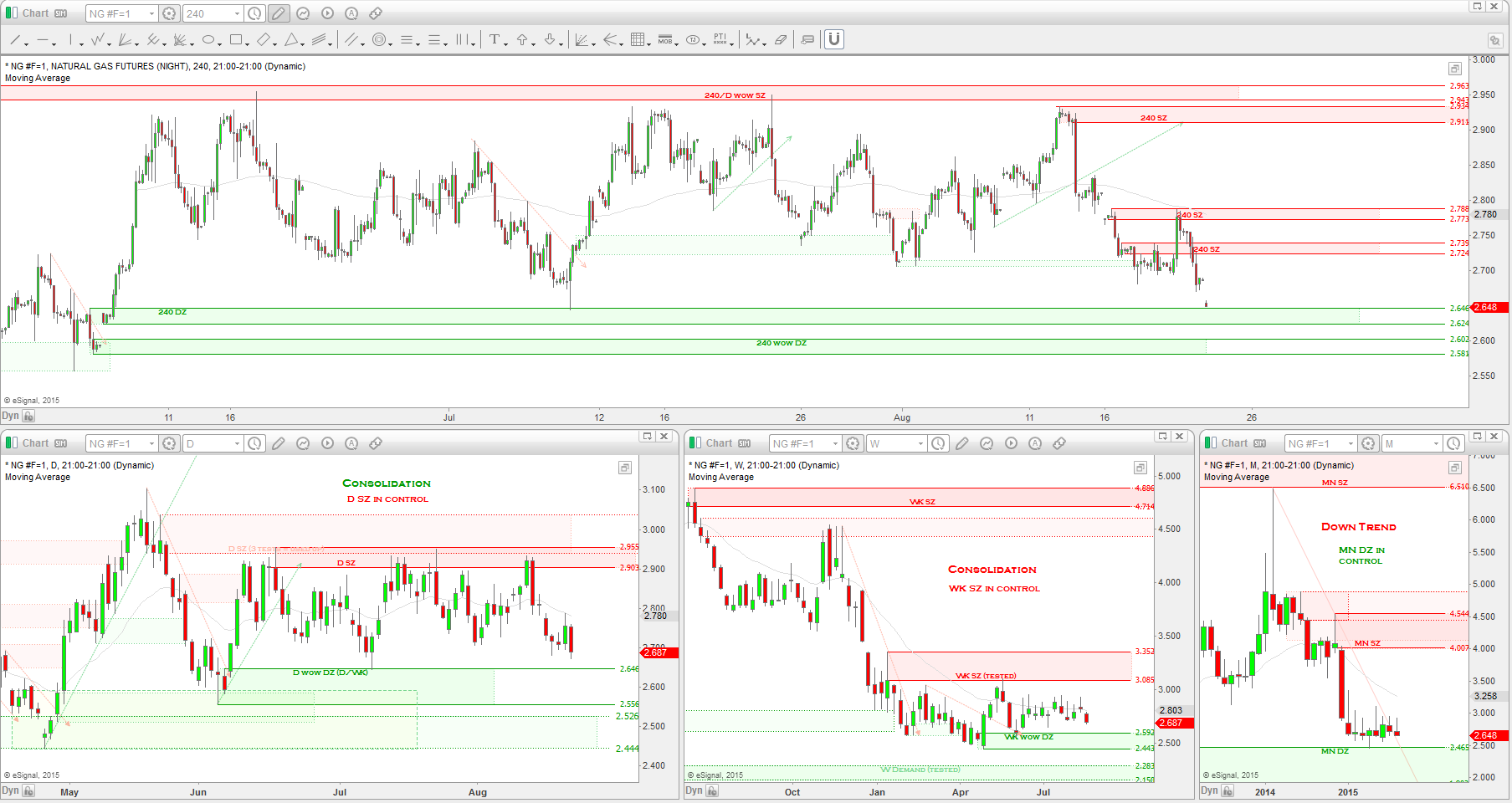

SUPPLY & DEMAND ZONES

Take note of the GREEN demand zones and RED supply zones mapped out below. These are the areas of interest for me because this is where there is a great deal of demand to fill buy orders and supply to fill sell orders from the institutions. SHADED GREEN ZONES = Strong Buy Zones

SHADED RED ZONES = Strong Sell Zones

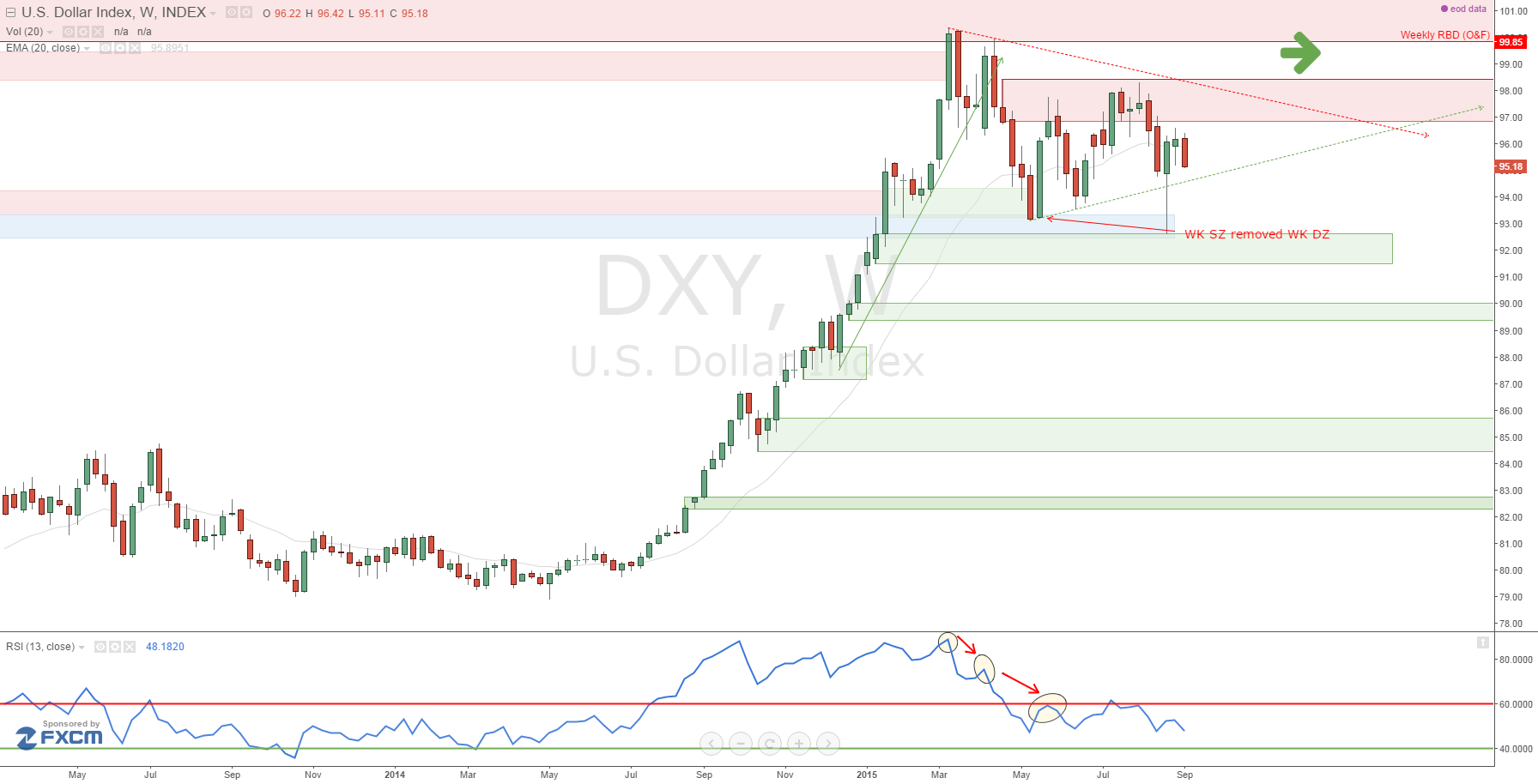

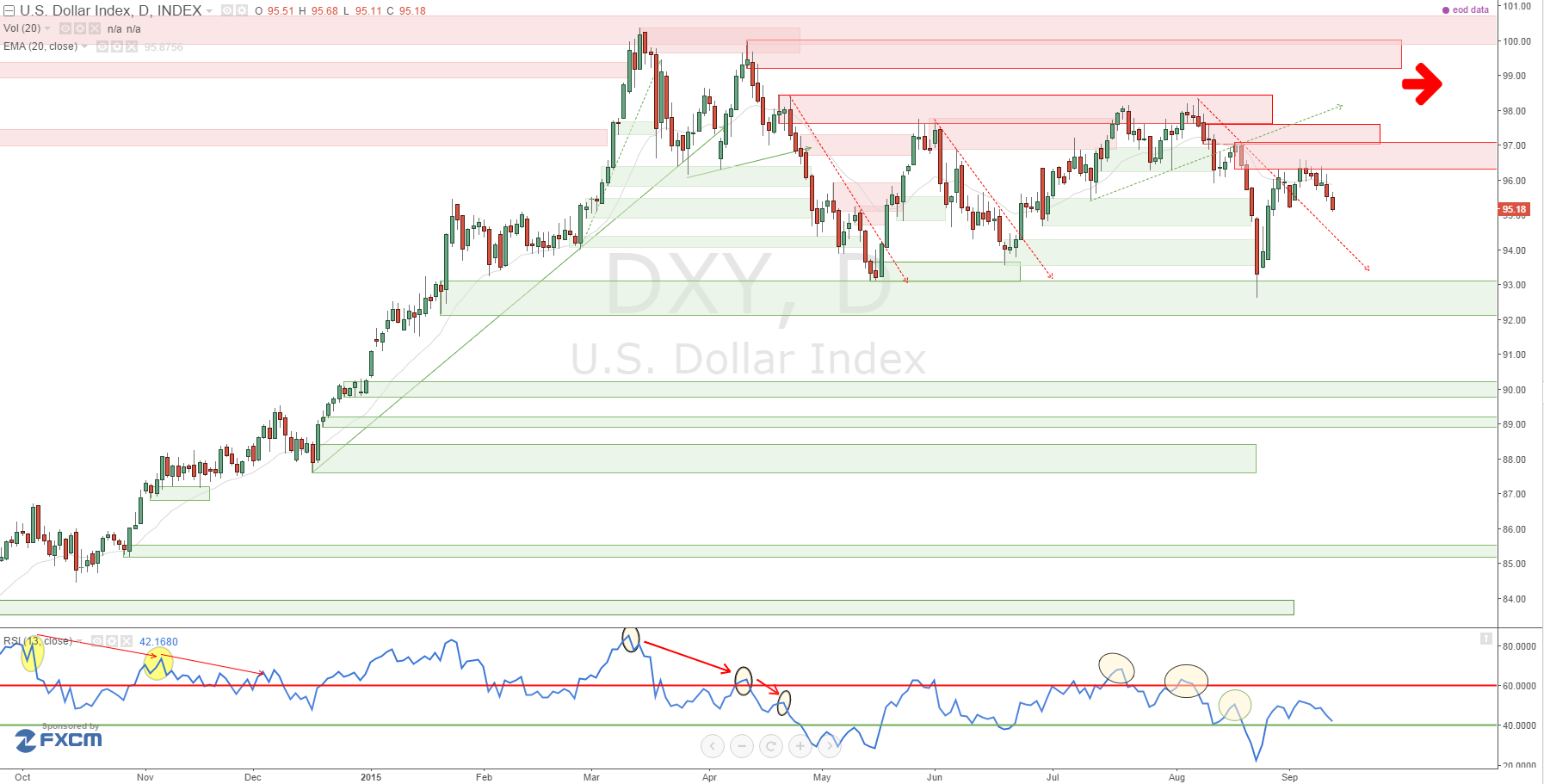

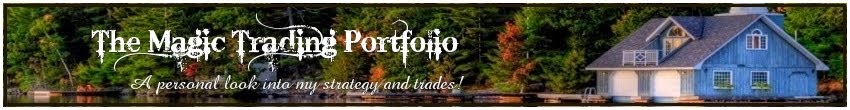

Commitment Of Traders Report: Institutional traders are VERY LONG biased. Perception of Monetary Standing: HAWKISH

$USD OVERVIEW (DAILY)

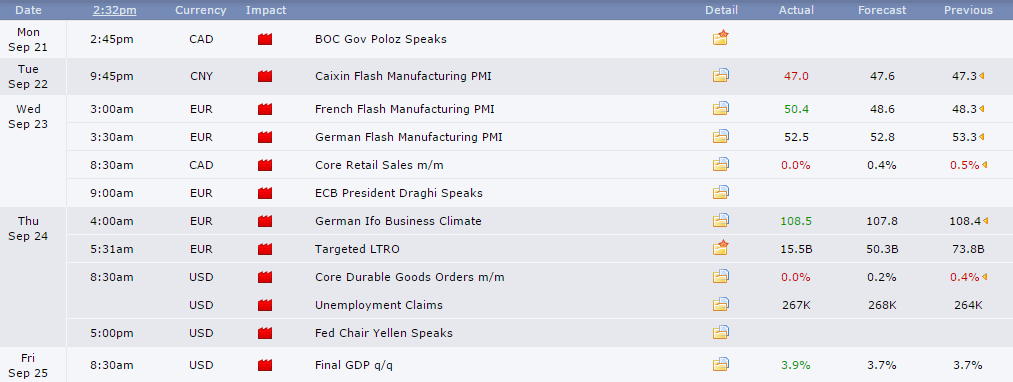

Happy Thanksgiving to all the fellow Canadian traders! What a week it was in the markets, we saw some big action as we expected to see, based on all the data that was released this past week. A big congrats to nametaker aka Nick for an amazing week of trading. He has really become an expert at reading price action. He is a testament to what will happen if you set your mind to being the best trader you can be and work your a%@ off! This week alfonso posted a very important video on examining the 6MN and 3MN charts to have a better read on what's happening with the major pairs at this very instance. What looked like a great trades when looking at the MN charts, all of a sudden became low odds set-ups when considering what was happening on the 3MN and 6MN charts. I am constantly amazed with how price action reacts to the HTF zones and being a swing trader, although 3MN and 6MN time frames seems so large when holding trades just a few days, this week was a perfect example of why these time frames are essential. I have personally changed my trading platform to now include the 3MN charts so they are visible to me at all times. As you may have noticed, i like to have all the time frames staring at me when I analyse price. I am constantly reminded of where in the story, price is currently trading within.

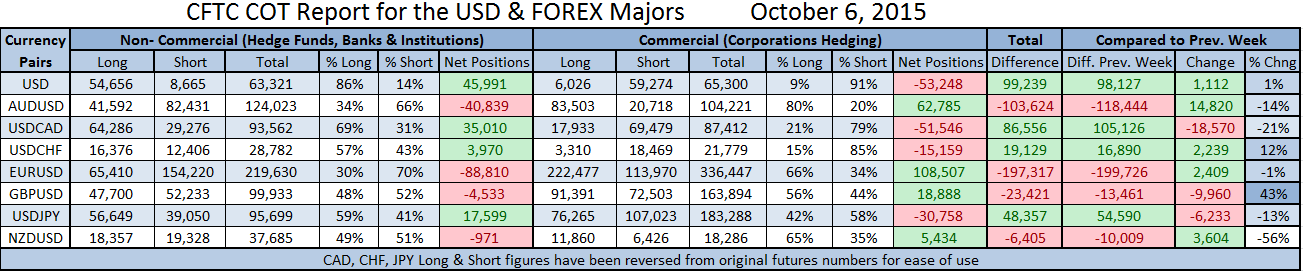

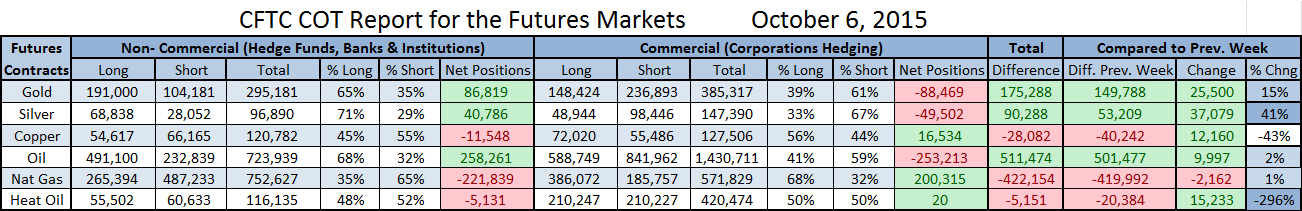

The last few weeks I have been including the data releases in with the chart to examine how the news effects price action and to be honest I am realizing that it is a waste of time. The news just moves price where the chart dictates. Supply and demand is king and institutional orders is what's important. So my focus, going forward, will be on the positions of the institutions and the adjustments to these positions so as to give us clues, confluences or warnings of critical changes in trend that is to come. I think this is where the real value in these reports come from. It is also important to note, that these reports are data that is collected on Tuesday's. So, considering that there is not much action in the market on Sunday's and Monday's are fairly slow, we can assume that the data being released is a reflection of the prior weeks trading. So going forward I will be pointing out the second last weekly candles action as I feel this will be a more accurate way of following the order flow of the institutions. Time to time you may see me change the layout of information as I will be experimenting with ways to best display the data in the most helpful way. So with all this being said, let's take a look at the latest release!

US DOLLAR > COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Institutional Positions: Hedge funds hardly adjusted their positions since the last report. If you take a look at the chart below you will see the green arrow pointing up at Septembers first week of trading, which was a red candle. The data shows us that hedge funds, during this month of consolidation, have been reducing their exposure on both the long and short side of the USD. Longs from 60k to 54k and short from 9.5k to 8.6k. The commercials, who are hedging, hold a 91% exposure to the short side, expecting continued strength. If price, does decide to start heading downwards, I would believe we should start seeing more longs being closed out and shorts being added to. This is what I will be focused on in the next few months to come.

On the charts: Tested MN Supply is in control at the moment and tested WK Supply as well. Technically, the force of price is to the downside, CFTC data confluence is yet to be seen.

https://gyazo.com/f711f4385fc63b2bd085708fd90a7a3b <<<<< CLICK ON THE LINK TO THE LEFT TO SEE A BIGGER VERSION OF THE CHART ABOVE!

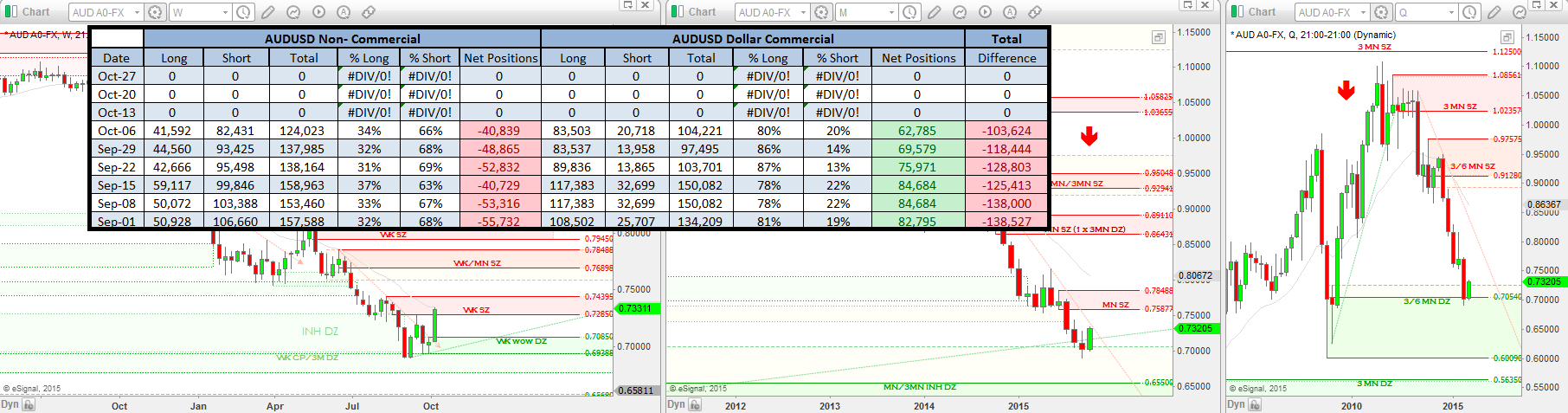

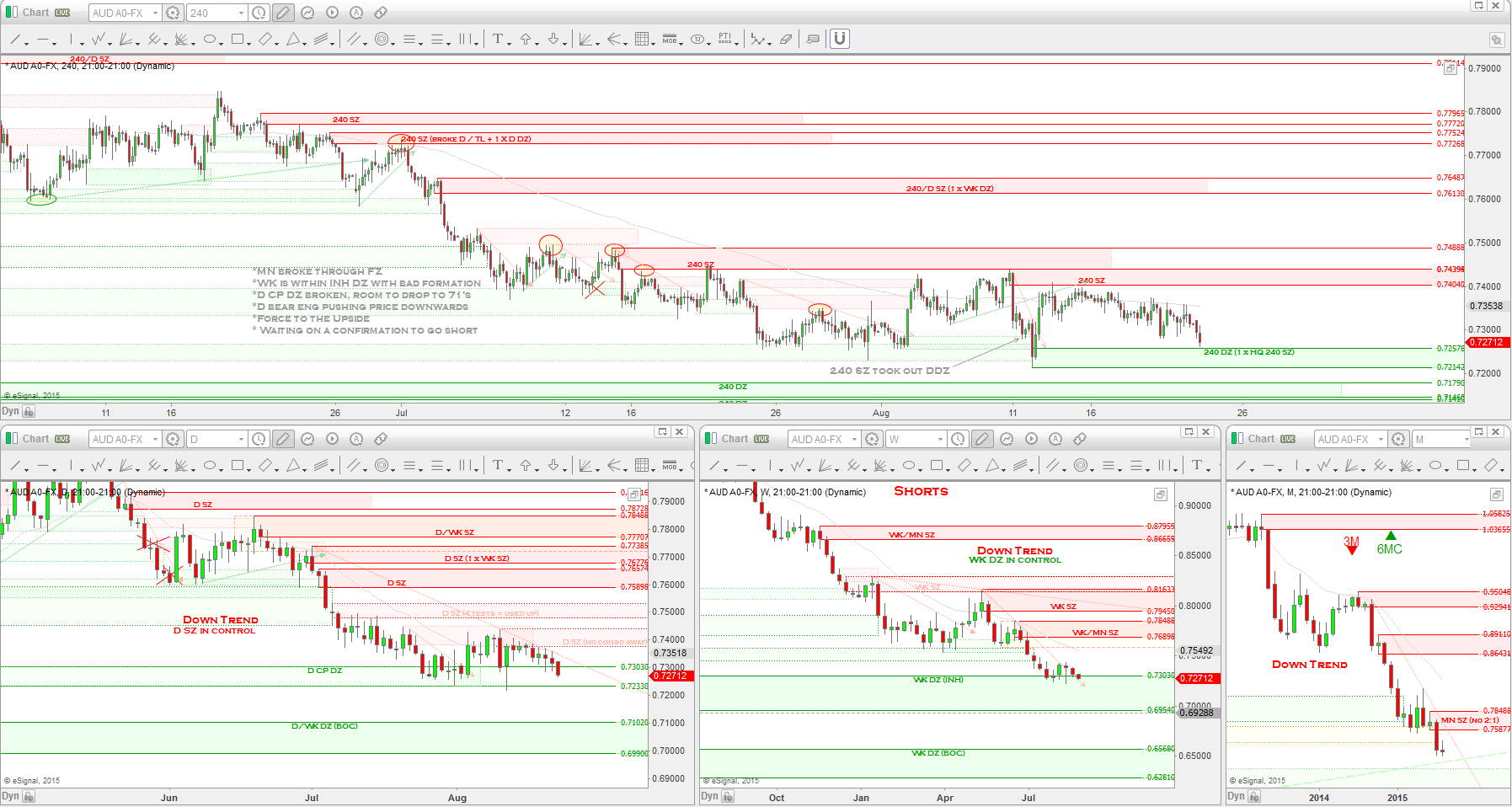

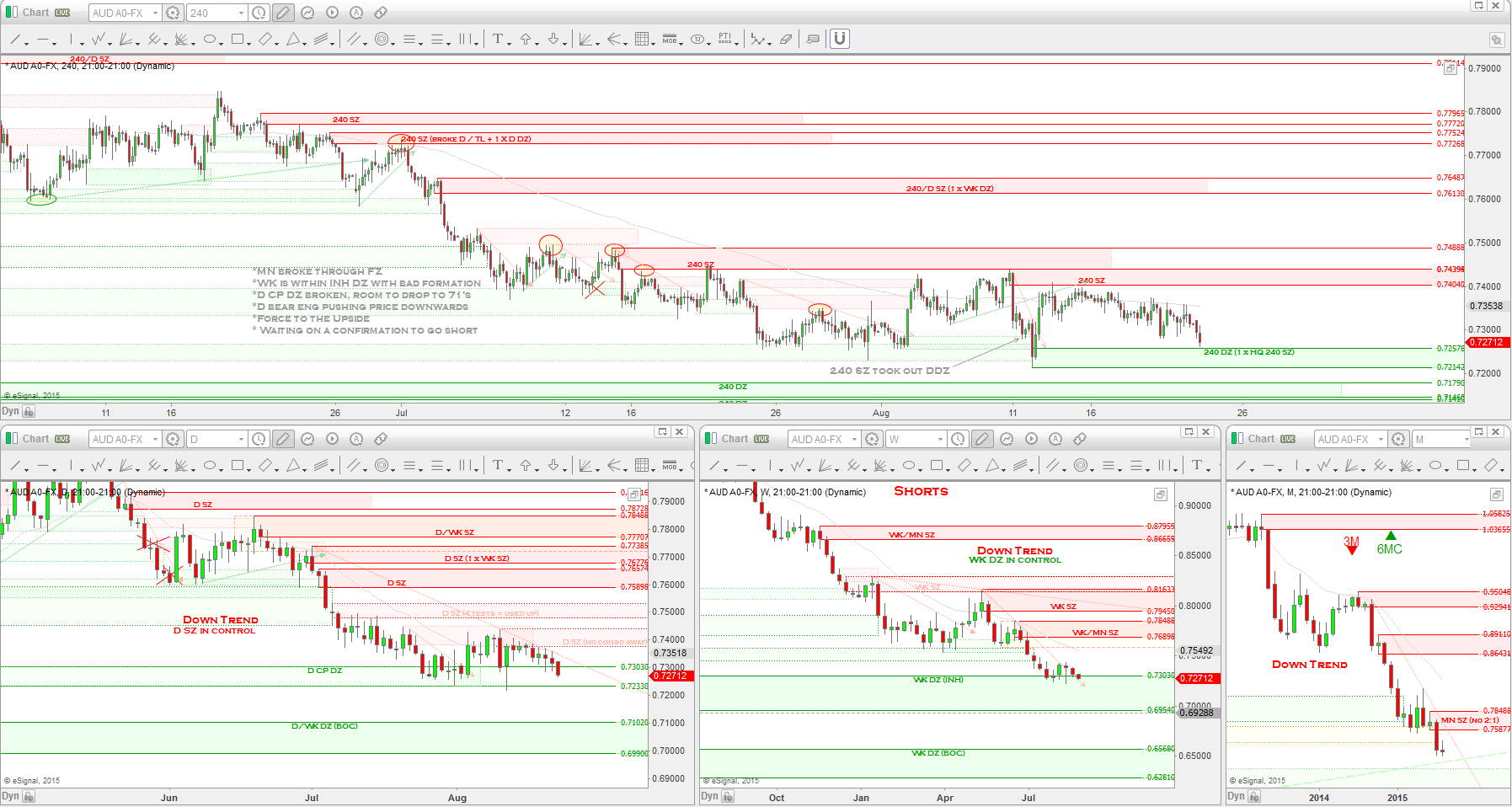

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Institutional Positions: Hedge funds decreased longs from 44k to 41k and reduced shorts from 93k to 82k. Overall, for September we see that about 28k of short contracts were closed as price came into contact with the 3MN DZ. We can assume a move up from the 3MN DZ towards MN SZ @ the 75's is in the making and if so, we could see longs being increased in October and more shorts being covered.

On the charts: We hit a 3MN DZ, the WK has a potential WK WOW DZ below, MN bullish engulf, all signals price could move to 0.7587 (MN Supply)

https://gyazo.com/897aaa67c9db597f72668232e8177e46

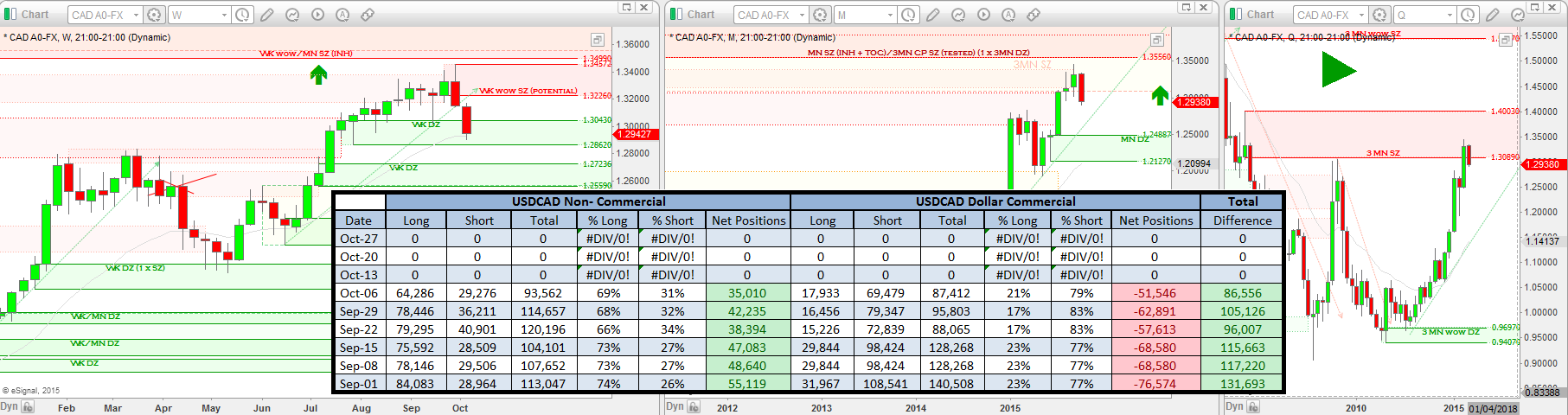

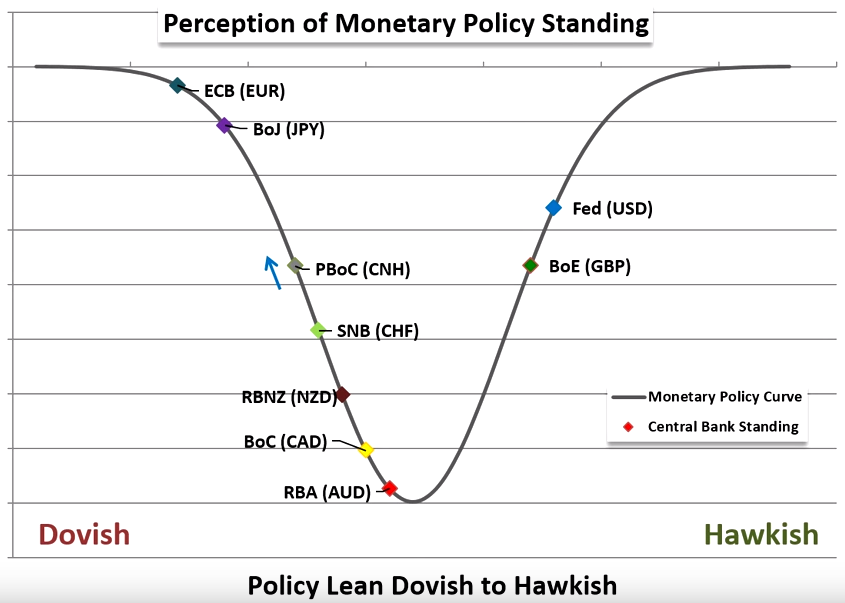

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

Institutions: Hedge funds took profits on their long positions when price hit the 3MN Supply, reducing longs from 78k to 64k. Short positions have also been covered from the hieght of 40K late September, when price hit the 3MN SZ, to last week at 29K. So we see longs being covered from the ride upward and also shorts being covered from the ride down.Bias is still long with 69% of total positions being exposed to the long side.

On the charts: Price is hitting a tested 3MN SZ and has penetrated a little deeper into it. A move to the downside towards the MN DZ @ 1.2488 seems very reasonable at this point. If a larger move to the downside is to be had, we would want to see shorts increasing and more longs being closed after price reacts from the MN DZ. I'll be watching for these moves in the coming months.

https://gyazo.com/1e4c98df05ea395af3c0dc04de999514

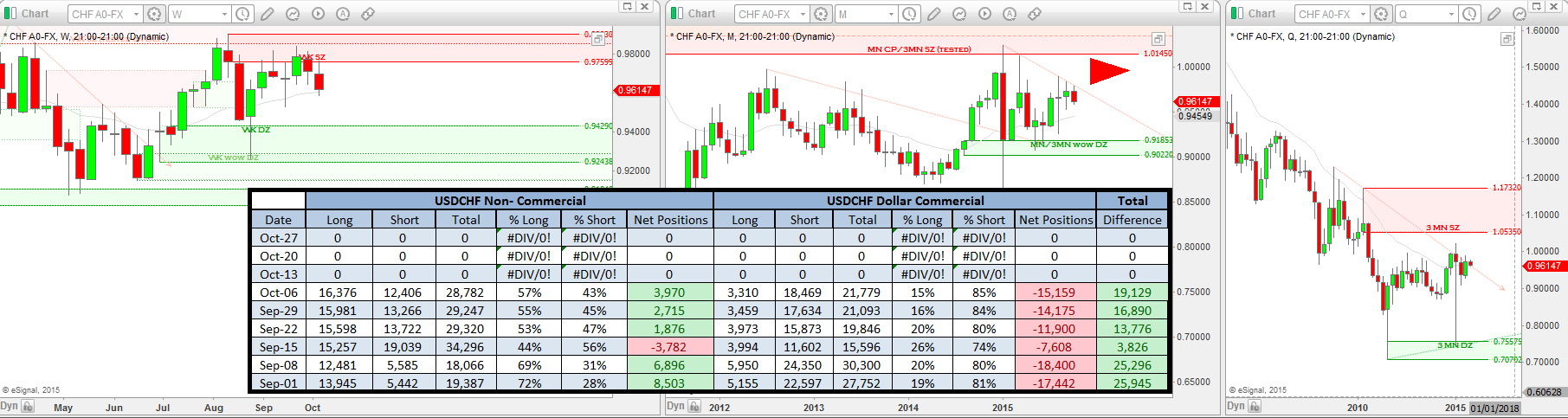

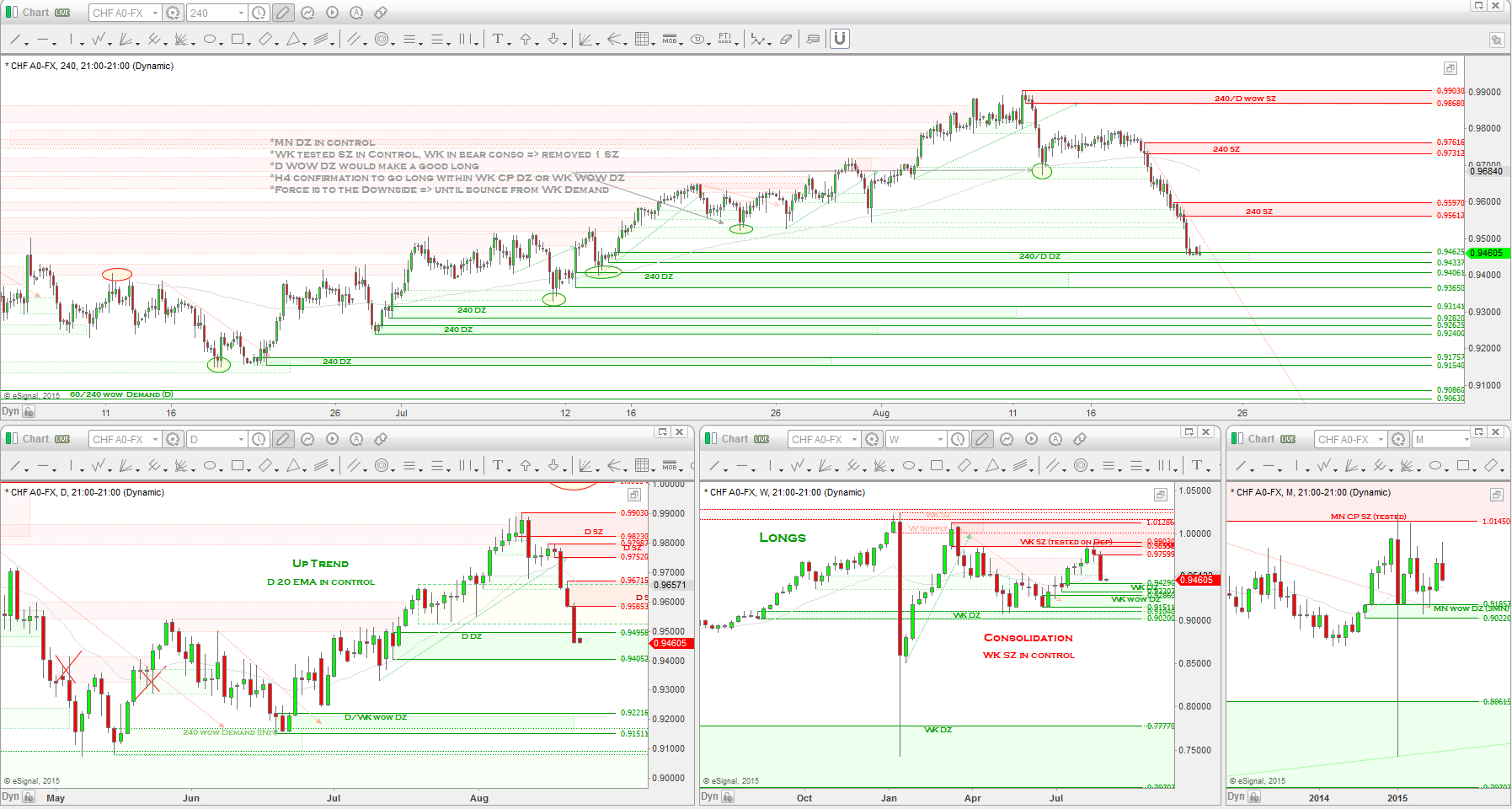

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Institutions: Hedge funds increased longs and covered some shorts during the previous week. The tone at the point is somewhat neutral with long exposure sitting at 57% and short at 43%. Net positions sit at a +3,970 to the long side.

On the charts: Price is reacting to the descending TL on the MN chart and also the WK SZ, so currently the force is to the downside.

https://gyazo.com/2e35c5ab6dc08e915cc8f9569cb4f233

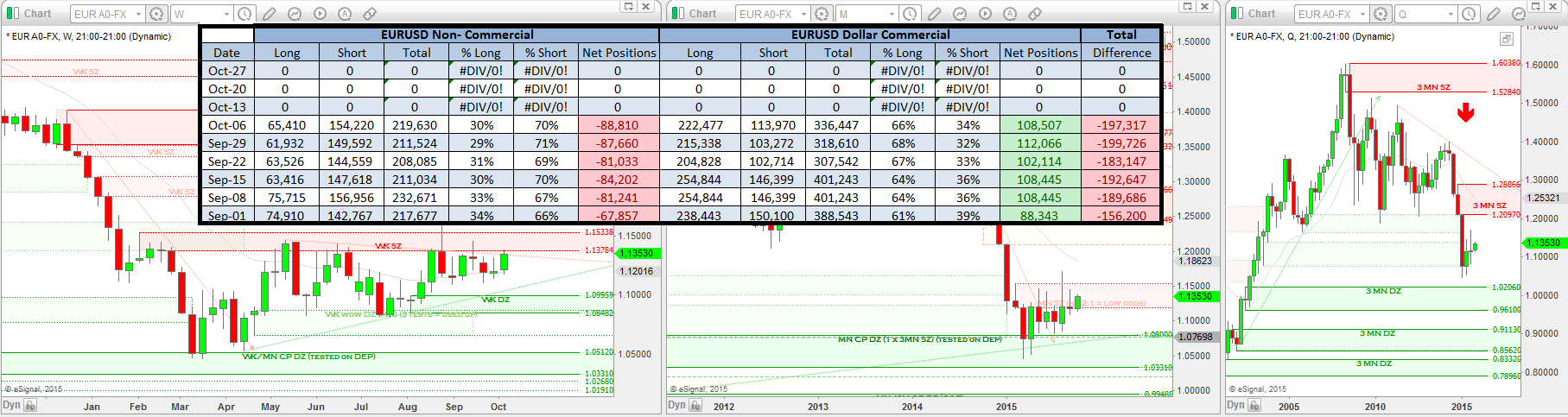

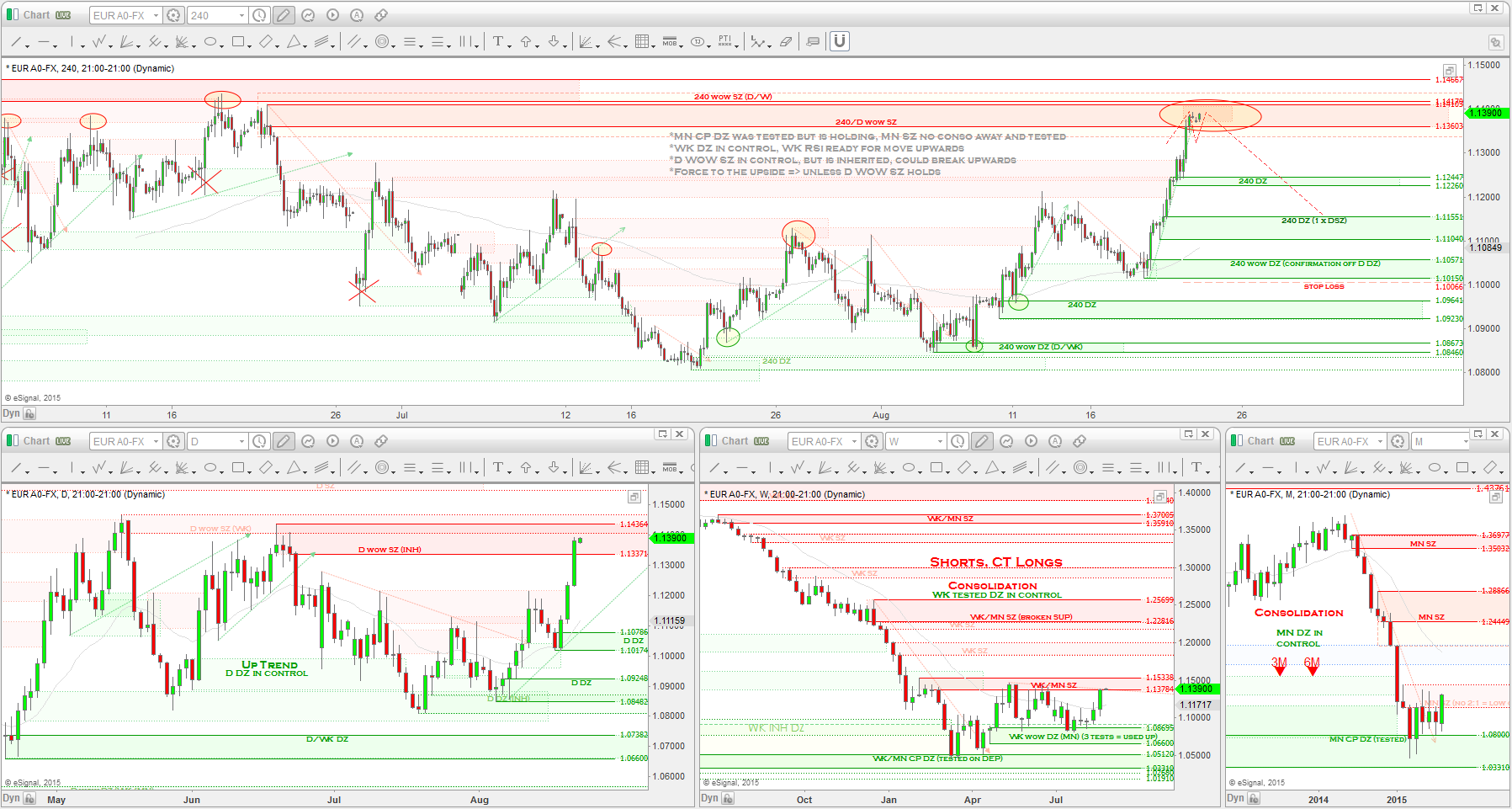

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Institutions: Hedge funds increased their longs from 61k to 65k with speculation favouring a move to the upside. While also increasing shorts from 149k to 154k. Long exposure increased by 1% in the process. The main thing we see here is although the institutions are adding longs for the move to the upside, they have also been increasing their short exposure the whole month of September. If a trend change was to begin to occur, we would want to see more shorts being covered and longs being added to. In this case all me see are longs being added as a hedge against a move to the upside. Short bias still persists!

On the charts: The 3MN chart has broken through 2 demand zones and has hit a MN CP DZ after the breaks, so a rally back upwards is suggested on the charts. But the question is, how high up? The 3MN SZ @ 1.2097 would be the logical target for the move up and if we see longs continue to be added to and possibly some shorts being covered on the way up, then this move would be the highest probability. Once there, longs would be closed and shorts again be added. Lets see if this is what's is in play!

https://gyazo.com/886b9e2940876ddd62f65571a27ae54f

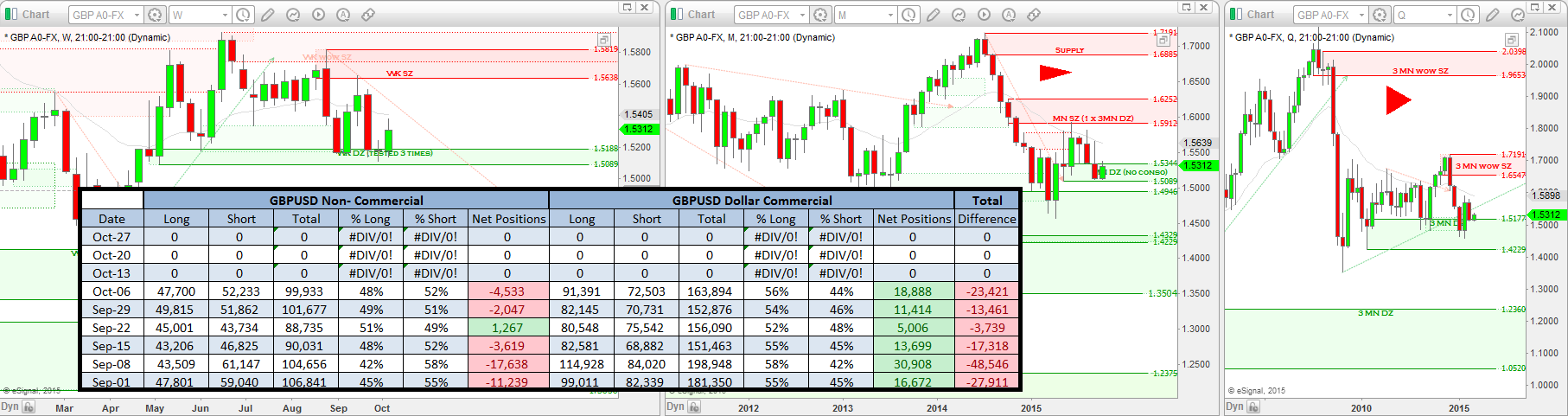

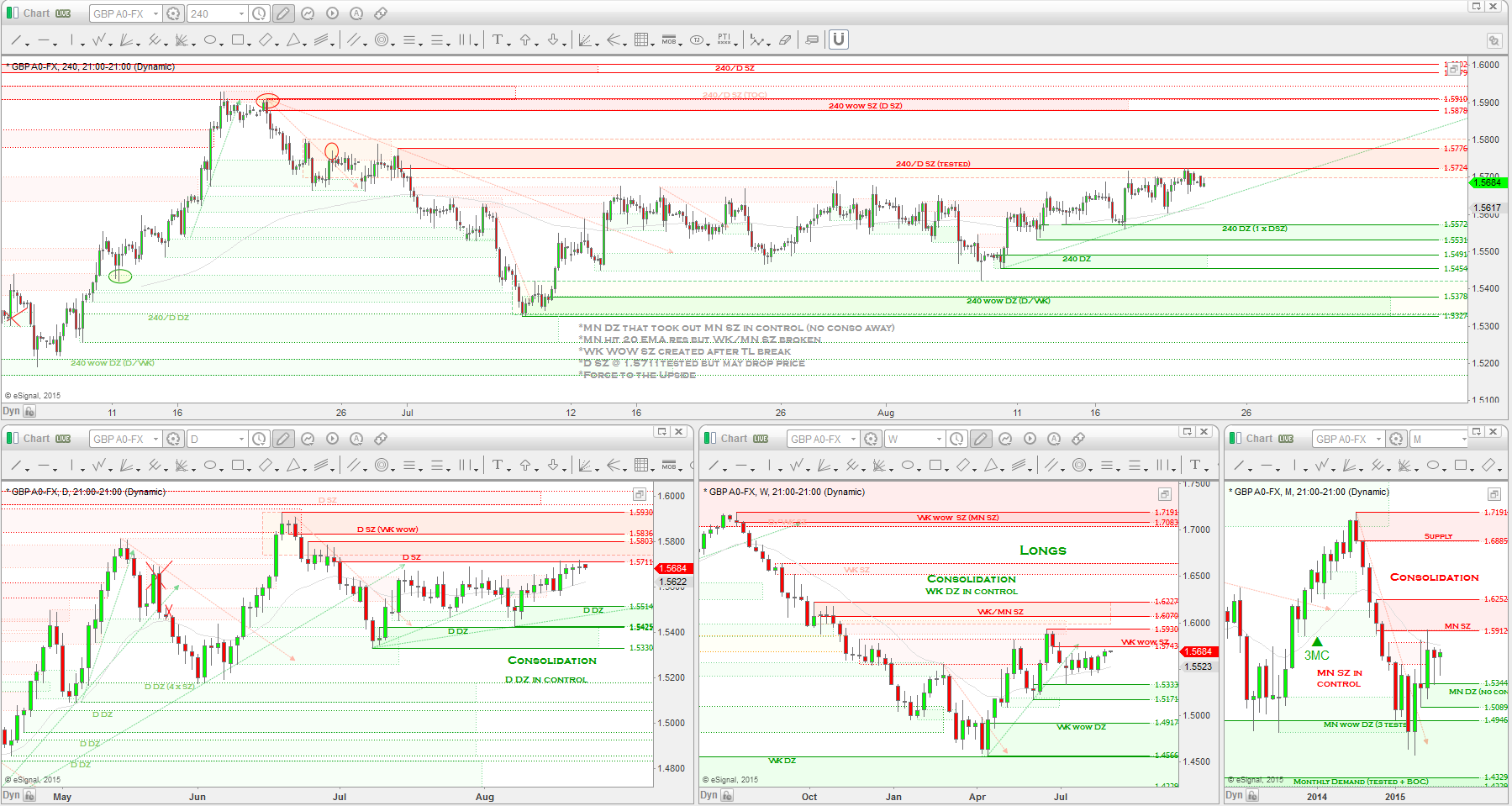

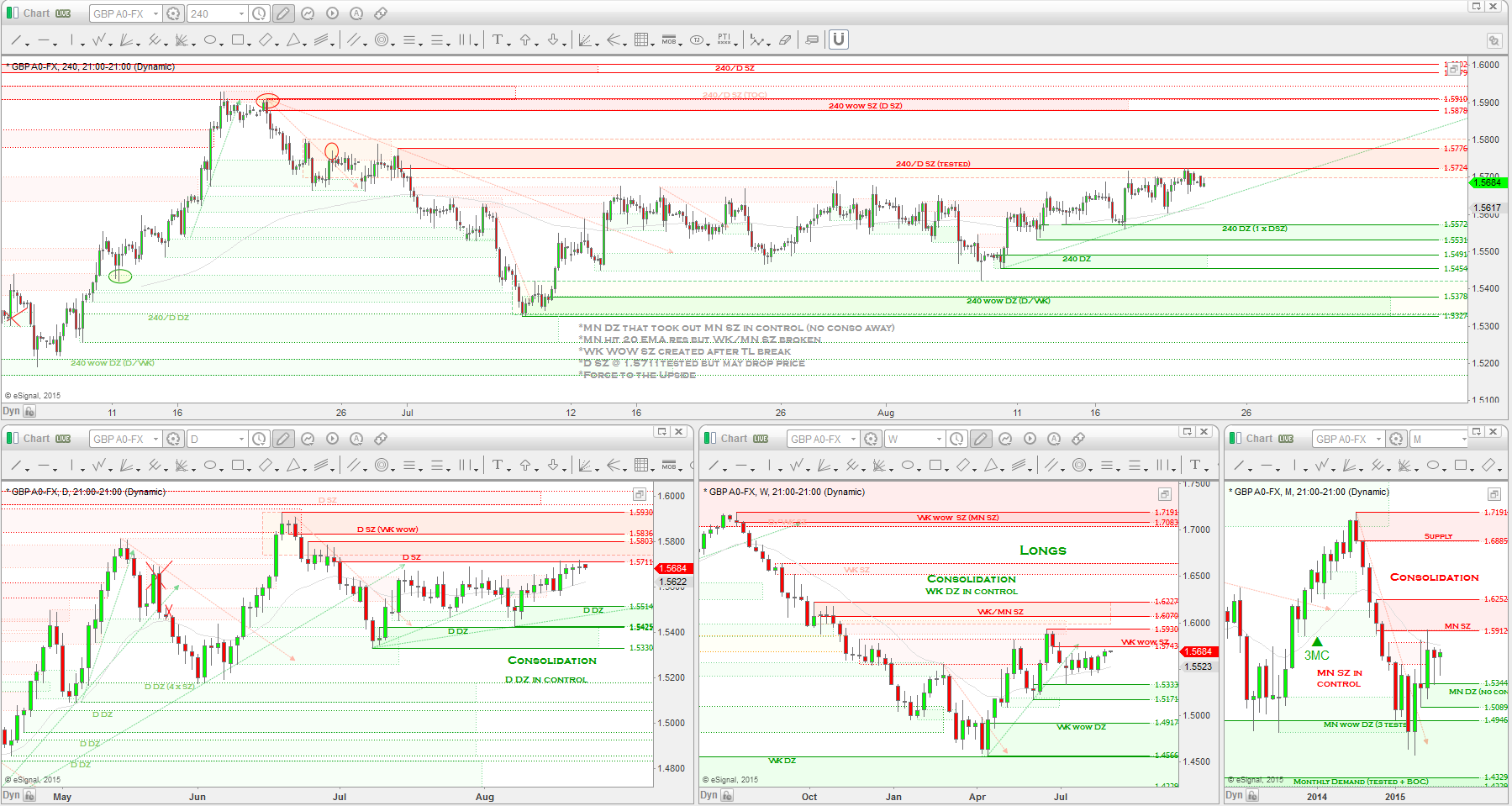

GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Institutions: Hedge funds closed longs and added to their short, but just small positions. Long exposure is at 48% and short at 52%. Very neutral bias at this point and expectation for a rate increase start to wither away. Slight bearish bias at -4,533, not enough for an edge in either direction.

On the charts: 3MN tested Demand is in control as price dropped further into the zone. Within this zone we have a bullish engulfing candle and a WK WOW DZ nested within it. The WK DZ though never consolidated away from the zone but price is reacting to it nonetheless. Tested WK Demand is holding price at the moment. Question is, for how long? Force is to the upside at the moment.

https://gyazo.com/8b5b25b56b77f280808bf71f68bfb557

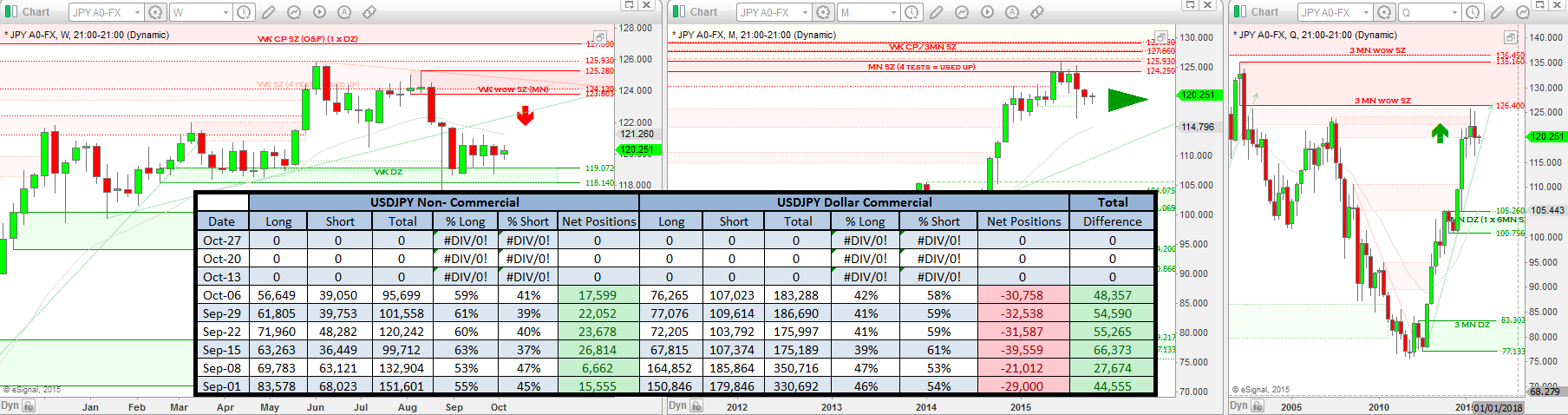

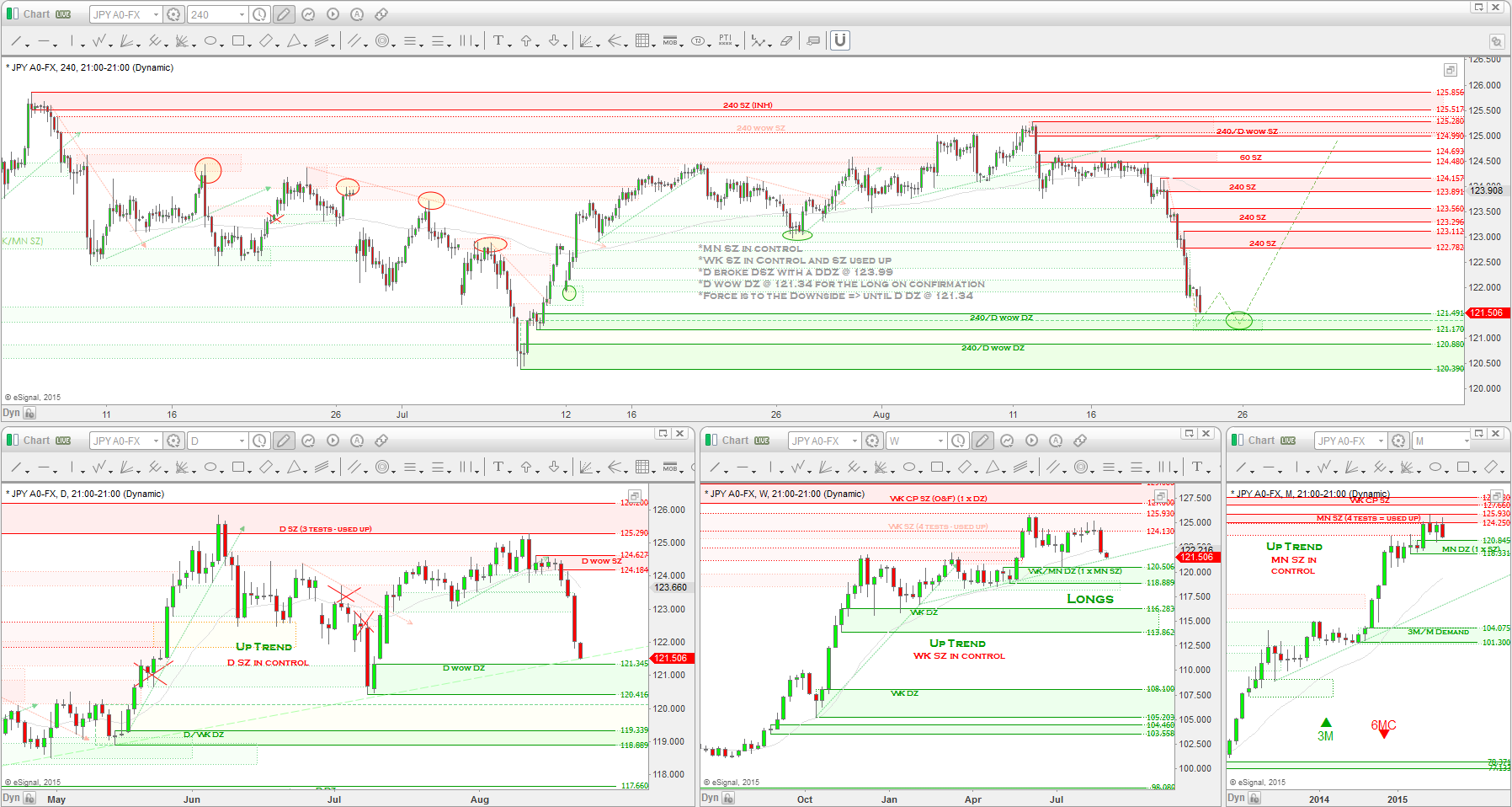

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Institutions: Hedge funds closed some longs from 61k to 56k and covered some shorts from 39.7k to 39k. Long exposure sits at 59% and shorts at 41% so basically a neutral bias at the moment and therefore not enough for an edge to trade in either direction. Sitting and waiting for a clear direction form the "BIG BOYS" on this one.

On the charts: Price just broke through three 3MN SZ's on this last rally up and hit a MN used up SZ in the 125's. Not exactly the type of SZ that causes a reversal of trend but enough to cause a retrace on the 3MN chart to fresh Demand. So a move toward the 110's is possible, but we would want to see shorts being increased and more longs being covered as a sign that this indeed is about to happen. WK DZ holding price so force is to the upside for now.

https://gyazo.com/e325873b05e295231b25d9590076630a

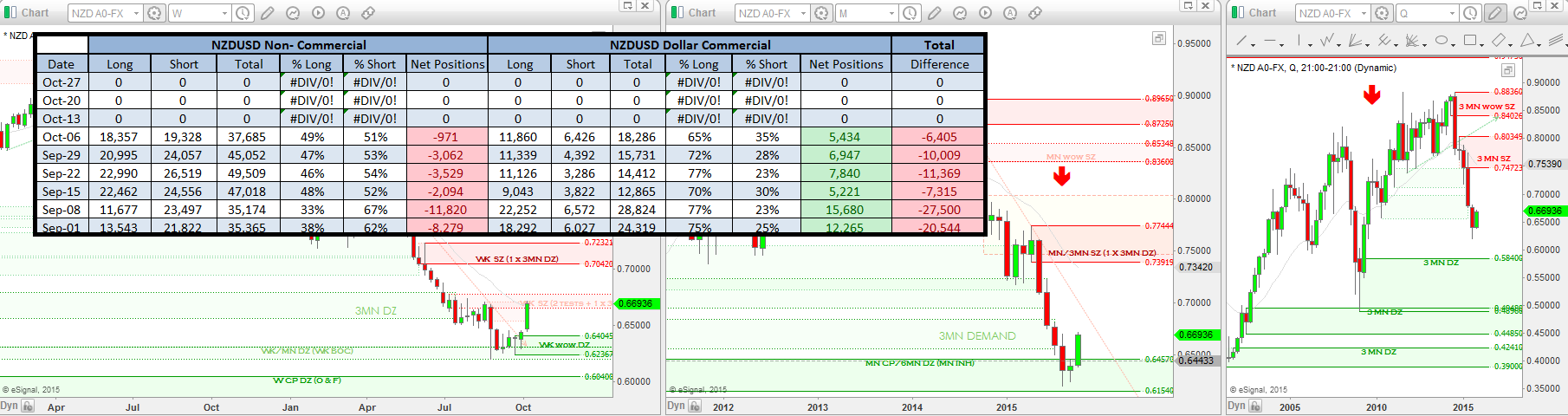

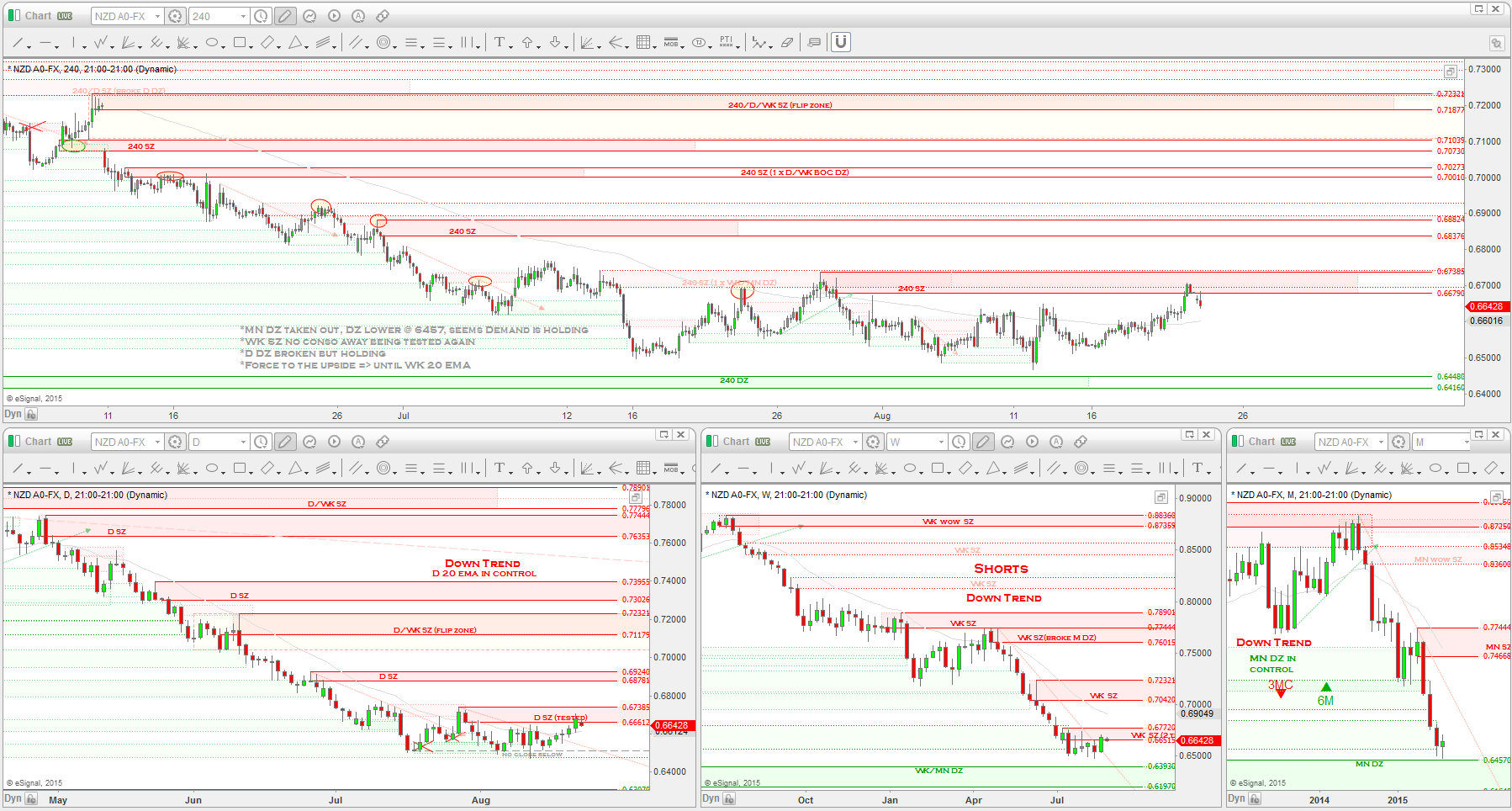

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Institutions: Hedge funds closed some longs and massively took profits on shorts by reducing from 24k to 19k as price hit the MN CP DZ. Long exposure sits at 49% and shorts at 51%. Neutral bias at this point with a slight exposure toward the short side. We have seen a shift from a short bias to now a neutral bias on the Kiwi. This could be in preparation for a rally back up in price. The charts certainly back this thesis.

On the charts: Price hit a MN CP DZ after the 3MN chart dropped and broke through 2 3MN DZ's and 1 6MN DZ. A possible rally up toward the 3MN CP SZ @ 0.7472 could very likely happen and with the hedge funds positions switching from short biased to a neutral bias, if we see consolidation between WK Supply @ 0.7042 and the WK WOW DZ being created @ 0.6404, combined with an increase in long positions and a decrease in shorts, we could very much expect a larger rally into the 74's. Keeping my eye on this potential mover!

https://gyazo.com/8a7ea19ab762a6a0c8a50d81be76631c

So that's the breakdown of the CFTC Report for this weekend folks. I have to say, I think this report is one of the better ones I have done. I like the direction i am headed with my analysis as it has taken me a while to think about how the reports and the Supply and Demand interact with each other and slowly, week by week, things become more clear to me. Logically putting the pieces of the puzzle together to forecast price action with the use of the Supply and Demand principles taught by Alfonso has made all the difference. I am committed to bringing this community the very best analysis I can possibly put together as we are a family, a family outside our regular family and friends, the family that understands our struggle to become profitable traders unlike anyone else! We are all here to make better lives for our loved ones and giving back to community is a great way to give back to each other! For those celebrating Thanksgiving and for those that aren't, let us be thankful for everything we have!

Kevin

Notes:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional traders

are SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

THE SETUP:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional tradersare SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

Notes: Trend is up on the monthly, bullish consolidation on the weekly and down trend on the daily chart.

THE SETUP:

THE SETUP:

$GBPUSD -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: HAWKISH

Notes:

THE SETUP:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISHNotes:

THE SETUP:

Video Link ==>

https://gyazo.com/e9f272b57e10e0c405897182e8d39b43

https://gyazo.com/d565cbf1795ea175746e02d2cff45839

https://gyazo.com/d61632b6308565e4ab3b990c2f9ea4cd

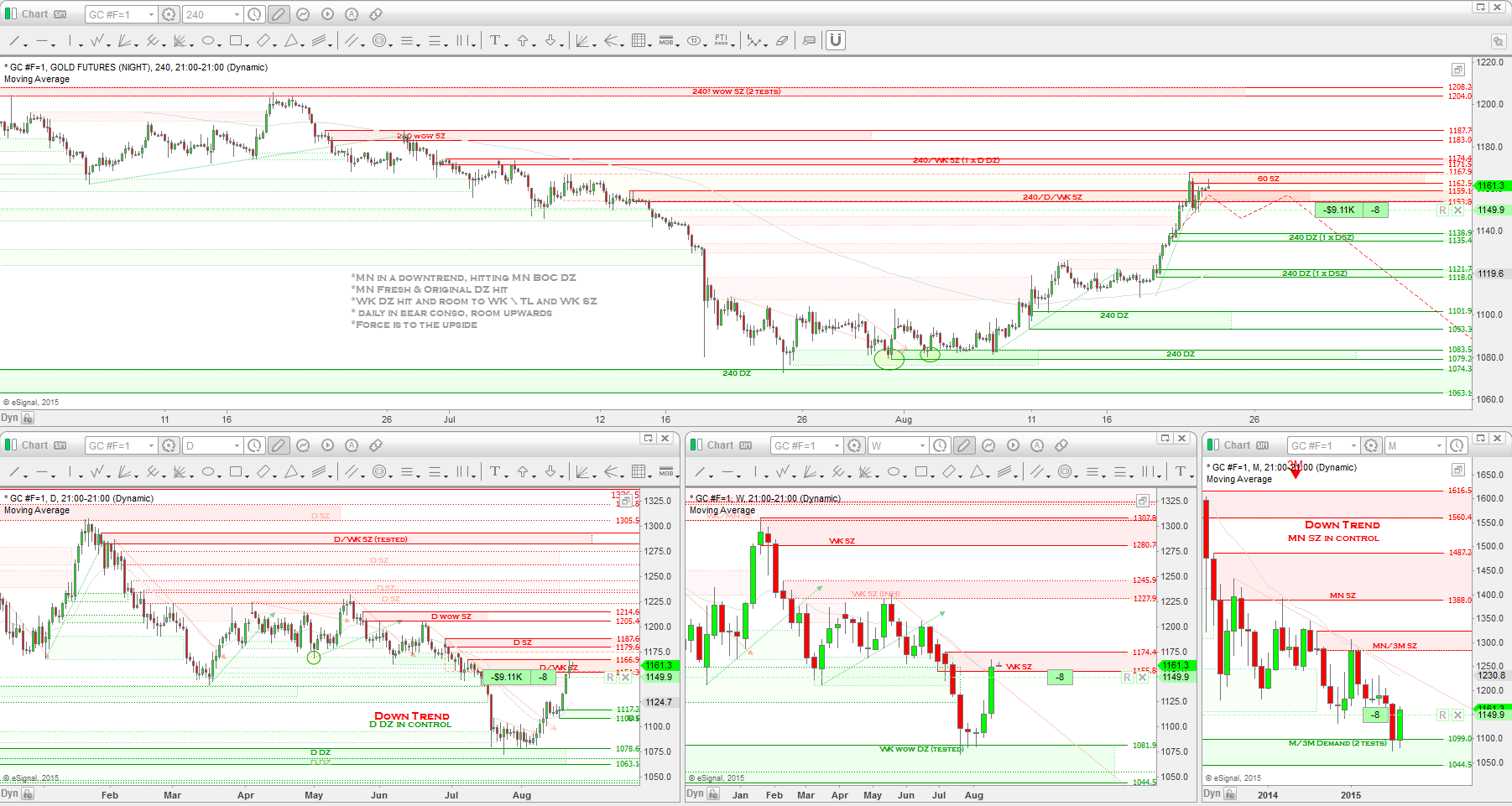

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/d1fd69a1e2d15b5155d61d121fe6a326

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

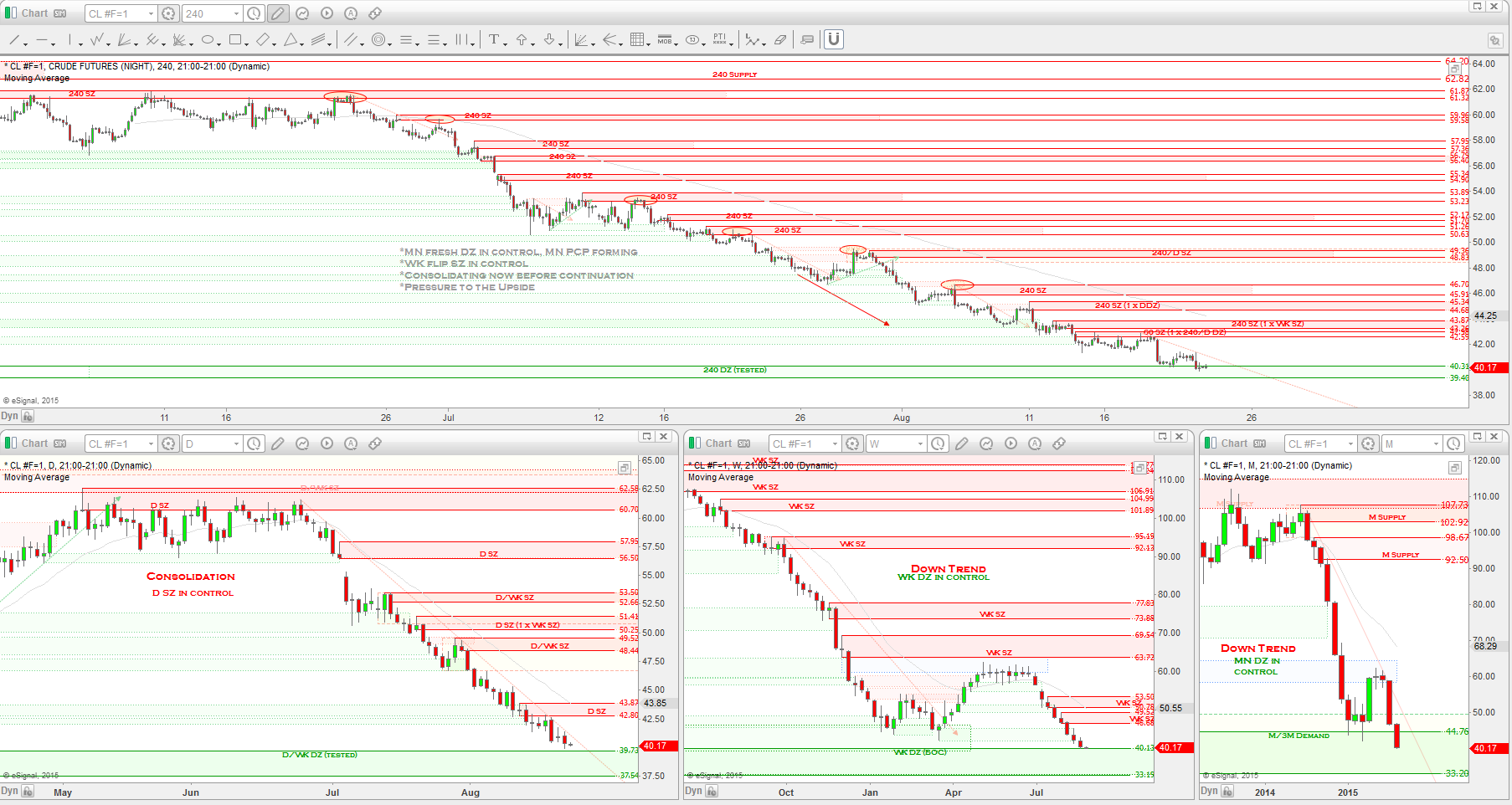

Commitment Of Traders Report: Institutional traders are VERY LONG biased.

Notes:

THE SETUP:

Video Link ==>

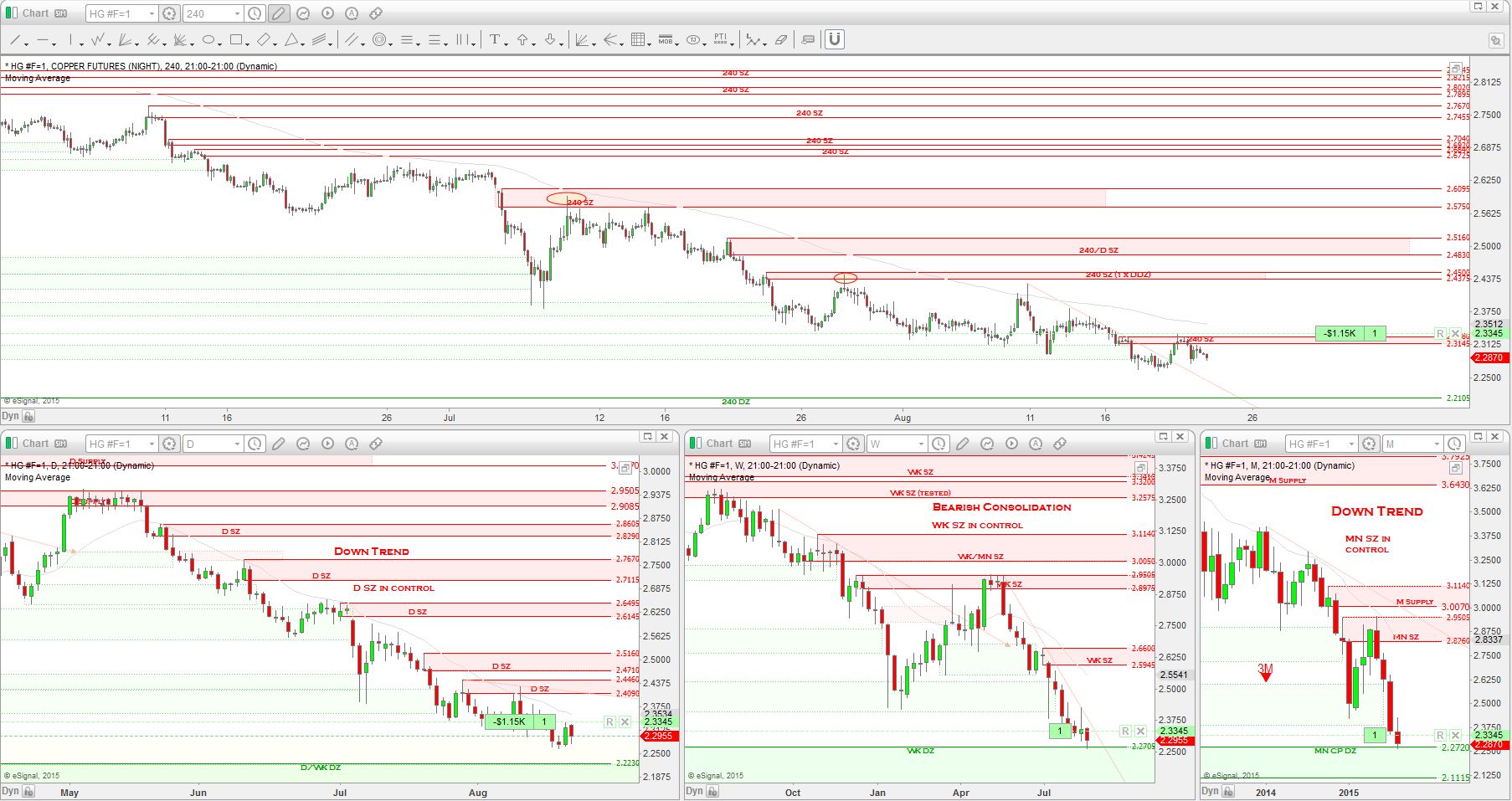

Commitment Of Traders Report: Institutional traders are VERY SHORT biased.

Notes:

THE SETUP:

Video Link ==>

Notes: Trend is down on the monthly, down on the weekly and bearish consolidation on the daily chart.

*WK SZ and WK TL in control

*WK SZ and WK TL in control

THE SETUP: LONG @ 0.7365, SL @ 0.7306, TP - technical stop

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

No comments:

Post a Comment