Welcome to a brand new week traders! I did a full analysis of the latest CFTC COT Report for you and you can find it down below! I will be doing a lot of focusing on my trade plan this week and Forex testing my strategy. I encourage you to do the same. Practice makes a winning trader and that's pretty much about it. I recommend that any of you who are serious about learning Supply and Demand from someone I consider to be the best in the business, Alfonso Moreno, sign up at www.set-and-forget.com and join me and many others on our journey to learn how the market really moves. Take a look at my updated charts below for a sample of how we are killing it in the community! You can have it all if you trade like the institutions do. Money, freedom, the ability to travel anywhere at any time, nice homes and fast cars. All it takes is dedication and hard work! Don't you just love trading? You can be anywhere in the world and still be able to make $$$, but only if you trade alongside the institutions with Supply & Demand! The inspirational shots to the left are courtesy of @fiiyat on Instagram. Great profile you should follow!

Welcome to a brand new week traders! I did a full analysis of the latest CFTC COT Report for you and you can find it down below! I will be doing a lot of focusing on my trade plan this week and Forex testing my strategy. I encourage you to do the same. Practice makes a winning trader and that's pretty much about it. I recommend that any of you who are serious about learning Supply and Demand from someone I consider to be the best in the business, Alfonso Moreno, sign up at www.set-and-forget.com and join me and many others on our journey to learn how the market really moves. Take a look at my updated charts below for a sample of how we are killing it in the community! You can have it all if you trade like the institutions do. Money, freedom, the ability to travel anywhere at any time, nice homes and fast cars. All it takes is dedication and hard work! Don't you just love trading? You can be anywhere in the world and still be able to make $$$, but only if you trade alongside the institutions with Supply & Demand! The inspirational shots to the left are courtesy of @fiiyat on Instagram. Great profile you should follow!

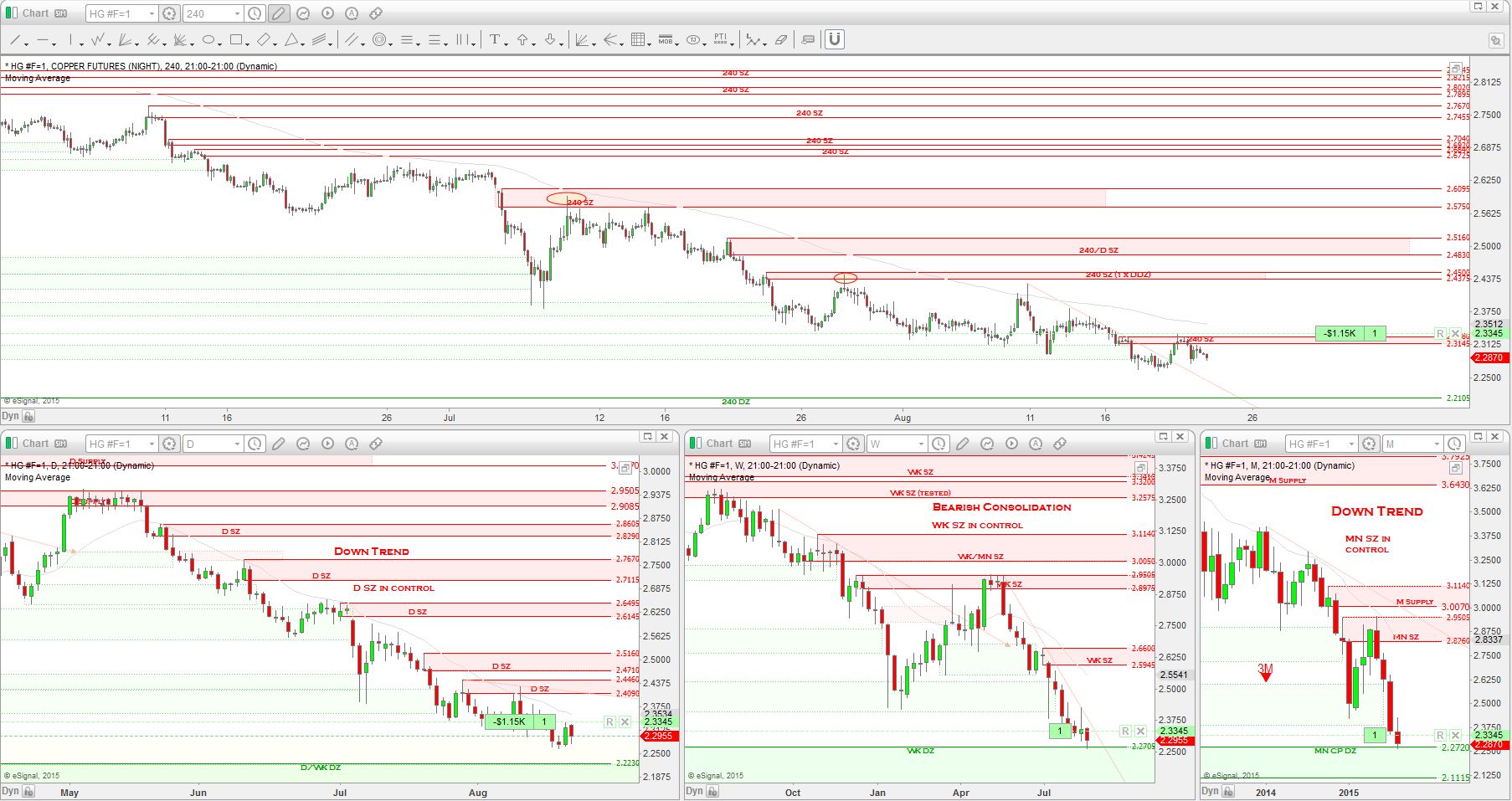

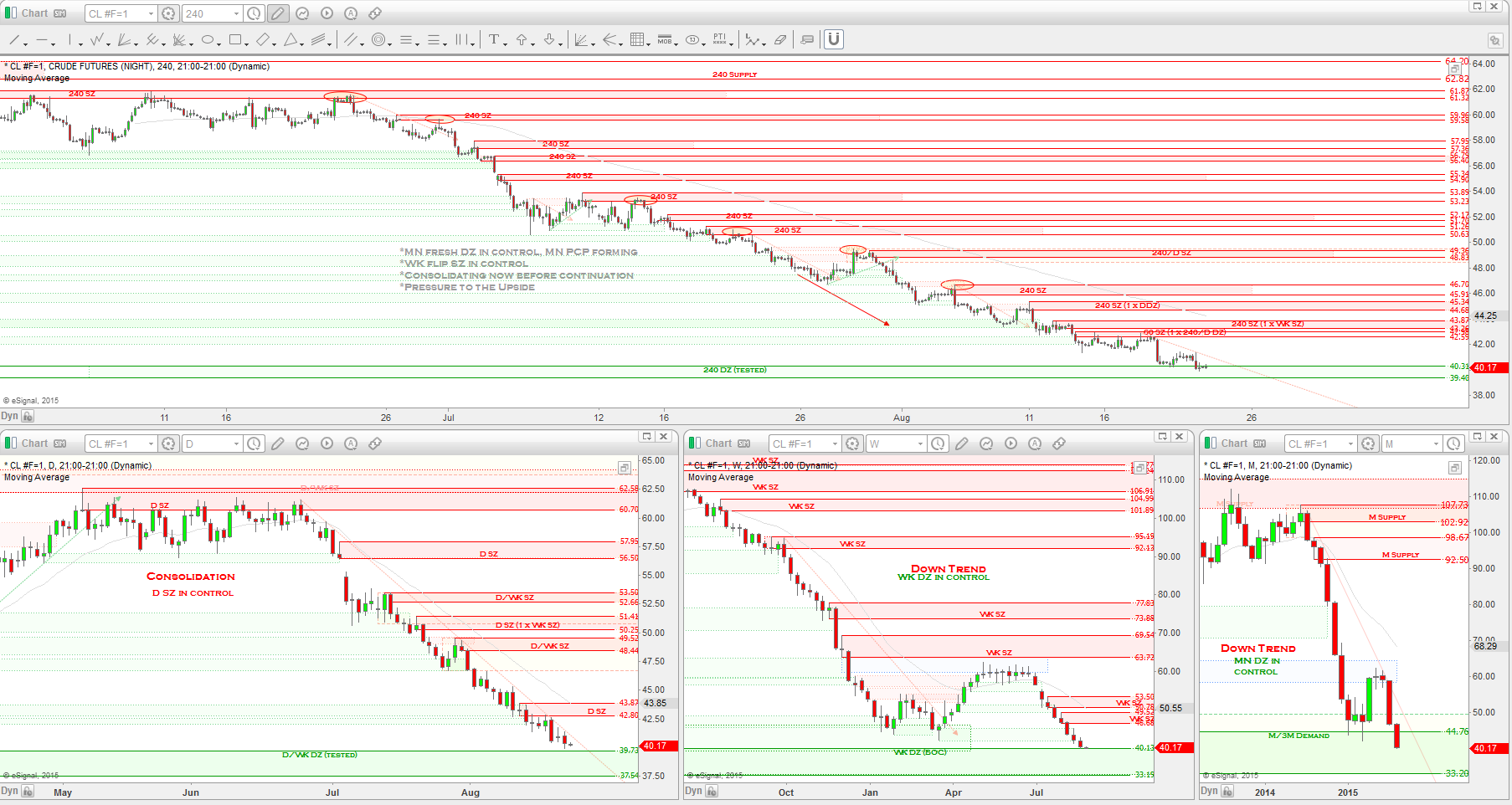

SUPPLY & DEMAND ZONES

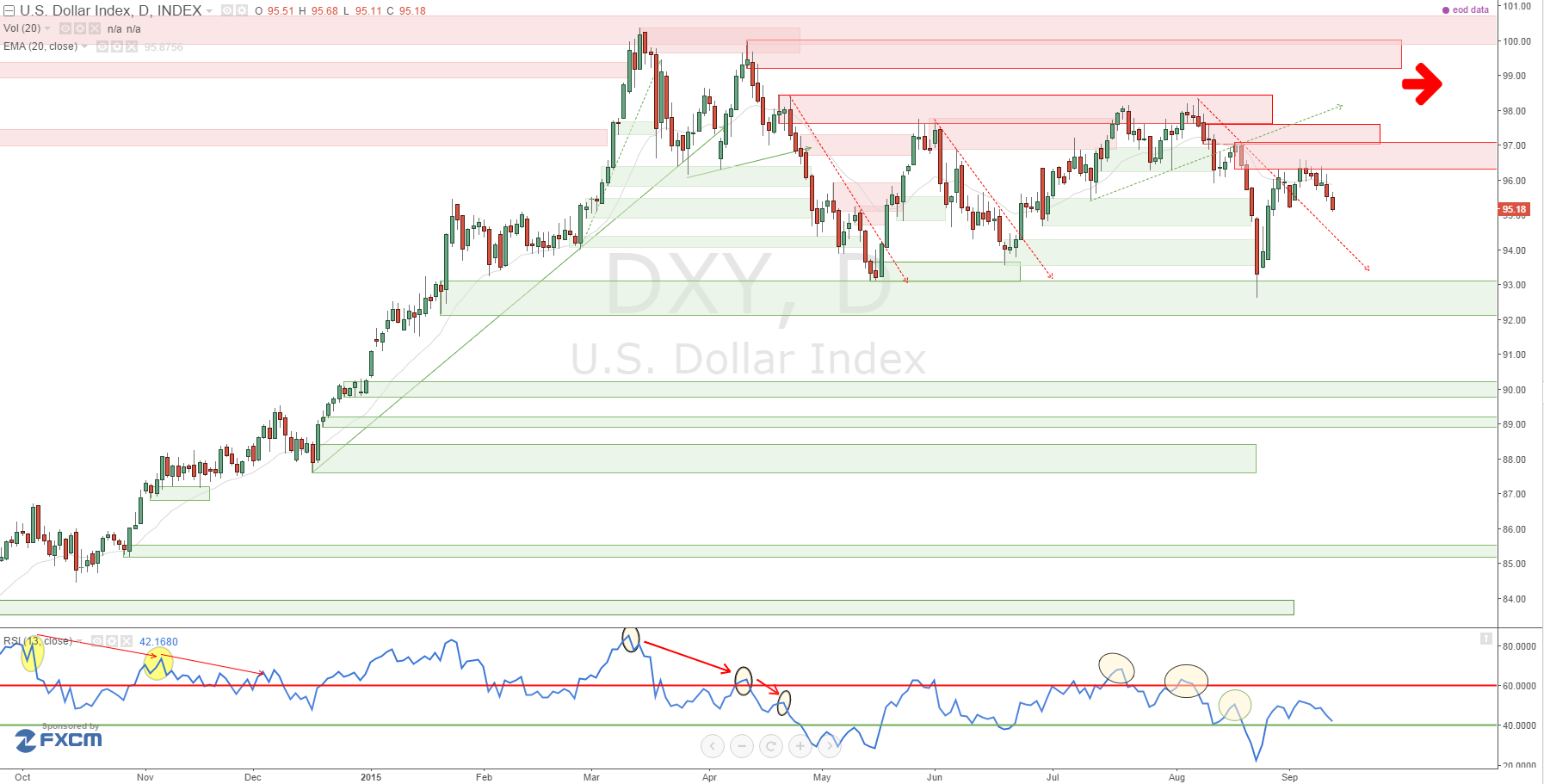

Take note of the GREEN demand zones and RED supply zones mapped out below. These are the areas of interest for me because this is where there is a great deal of demand to fill buy orders and supply to fill sell orders from the institutions. SHADED GREEN ZONES = Strong Buy Zones

SHADED RED ZONES = Strong Sell Zones

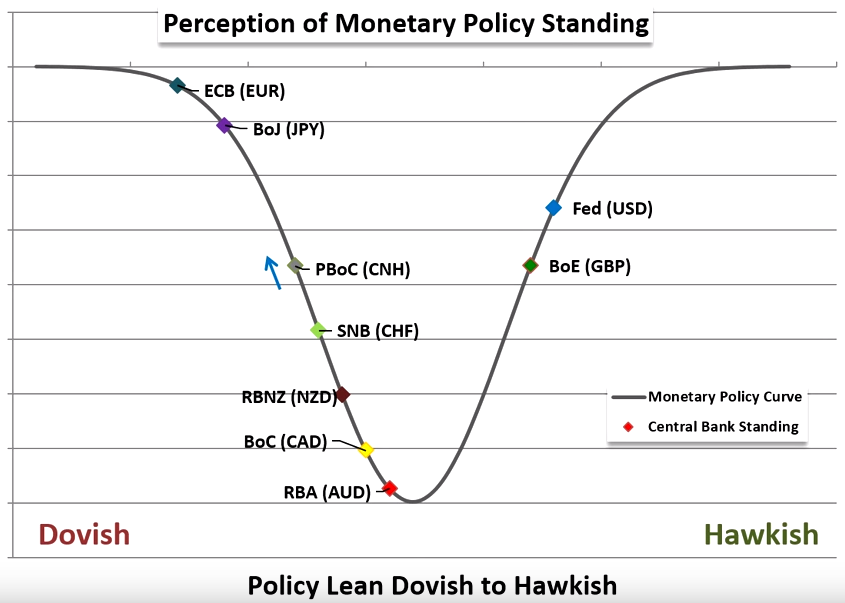

Commitment Of Traders Report: Institutional traders are VERY LONG biased. Perception of Monetary Standing: HAWKISH

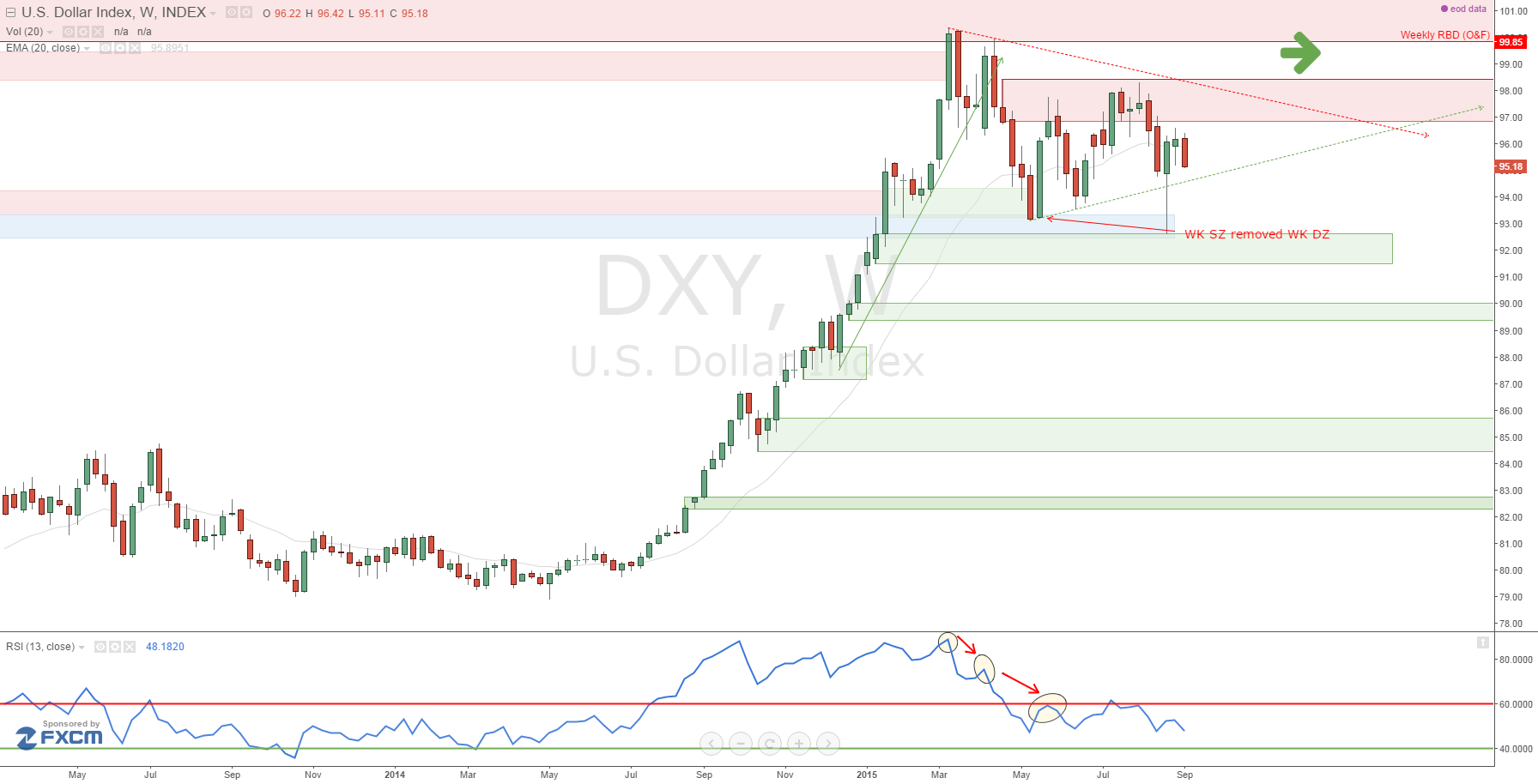

$USD OVERVIEW (DAILY)

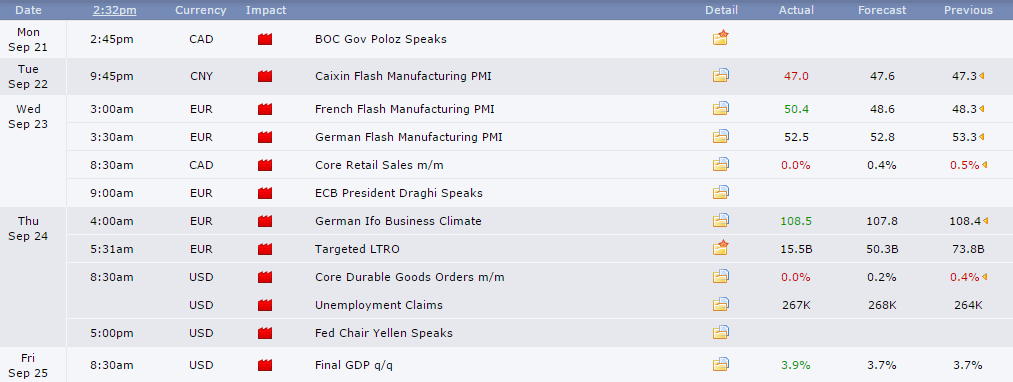

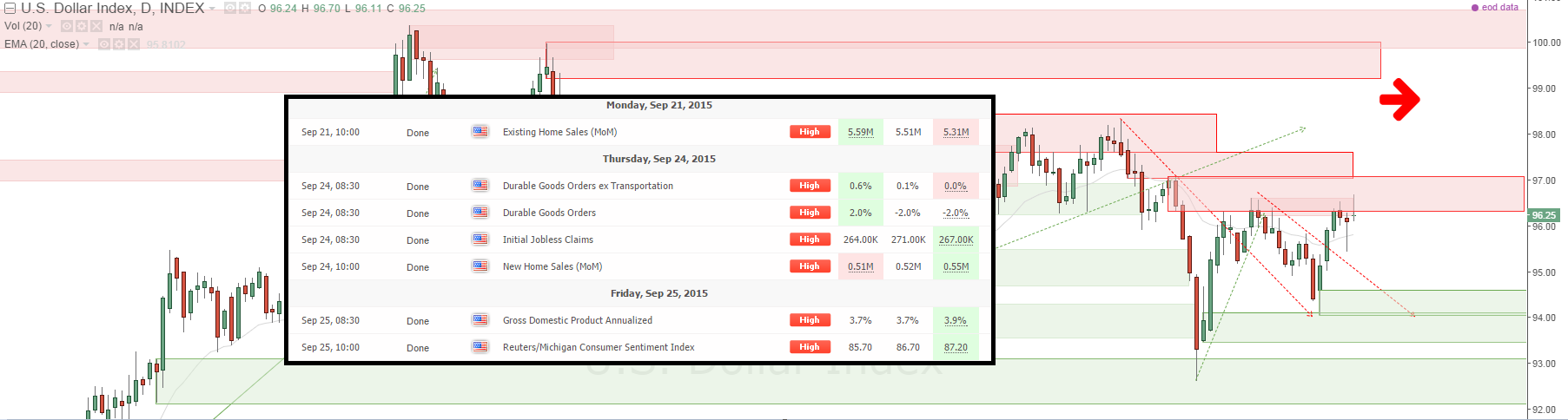

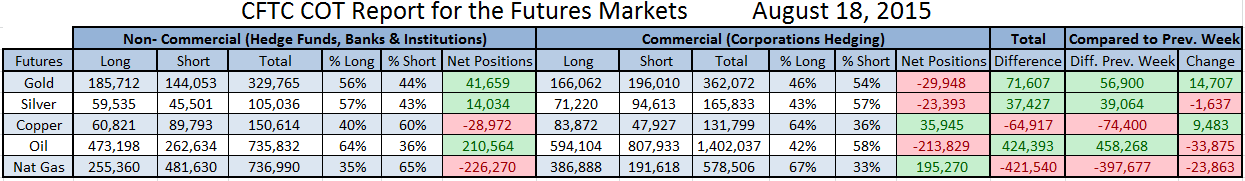

How's it going traders!? We had a very decent move in the markets this past week and with a lack of strong data to push the markets, we saw a lot of volatility in the EURUSD, GBPUSD and AUDUSD. Great opportunities to get on board these pairs with some some PCP's and speaking of which, we now have The PCP lesson's!!! I have been waiting for these suckers to come out because there are just too many times that price shoots away from a zone before actually hitting it and then never provides any pull-backs to get in on the move. Needless to say, I will be including these new rules into my trading plan and will begin testing them very soon. But, for now, let's take a look at the latest data from the report released on Friday.

US DOLLAR > COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Hedge Funds: The hedge funds increased their longs from 49k to 51k and slightly increased their shorts from 10.1k to 10.6k. Overall long exposure sits at the same 83% and total positions went up from 59k to 62k. So the bias still sits at very bullish as Yellen came out an mentioned plans to raise the interest rates this year. I should point out that throughout the entire year the hedge funds have consistently held between 78% and as high as 93% of their total USD exposure to the long side.

Market Movers: This happened as the week began with some negative data and then turned positive to finish off Friday.

On the charts: price rallied from a D WOW DZ and right into a D WOW SZ with a bad base, so therefore the SZ was broken. Consolidation continues on the WK chart but price is starting to get coiled up really tight. We can expect a breakout more soon. Maybe a PCP?

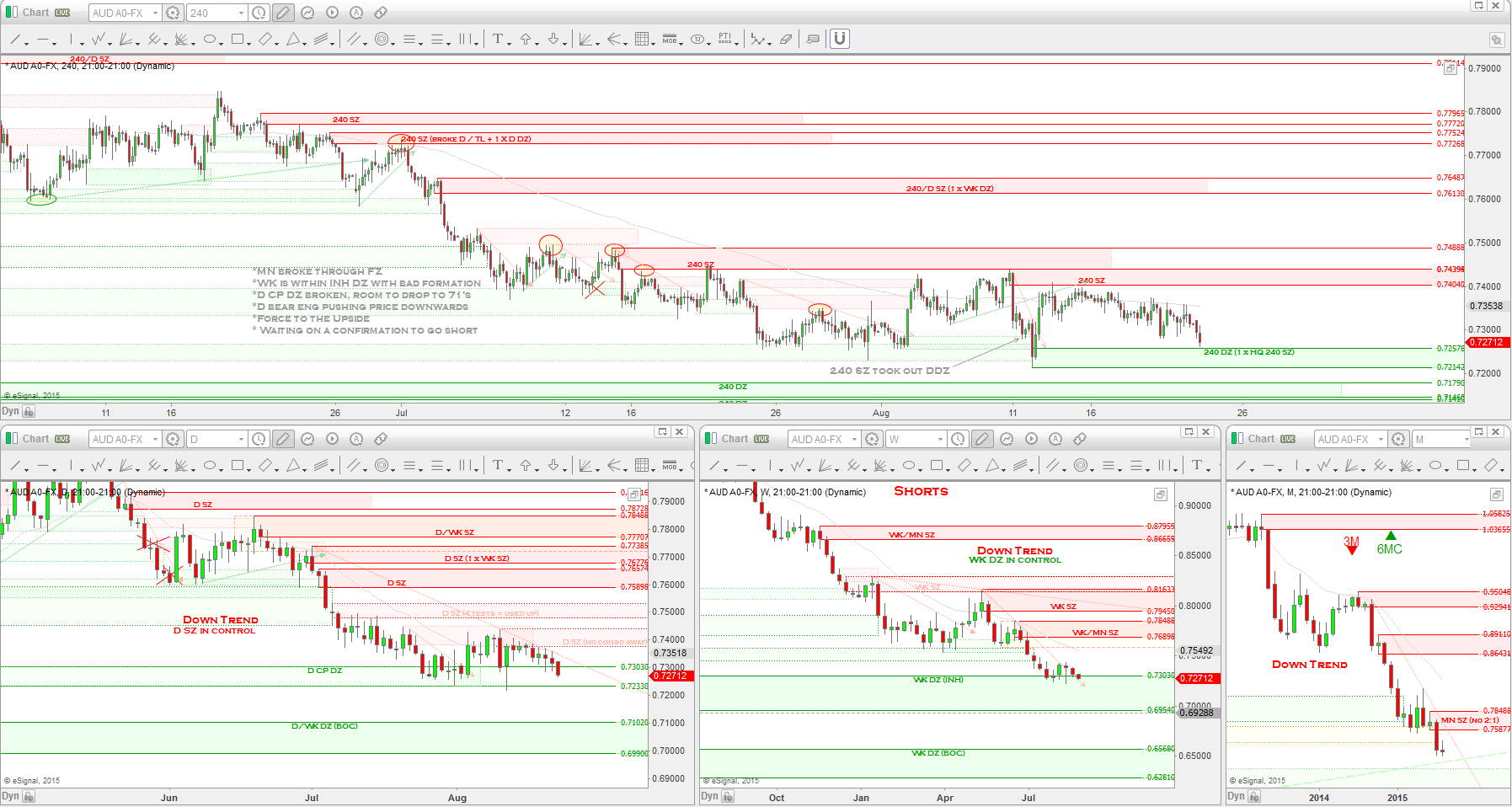

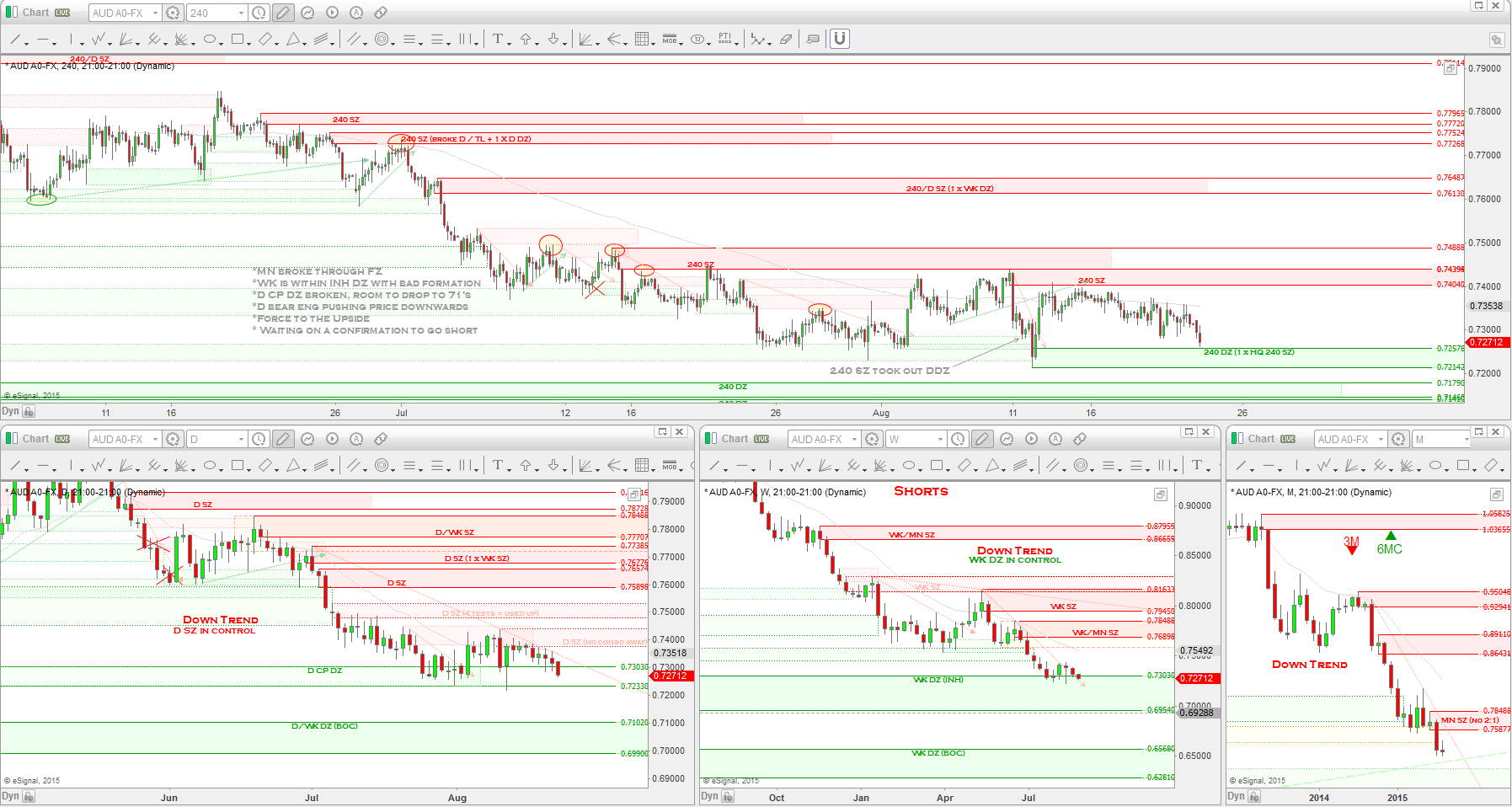

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Hedge Funds: The hedge funds greatly reduced longs from 59k to 42k and also shorts from 99k to 95k. In the process, they dropped their total long exposure from 37% to 31%. So a lot of profit taking on their longs as price rallied into supply. A break out on the USD would have the AUDUSD prime for a continuation of the drop.

Market Movers: Some medium importance data came out Monday but it was the negative Chinese data on Tuesday that helped drop price from the WK SZ.

On the charts: Price dropped from the WK SZ, as expected, and right into a D tested WOW DZ. So it seems the negative Chinese data was released at the perfect spot to drop price.

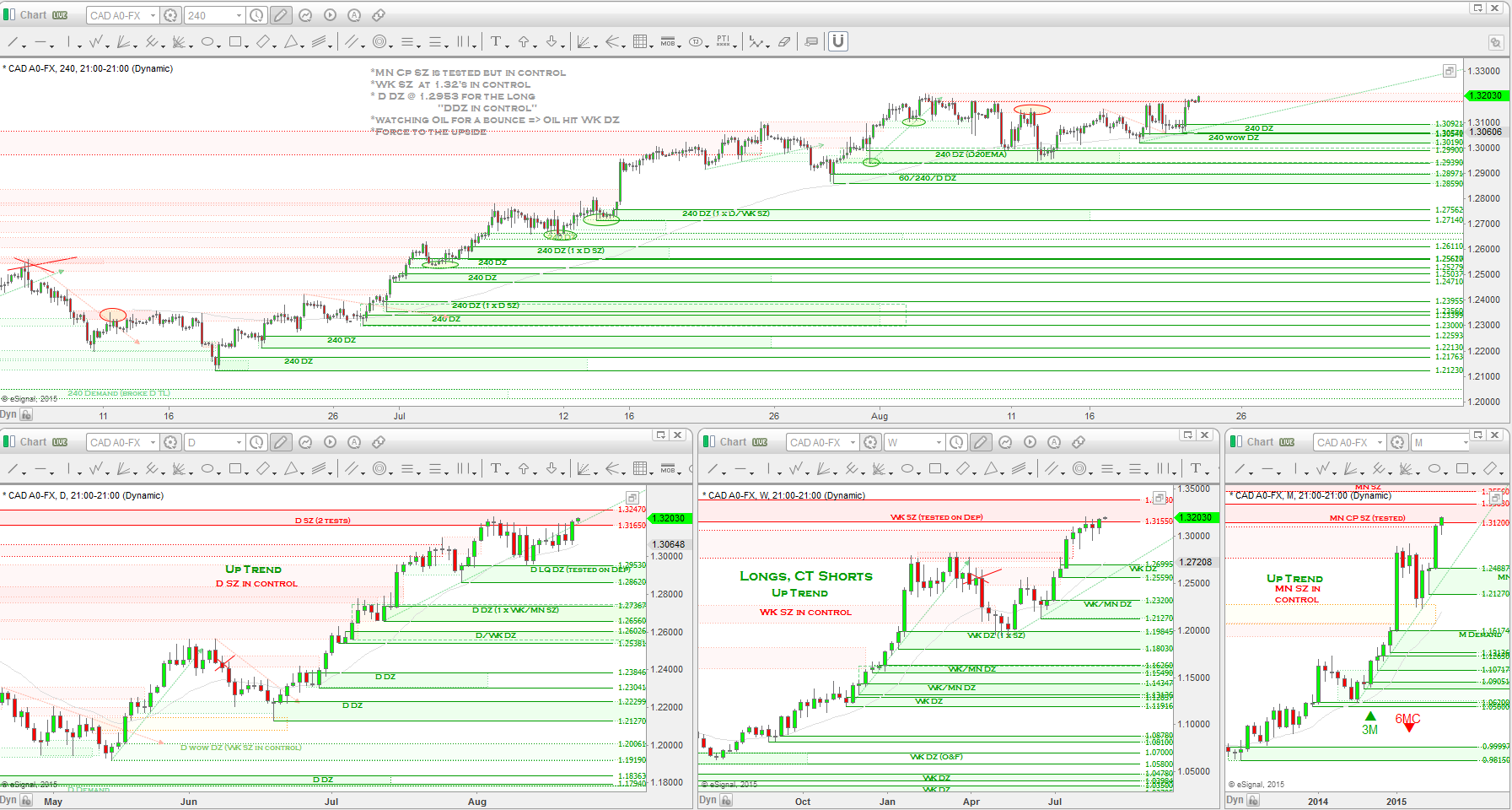

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

Hedge Funds: The hedge funds increased longs from 75k to 79k last week and massively increased shorts from 28k to 40k. In the process they dropped long exposure from 73% to 66%. Long exposure hasn't been so low since mid July when price was rallying up from WK Demand. Bias still to the long side.

Market Movers: The week started of negative with Wholesale Sales as price dropped into D Demand and then followed up with more negative data mid week.

On the charts: this was represented by the drop we saw from the WK Supply area down into the D/WK Demand area where the Negative data helped drive price back upwards.

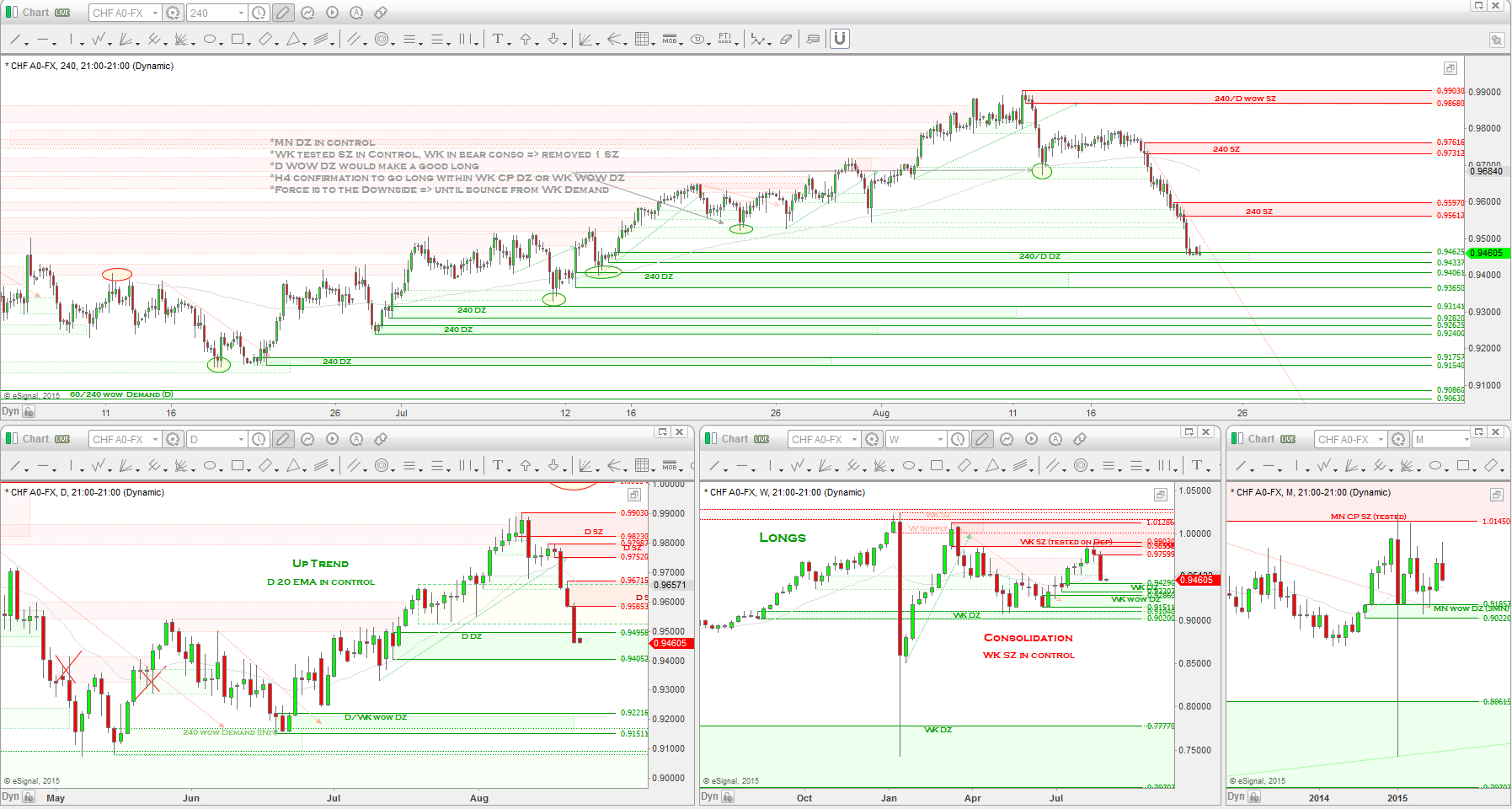

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Hedge Funds: The hedge funds slightly increased longs from 15.2k to 15.5k and decreased shorts from 19k to 13k. Wile doing so the shifted short exposure from 56% to 47%. So they bsically closed out some shorts for profits as price dropped into an H4 Demand zone that removed an opposing D SZ.

Market Movers: Not much in terms of data to move the pair except the USD positivity mid to end of week. Seems closing short positions was the right move to make for the "BIG BOYS!"

On the charts: we saw price drop from a D WOW SZ, where I took an H4 WOW short into an H4 DZ that removed a D SZ, it was there we saw a bounce back up following the USD.

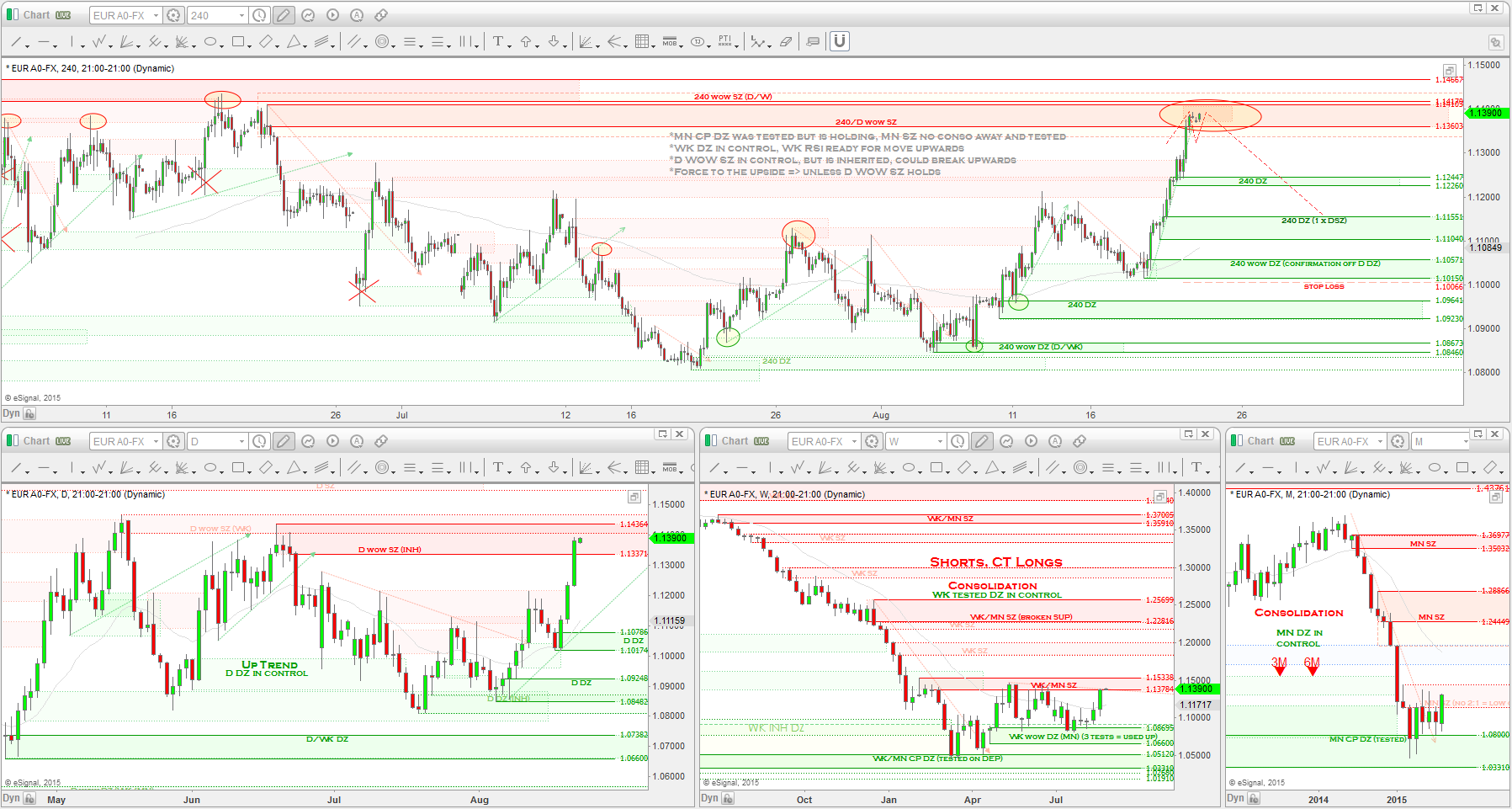

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Hedge Funds: The hedge funds slightly increased longs and slightly decreased shorts last week. Increasing long exposure by 1% was pretty much nothing.

Market Movers: Some mixed data was released mid week followed by a speech by Draghi which could explain the lack of movement of positions by the big players leading into the week.

On the charts: we saw that rally into D bearish engulfing territory and then a drop drop into the D WOW DZ, then a rally into an H4 SZ that removed a D DZ and then another drop into a new D WOW DZ. A nice D WOW SZ above could be ready to drop price lower.

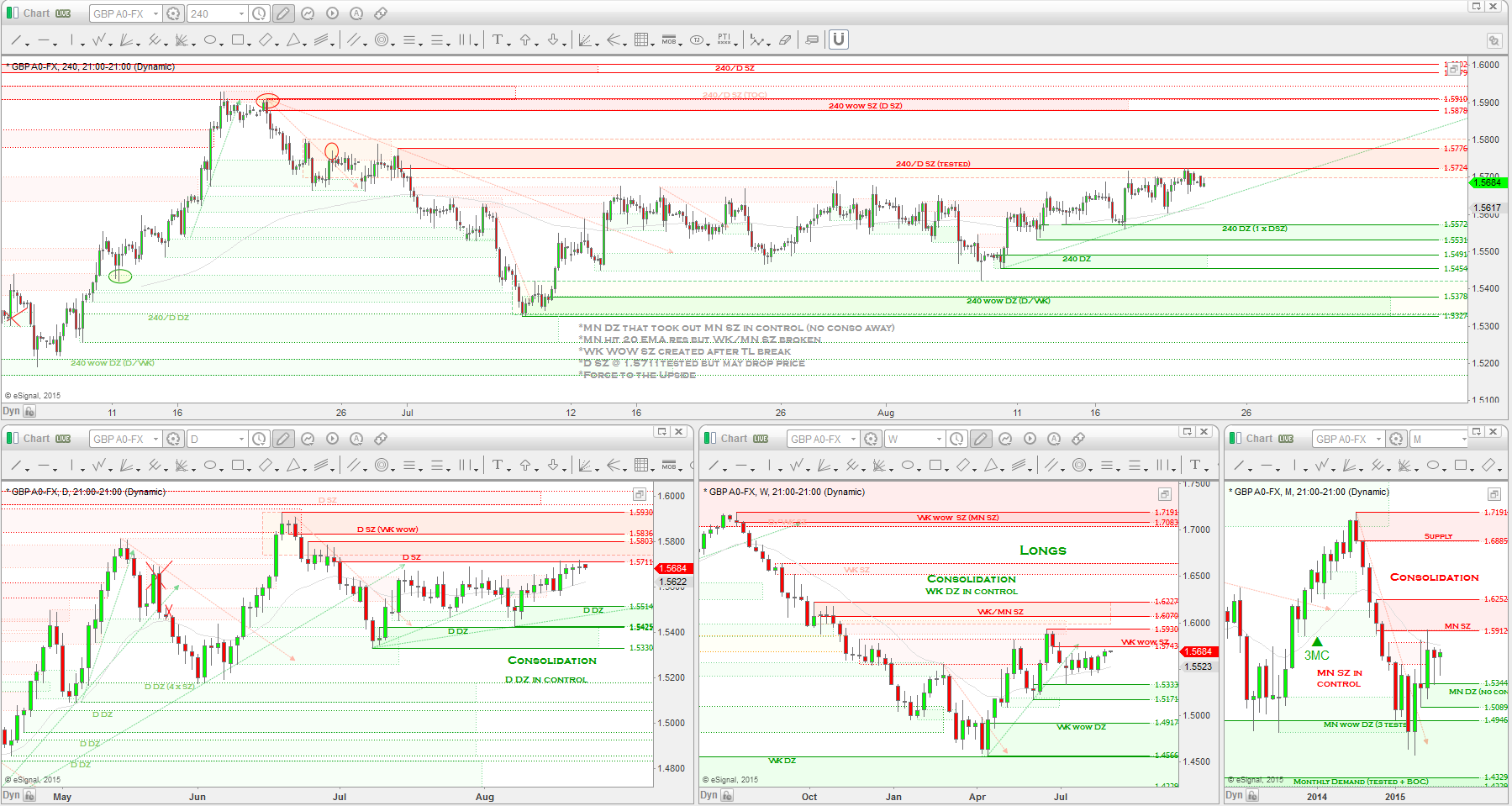

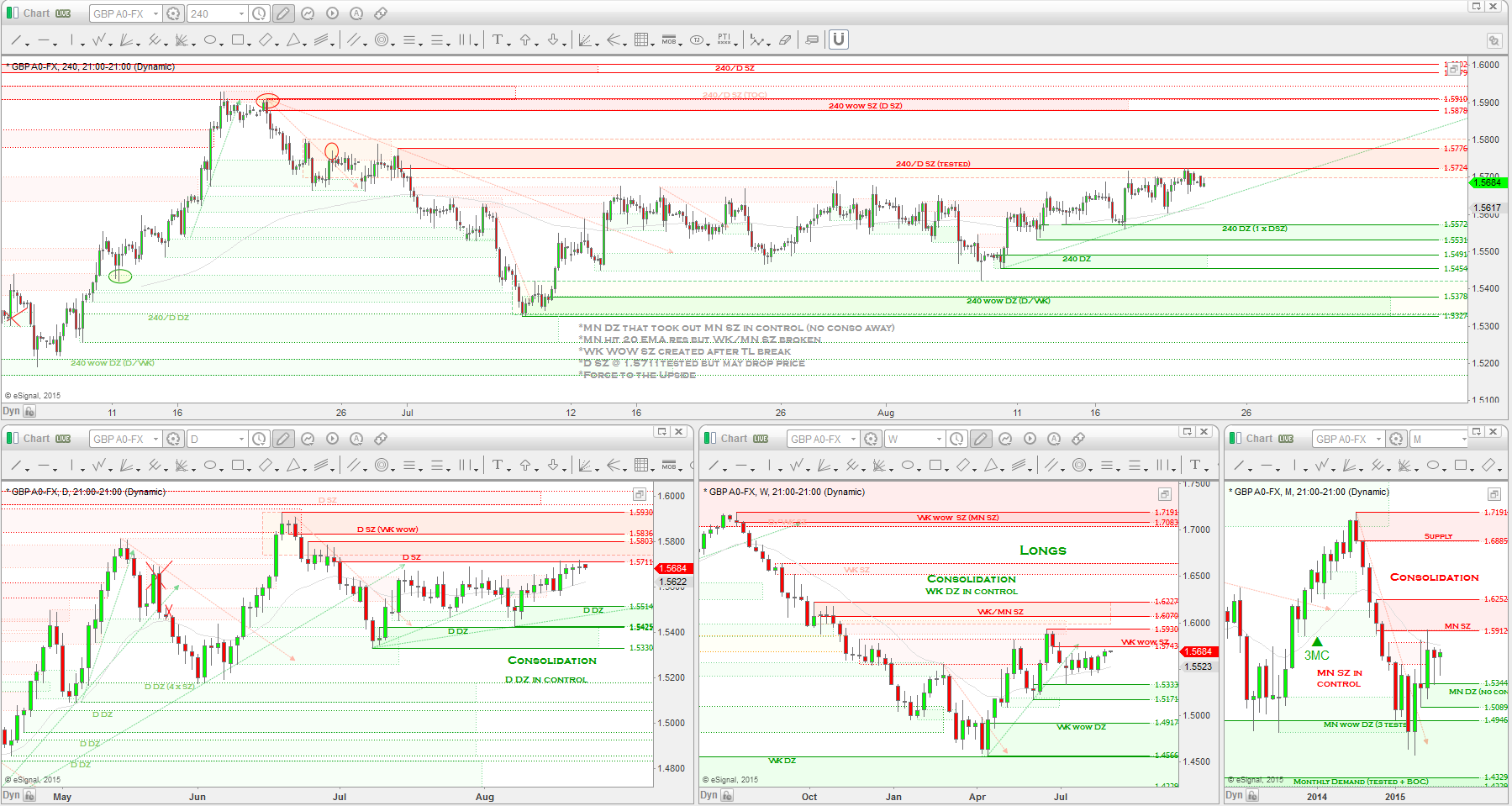

GBPUSD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Hedge Funds: The hedge funds increased longs from 43k to 45k last week as price rallied into WK Supply and covered shorts from 90k to 88k and in doing so they once again became slightly bullish with their positions at a net +1,267 contracts long. Long exposure now sits at 51% of total positions.

Market Movers: In terms of data, not much was released to move price except for supply and demand.

On the charts: we saw price drop from the WK WOW SZ mentioned weeks ago. MN Demand is being penetrated even deeper now since there was no 1 candle consolidating away from the zone, we expected this. Twice tested WK Demand is in control now, so a further drop can very easily happen these coming couple weeks.

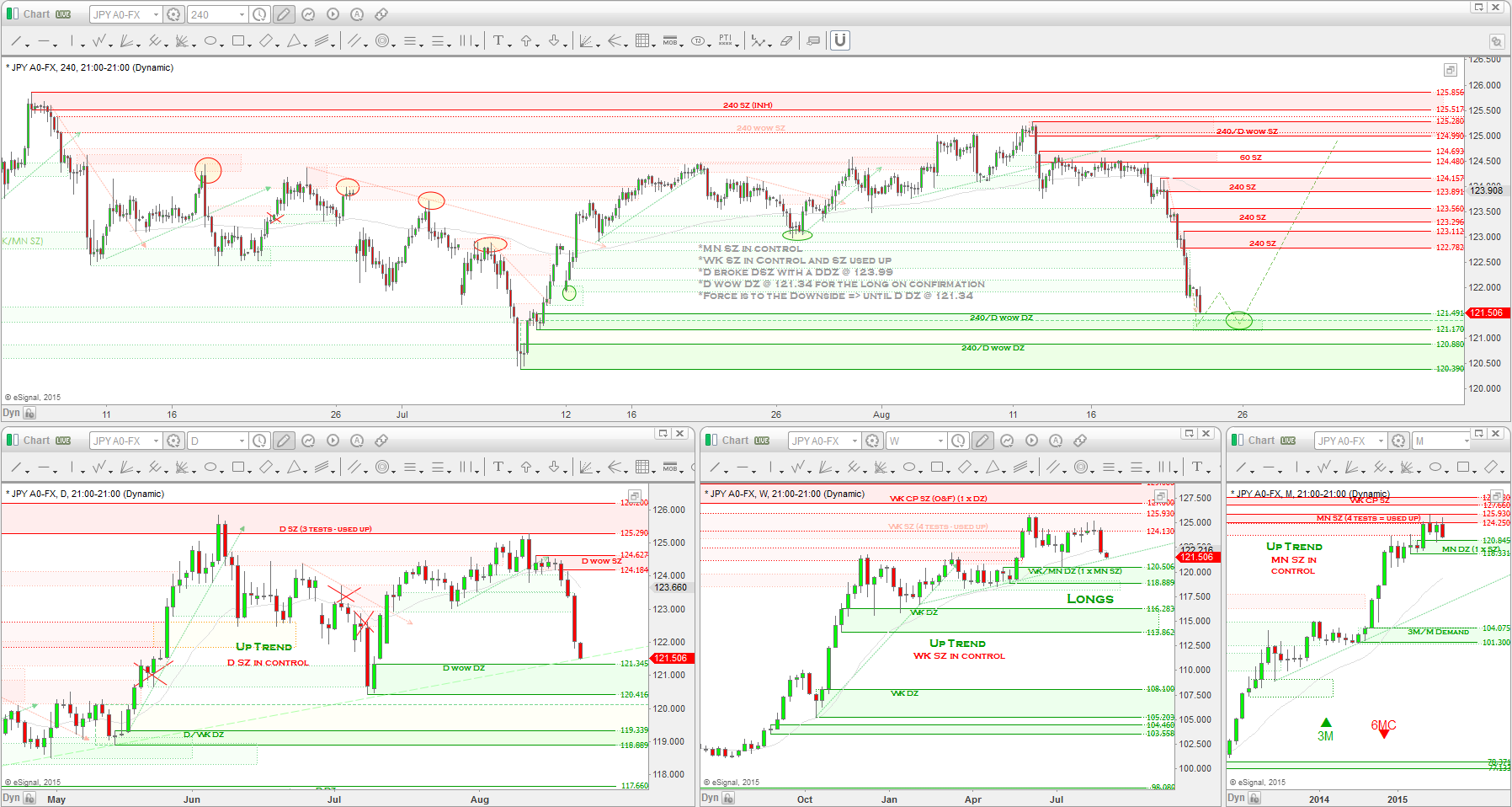

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Hedge Funds: The hedge funds increased their longs from 63k to 71k and increased shorts from 36k to 48k last week. In so doing, they dropped long exposure from 63% to 60%.

Market Movers: Not much in terms of market moving data from the JPY and so consolidation is what we saw.

On the charts: continued consolidation on the charts as price bounces between D Supply and D Demand.

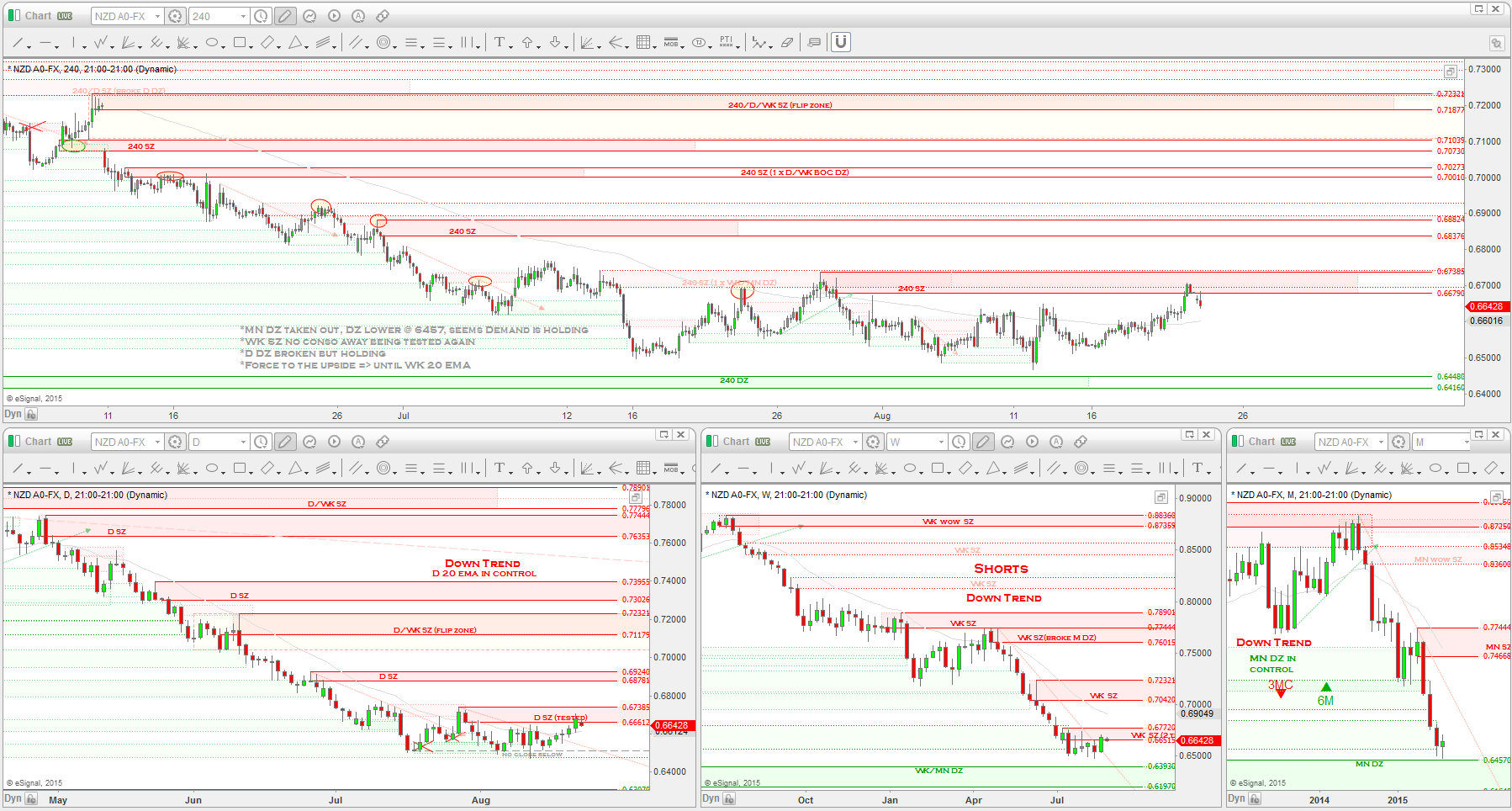

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Hedge Funds: The hedge funds slightly increased longs and shorts last week. Long exposure dropped from 48% to 46% after we saw the huge move the previous week with the long positions doubling. Net positions sit at -3,529 which is down from the -11,820 just 3 weeks ago.

Market Movers: data was mixed mid week week with both negative and positive results being released.

On the charts: price again dropped into tested D Demand and again rallied back up toward the descending WK TL. A push into WK Supply at 0.6539 would be nice to see at this point and if short exposure increases by the hedge funds, a short could be setting up here.

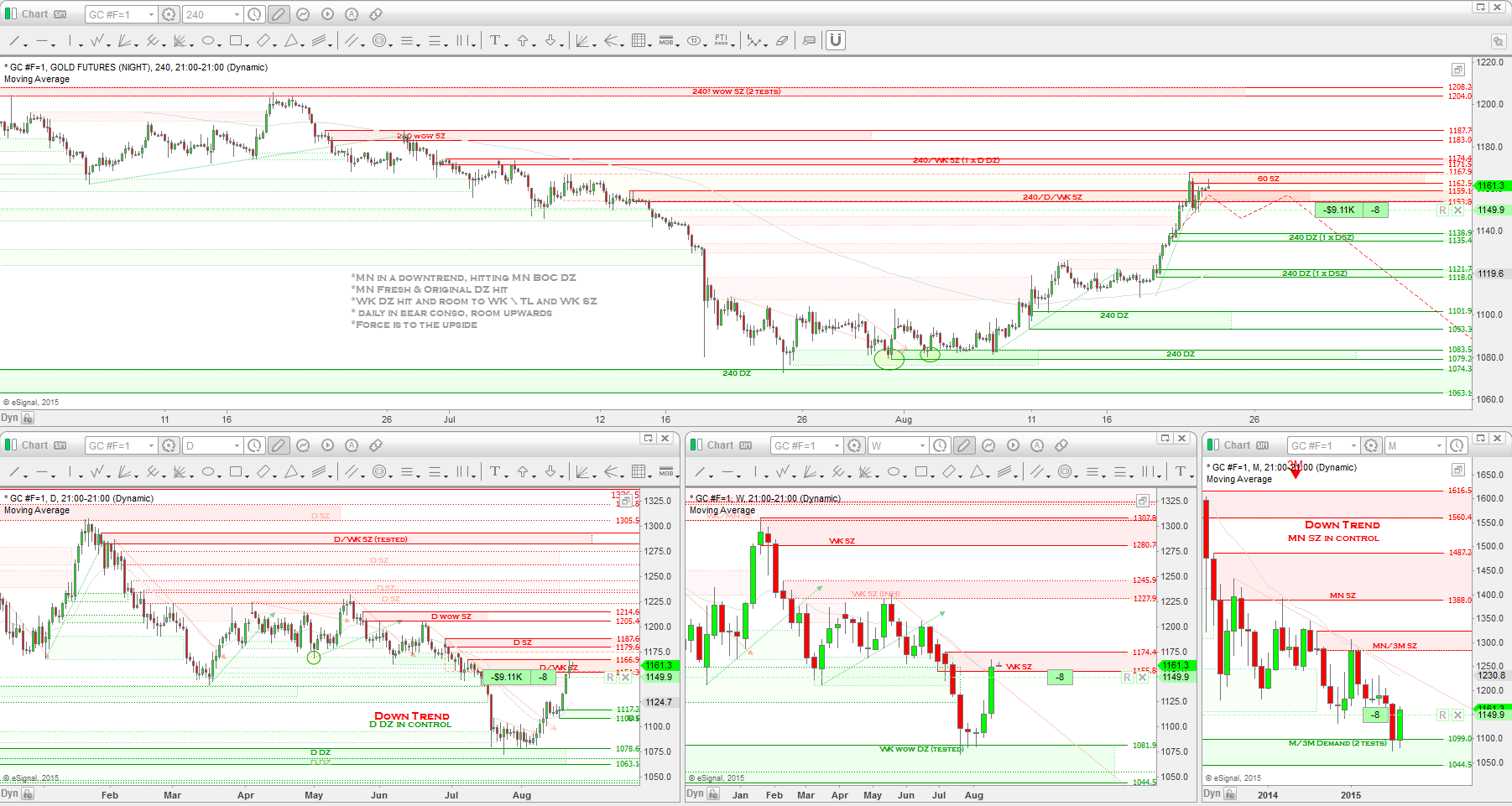

So that's the breakdown of the majors, the data released last week and how it effected the charts and what the institutions have been doing with their positions lately traders. Oil had a significant rally a few weeks ago which has strengthened the AUD, CAD and the NZD while they all hit their HTF zones. So you can see that the Hedge Funds, although they took profits at these higher time-frame zones, they are also still sticking with their guns and remaining with the same bias as before. Gold is starting to see a nice rally as well but the HTF down trend is still holding. USD seems primed for another rally up and the EURUSD also looks ready for another drop further down. Talks about the BOE increasing the interest rate hasn't done much for the GBPUSD lately as we have seen continued selling pressure set in. Things are looking so juicey lately and there are a bunch of good looking opportunities setting up for some trades this coming week as we have some great market moving data being released. So stay disciplined and focused traders, my charts are all set and ready for the week and I hope yours are as well!

Have a profitable week!

Kevin

Notes:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional traders

are SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

THE SETUP:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional tradersare SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

Notes: Trend is up on the monthly, bullish consolidation on the weekly and down trend on the daily chart.

THE SETUP:

THE SETUP:

$GBPUSD -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: HAWKISH

Notes:

THE SETUP:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISHNotes:

THE SETUP:

Video Link ==>

https://gyazo.com/e9f272b57e10e0c405897182e8d39b43

https://gyazo.com/d61632b6308565e4ab3b990c2f9ea4cd

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/d1fd69a1e2d15b5155d61d121fe6a326

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Commitment Of Traders Report: Institutional traders are VERY LONG biased.

Notes:

THE SETUP:

Video Link ==>

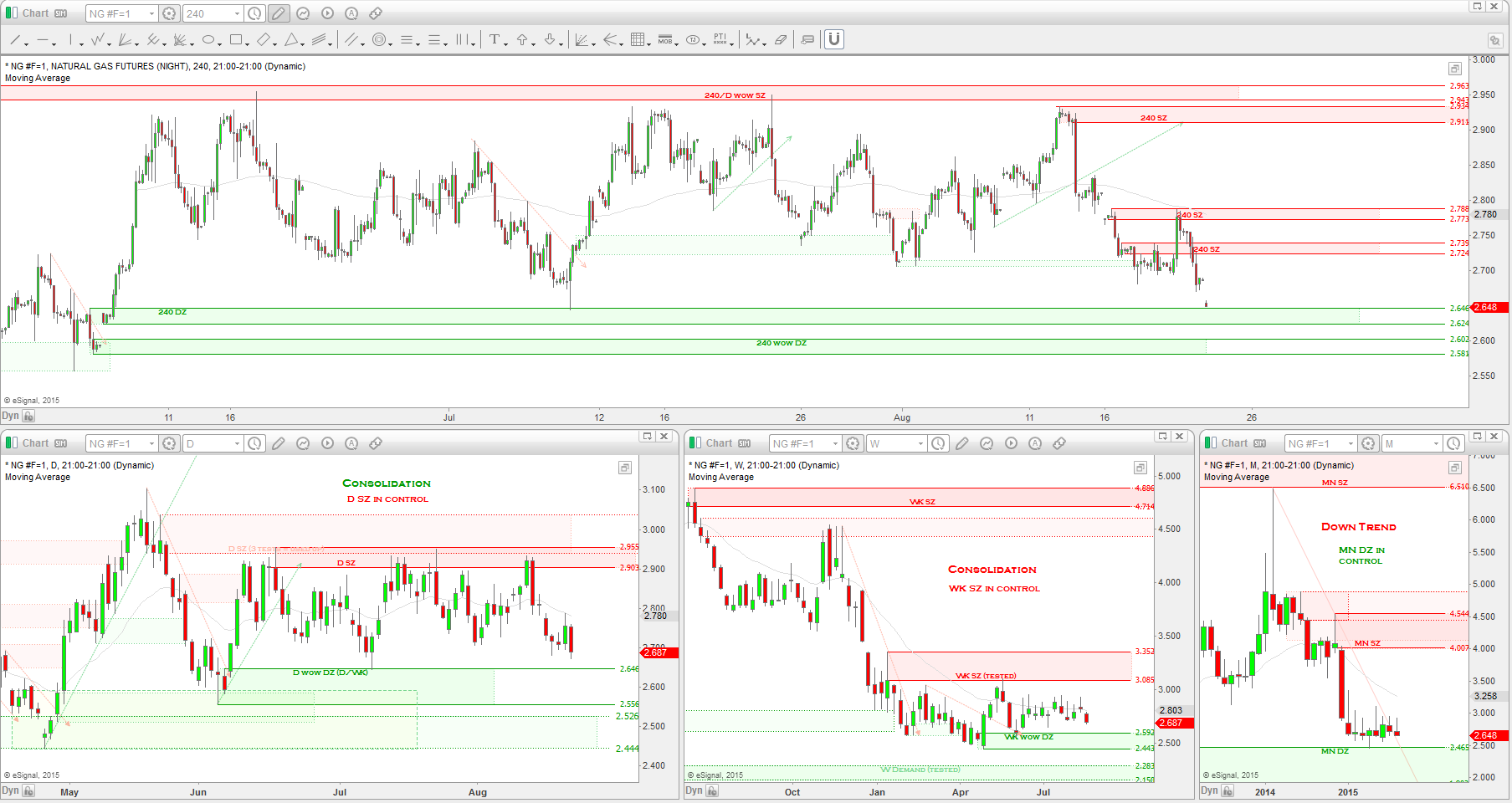

Commitment Of Traders Report: Institutional traders are VERY SHORT biased.

Notes:

THE SETUP:

Video Link ==>

Notes: Trend is down on the monthly, down on the weekly and bearish consolidation on the daily chart.

*WK SZ and WK TL in control

*WK SZ and WK TL in control

THE SETUP: LONG @ 0.7365, SL @ 0.7306, TP - technical stop

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1