SUPPLY & DEMAND ZONES

SHADED GREEN ZONES = Strong Buy Zones

SHADED RED ZONES = Strong Sell Zones

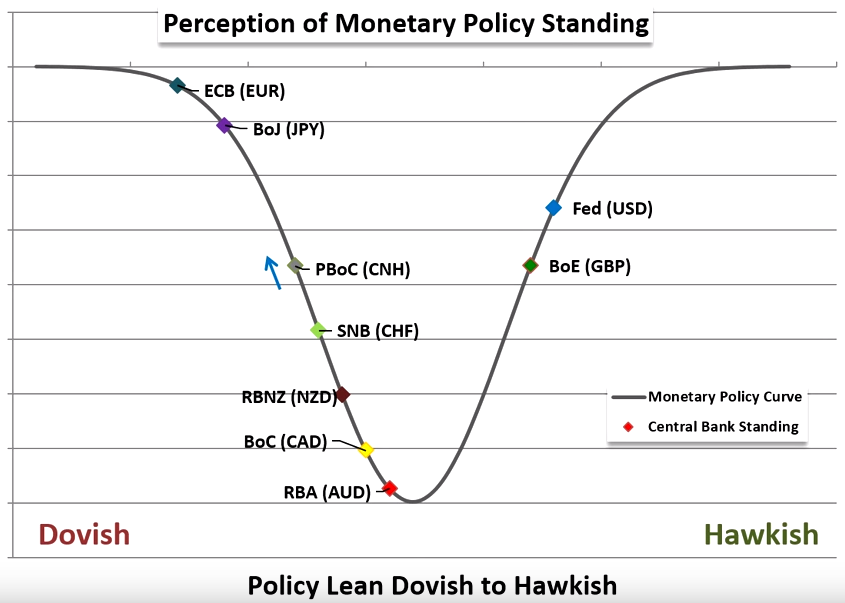

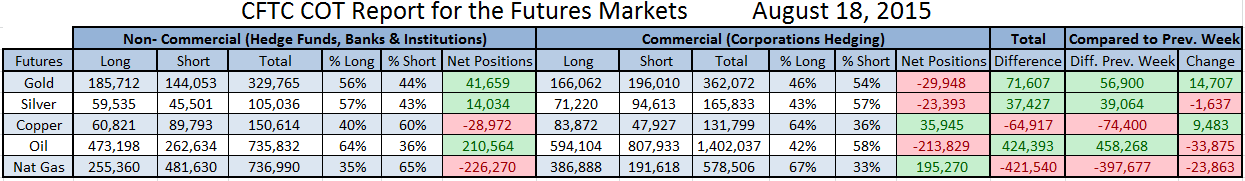

Commitment Of Traders Report: Institutional traders are VERY LONG biased. Perception of Monetary Standing: HAWKISH

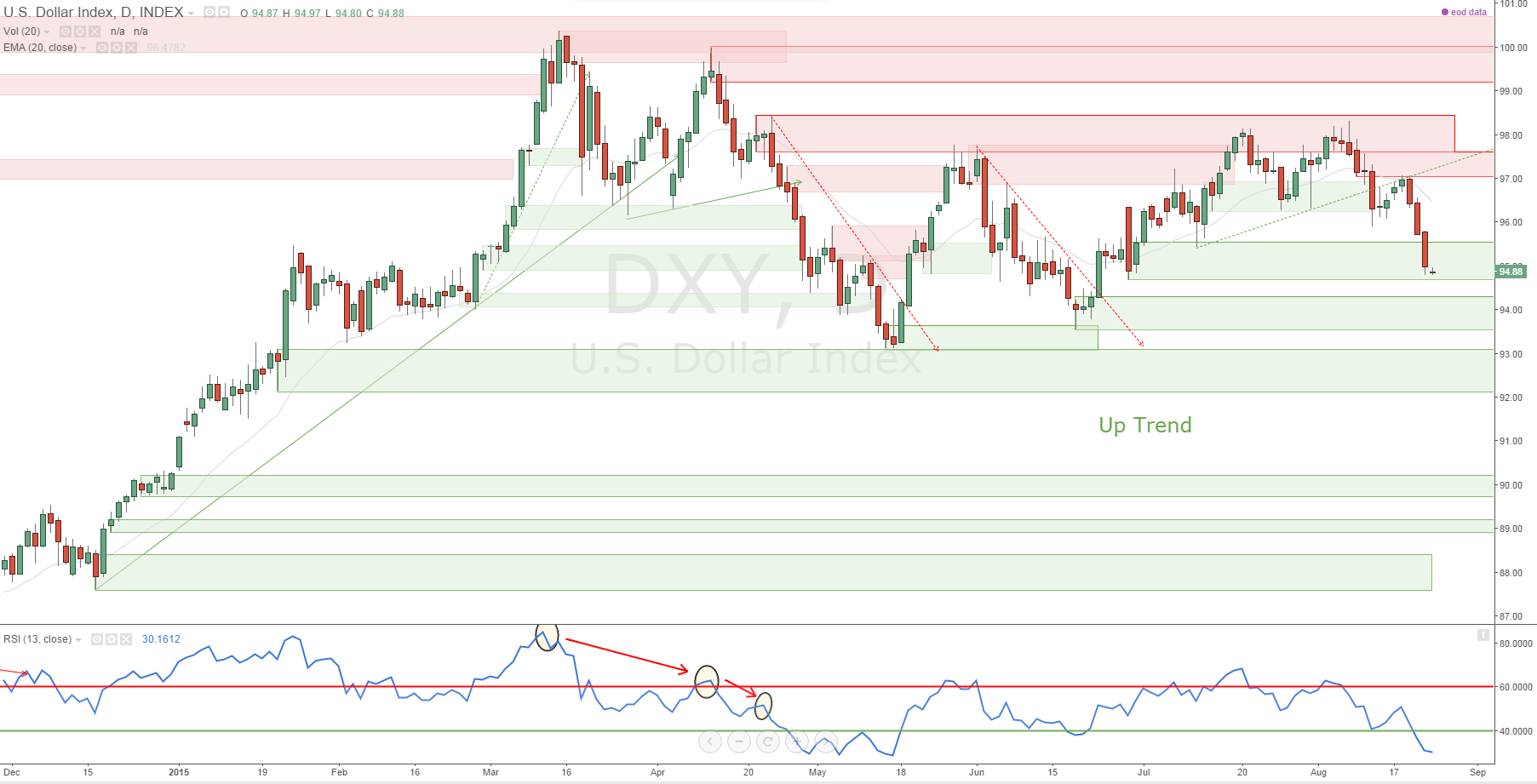

$USD OVERVIEW (DAILY)

US DOLLAR => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds this week added to their longs and added massively to their shorts as price entered a D SZ and therefore filled some of their sell orders and dropped price. Short positions went up from 6k to 11k, so practically doubling their size. Long exposure dropped in the process but overall sentiment is still bullish.

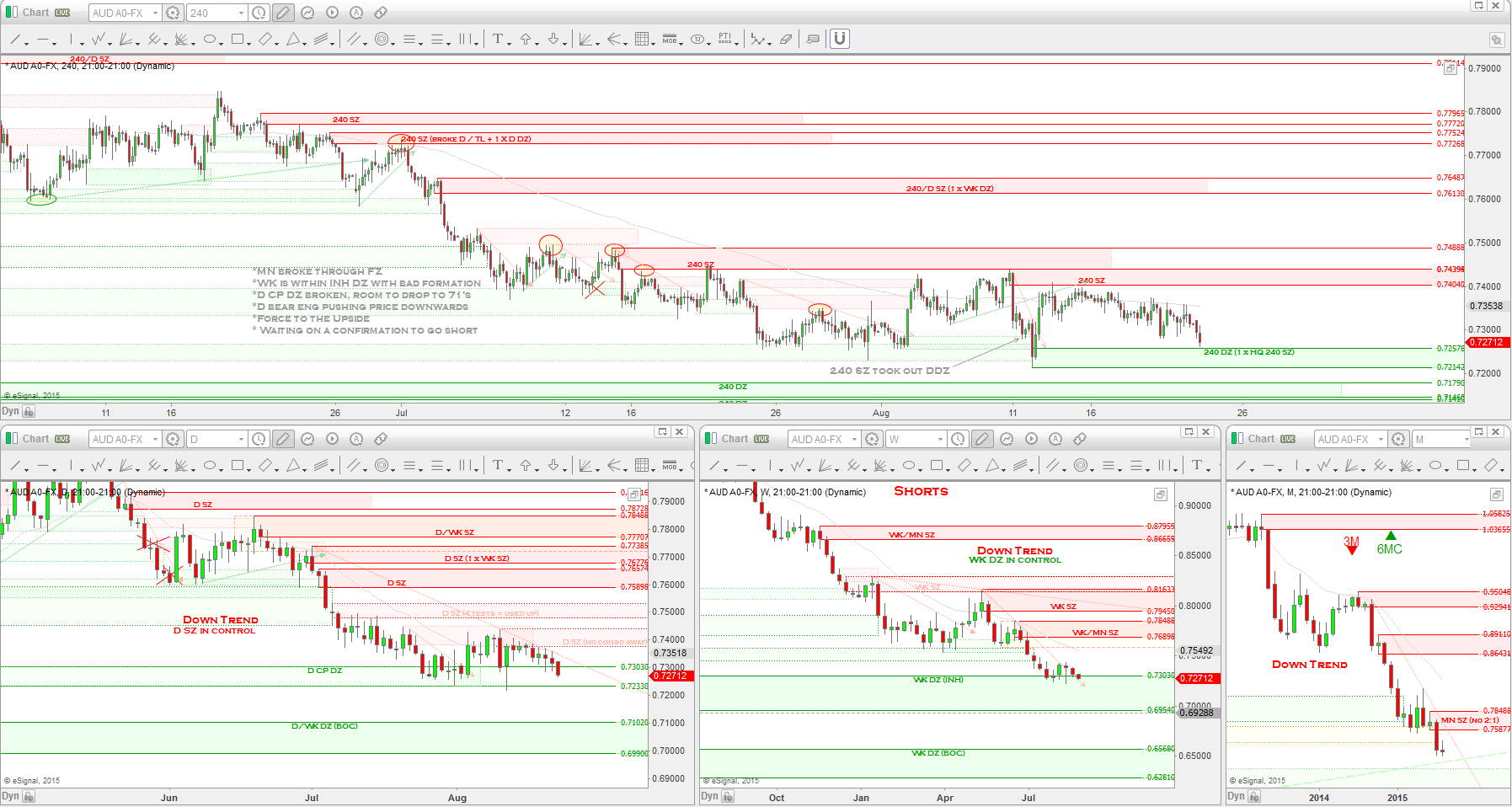

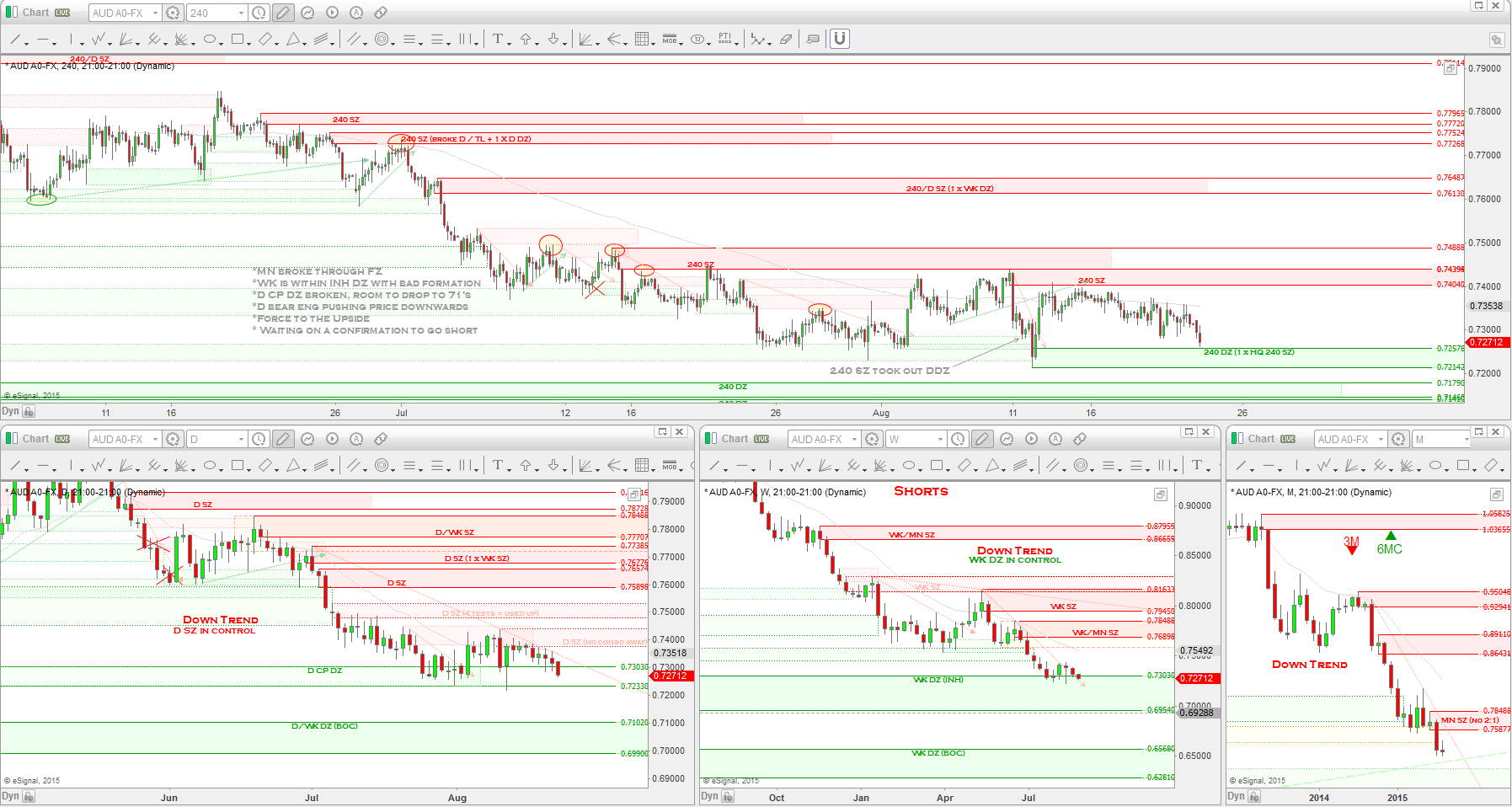

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Notes: I did a deep analysis of the AUDUSD here. The hedge funds didn't move their positions around on the Aussie. Portfolio exposure sits at the same and long and short positions as well. On the charts we see price continue to consolidate. What we could be seeing here is continued sideways action until the USD bounces from the D WOW DZ we are dropping into soon and then the AUDUSD might continue it's drop. Just speculating here.

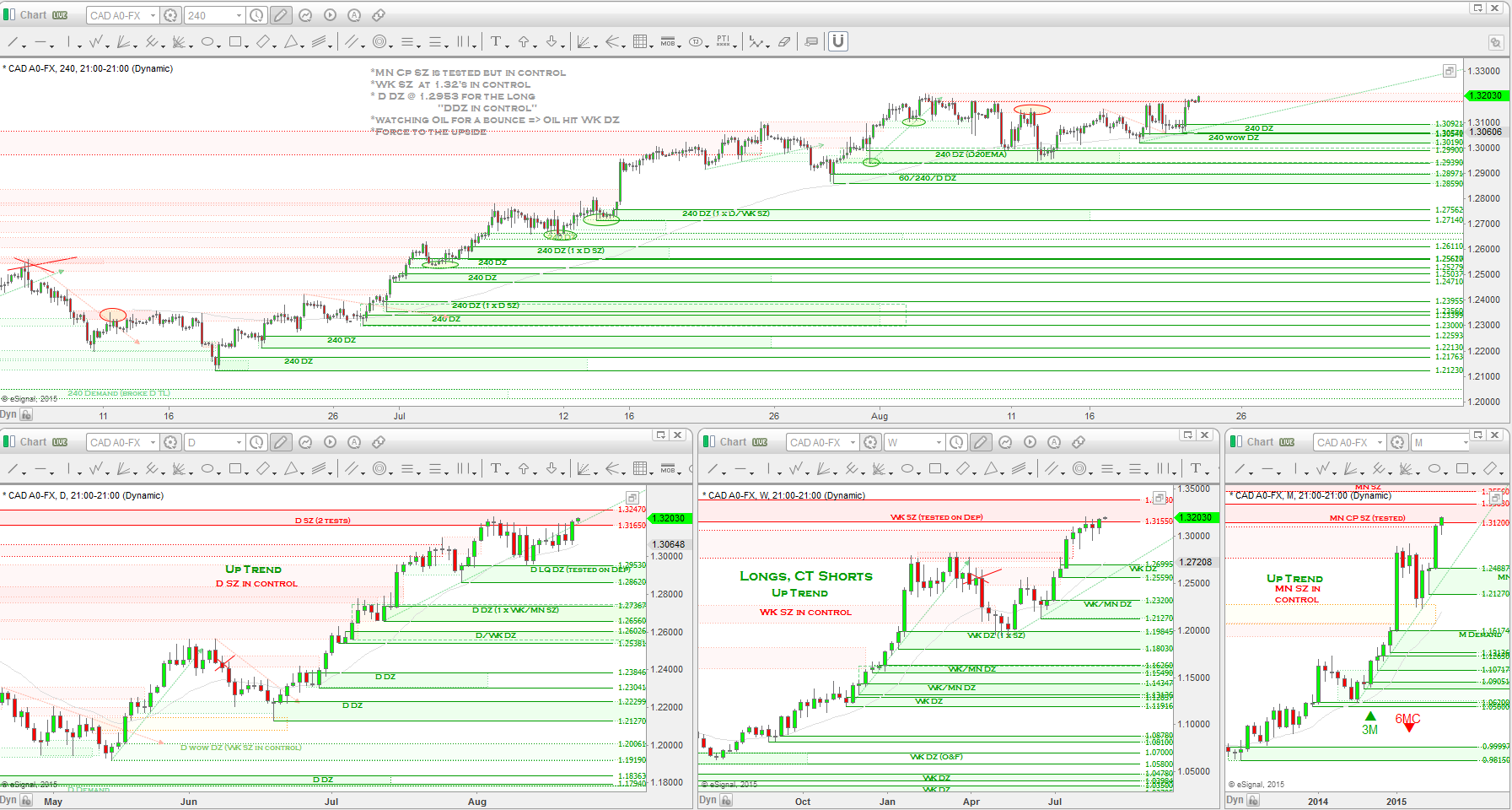

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

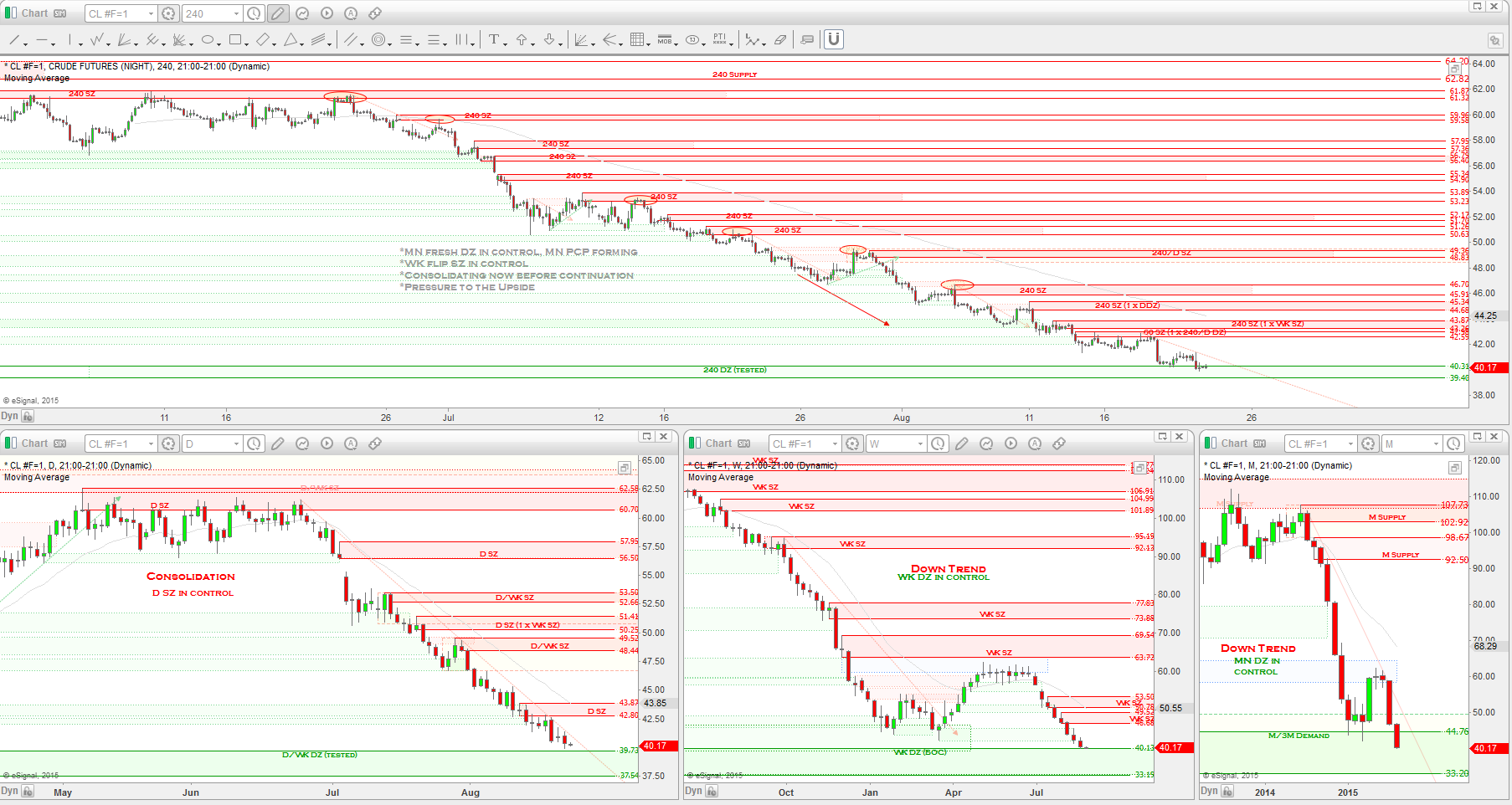

Notes: The hedge funds closed out some of their long positions and closed out their short positions as price dropped into the low quality D DZ I mentioned last week and held. Long exposure has increased from 77% to now 80%, making the USDCAD the pair with the 2nd largest portion of the hedge funds portfolio favouring one direction. In the mean time, Oil continues to drop further into the low 40's, breaking through a WK WOW DZ with a poor ERC move away from the base. We could see lows into the high 30's from what I see in the charts, this will help the USDCAD rally for sure.

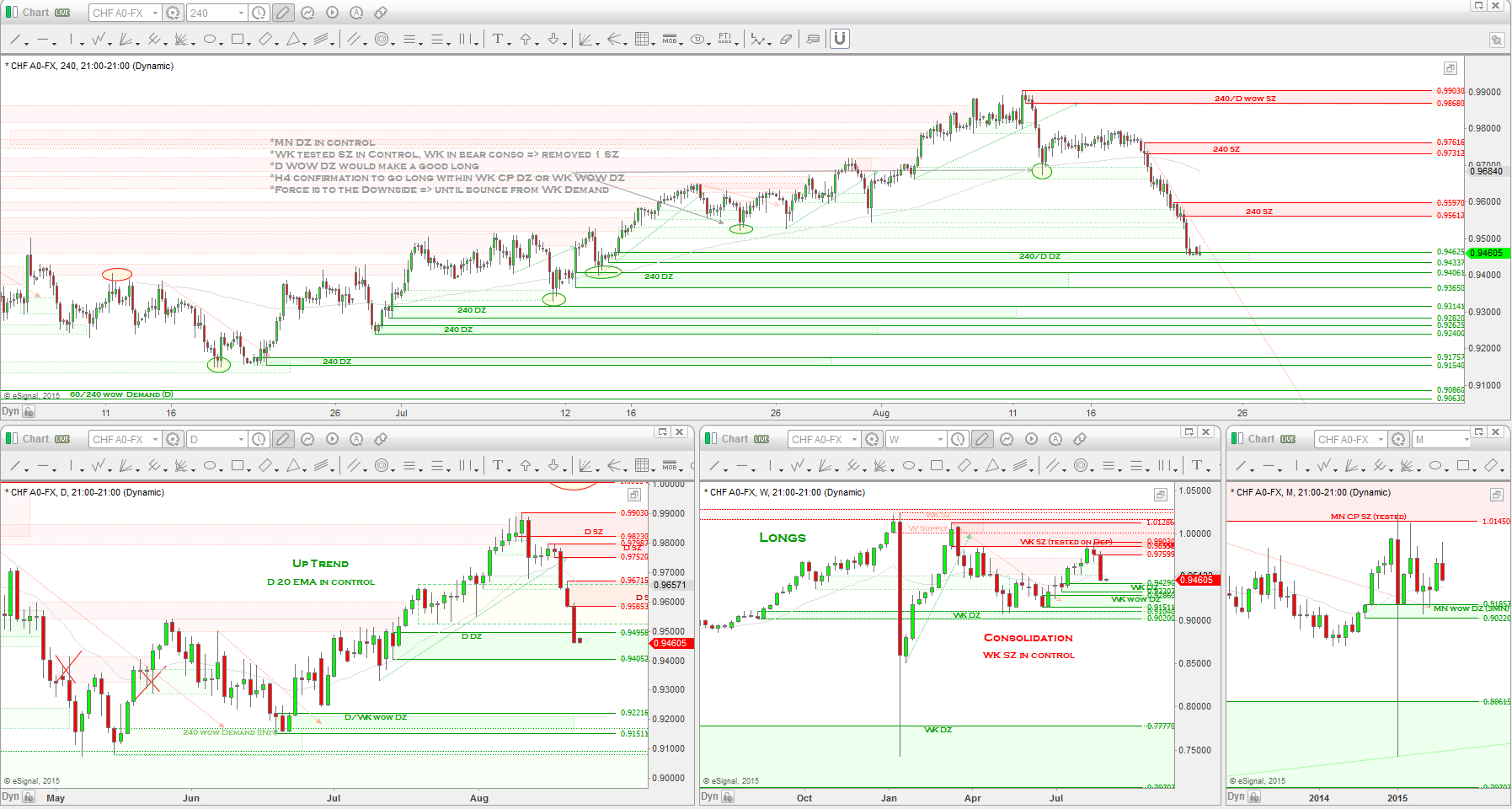

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds added to their longs and reduced shorts and price reacted from a tested WK SZ and dropped through a WK DZ that didn't have a 2:1 move away so therefore broke through. WK CP DZ sits at the .94's as the USD approaches the D WOW DZ so we could be seeing a bounce this coming week. With the hedge funds committing to the long side this week, a bounce play long looks very good to me.

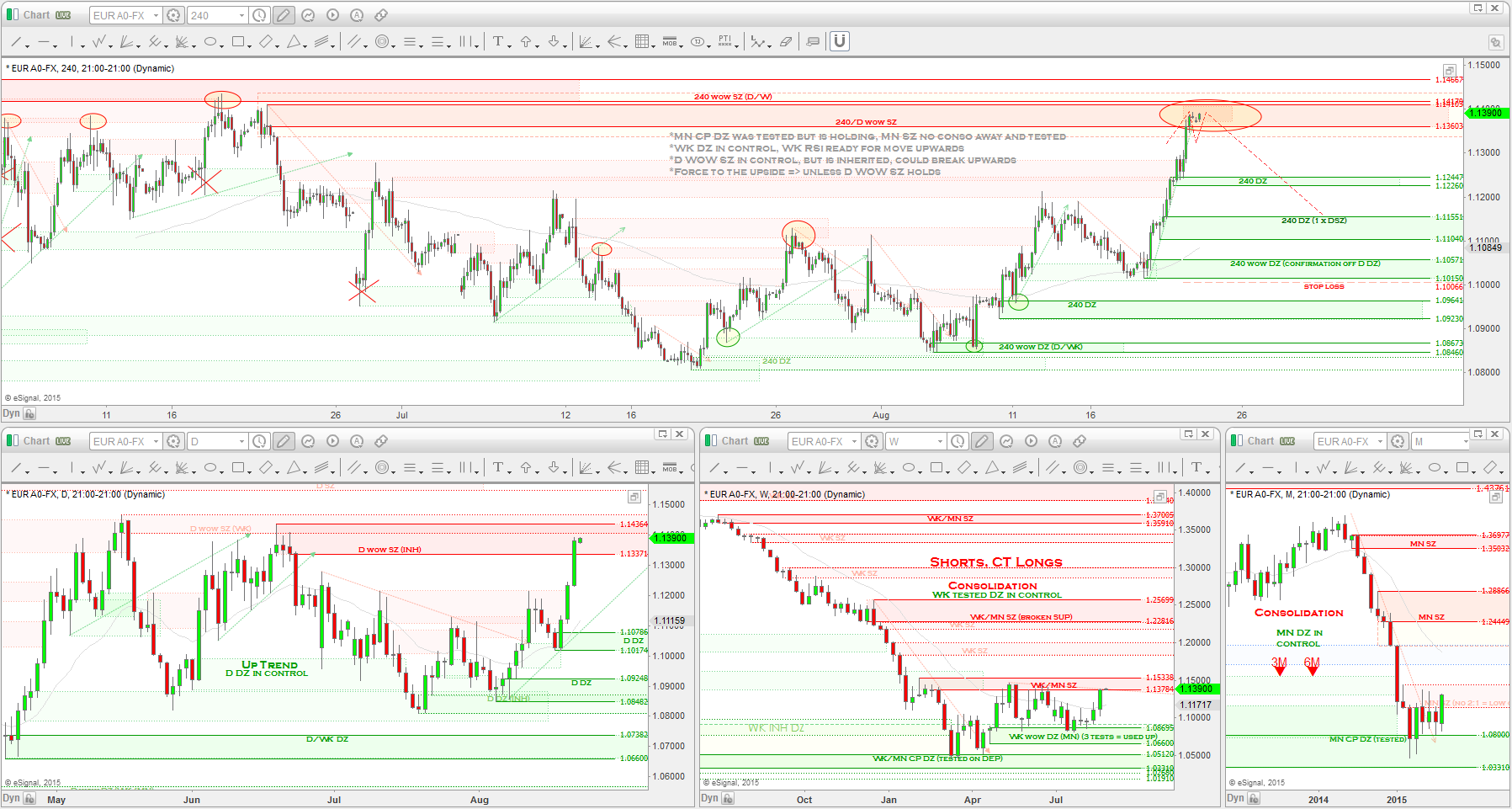

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds, as expected, increased their longs by a bit but the big moves came as they closed a significant portion of their shorts as price dropped into a D DZ and reacted from the WK DZ which had been tested twice before. About 21k short positions were closed causing a large spike upwards. I had placed a long entry order on the D DZ but later cancelled when reviewing the WK analysis video and hearing Alfonso mention the drop from last months highs. My original analysis, combined with the COT data, put the odds in the favour of a rally in price and turns out I should have stuck with my thinking, everything is always clearer afterwards! Lesson here, it's great to listen to others for help but eventually trading is about trusting yourself and your own analysis and therefore you have to trust your own set-ups!

Lesson here, it's great to listen to others for help but eventually trading is about trusting yourself and your own analysis and therefore you have to trust your own set-ups!

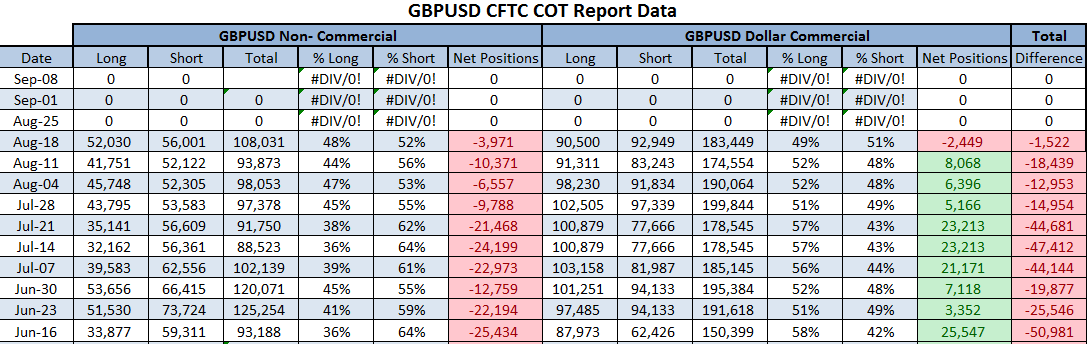

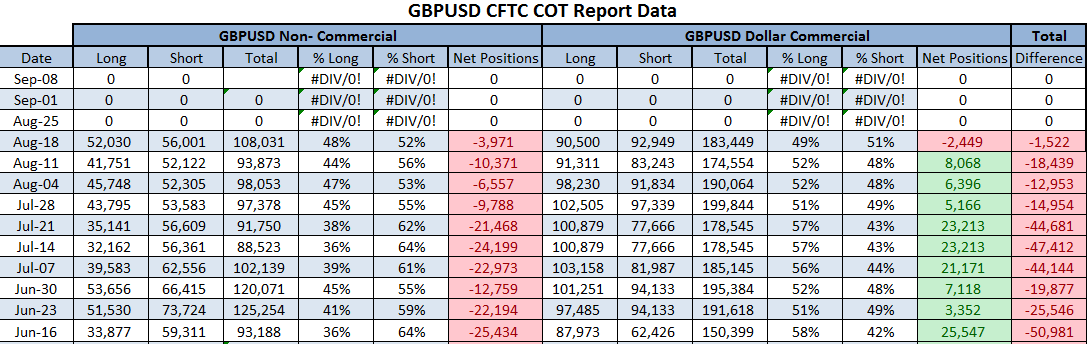

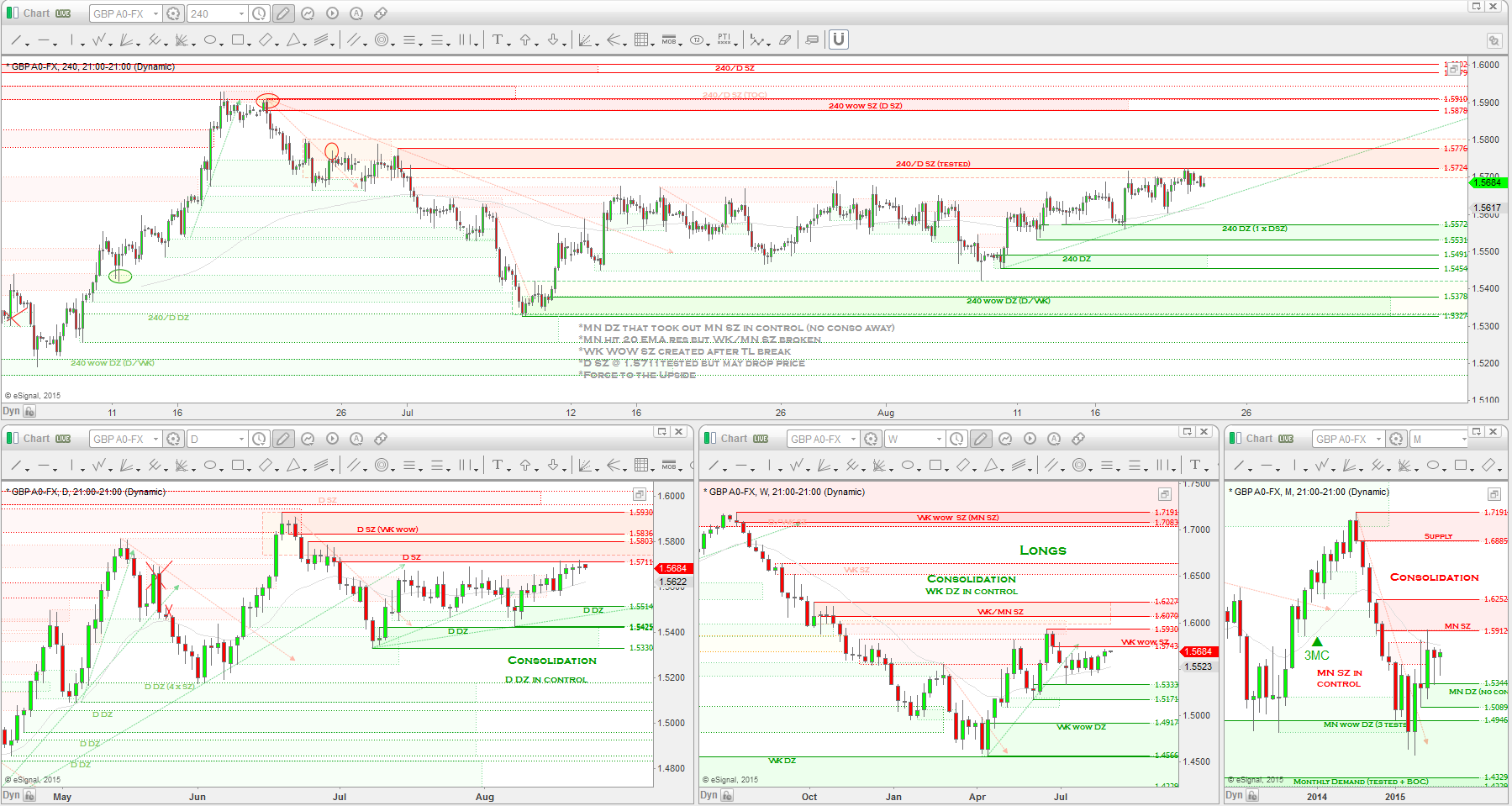

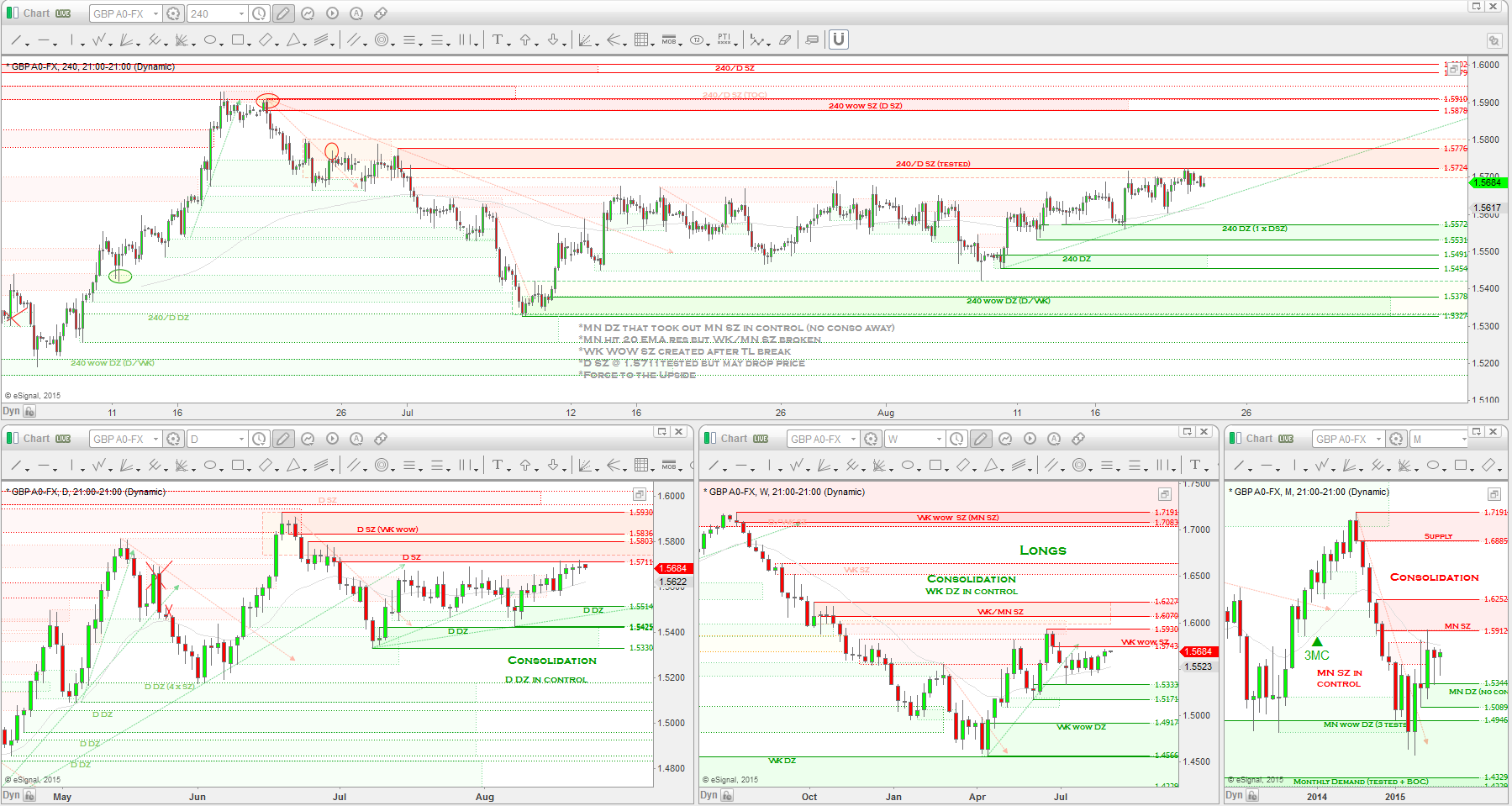

GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds increased their longs from 41k to 52k and short from 52k to 56k with net positions being -3,971k the neutral stance is setting in even stronger. The change from the previous week to this past week was a positive 16k contracts long. Long exposure is now 48% vs 44% previously. On the charts we are reacting from MN Demand and have been in consolidation on the WK. Looks like what we were watching for is starting to happen here, a shift in direction is starting to take place now. Take a look at the inserted chart below to see the shift that has been happening throughout the summer.

https://gyazo.com/2ca38f7a946f536c0ce5cbe2dd126044

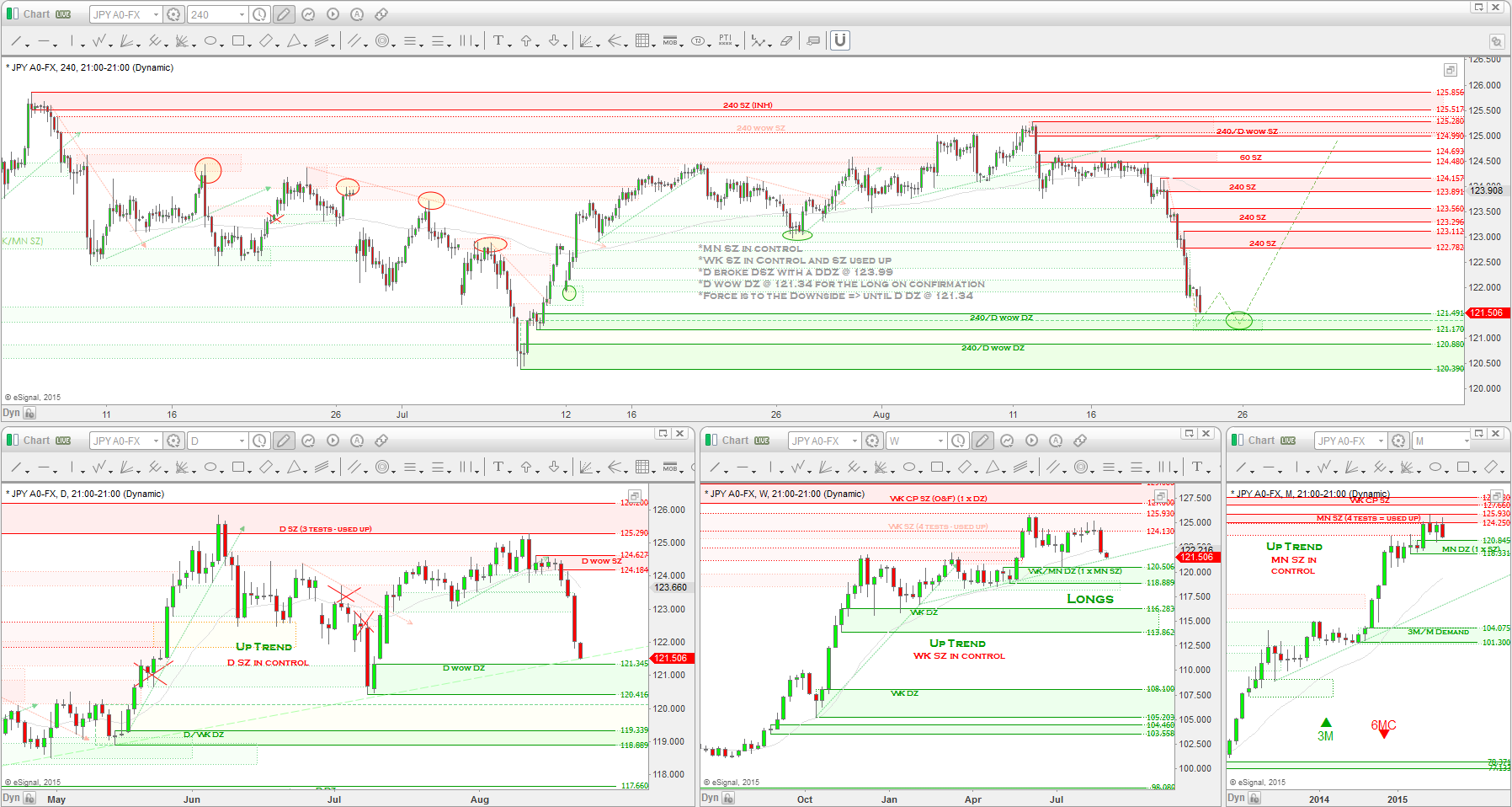

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds closed some longs and kept the shorts the same this past week. Longs from 150k to 136k, dropping long exposure from 77% to 75%, still very bullish but some heavy profit taking happening from the "Big Boys". Price now dropping toward a nice D WOW DZ at the 121's. Could be nicely timed with the USD D WOW DZ for longs. We'll see.

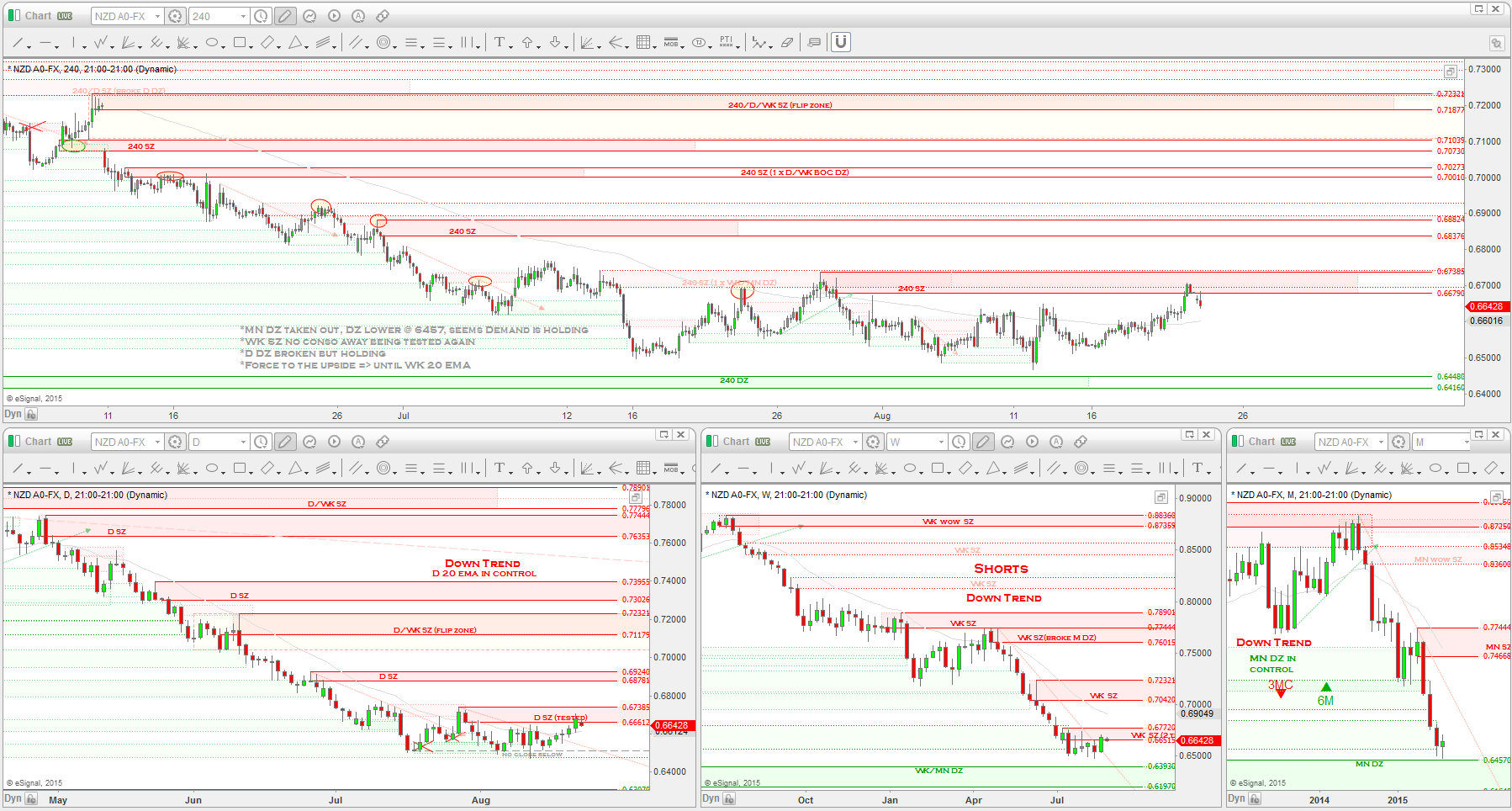

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds increased longs while decreasing shorts. Not by any major numbers so still sitting at the same level as before. On the charts, price is reacting from MN Demand so this data could be showing us the buy orders being filed and a possible move to the upside from here. Not too sure on this one, still watching.

So it seems many of the pairs are setting up for potential continuations of the HTF trends, I personally will be looking to go short the AUDUSD and the EURUSD and will be looking to go long the USDCAD, USDCHF, USDJPY and now the GBPUSD. Which pair will turn out to be the highest odds pair to trade will depend on the price action from the USD. But with the COT report showing us that the hedge funds are still very bullish the USD, odds are the USDCHF, USDJPY, EURUSD and AUDUSD will make great trades. Time will tell and I will be watching the charts very closely this coming week for my entries on these pairs. I wish you all a great trading week!

Kevin

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds this week added to their longs and added massively to their shorts as price entered a D SZ and therefore filled some of their sell orders and dropped price. Short positions went up from 6k to 11k, so practically doubling their size. Long exposure dropped in the process but overall sentiment is still bullish.

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Notes: I did a deep analysis of the AUDUSD here. The hedge funds didn't move their positions around on the Aussie. Portfolio exposure sits at the same and long and short positions as well. On the charts we see price continue to consolidate. What we could be seeing here is continued sideways action until the USD bounces from the D WOW DZ we are dropping into soon and then the AUDUSD might continue it's drop. Just speculating here.

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds closed out some of their long positions and closed out their short positions as price dropped into the low quality D DZ I mentioned last week and held. Long exposure has increased from 77% to now 80%, making the USDCAD the pair with the 2nd largest portion of the hedge funds portfolio favouring one direction. In the mean time, Oil continues to drop further into the low 40's, breaking through a WK WOW DZ with a poor ERC move away from the base. We could see lows into the high 30's from what I see in the charts, this will help the USDCAD rally for sure.

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds added to their longs and reduced shorts and price reacted from a tested WK SZ and dropped through a WK DZ that didn't have a 2:1 move away so therefore broke through. WK CP DZ sits at the .94's as the USD approaches the D WOW DZ so we could be seeing a bounce this coming week. With the hedge funds committing to the long side this week, a bounce play long looks very good to me.

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds, as expected, increased their longs by a bit but the big moves came as they closed a significant portion of their shorts as price dropped into a D DZ and reacted from the WK DZ which had been tested twice before. About 21k short positions were closed causing a large spike upwards. I had placed a long entry order on the D DZ but later cancelled when reviewing the WK analysis video and hearing Alfonso mention the drop from last months highs. My original analysis, combined with the COT data, put the odds in the favour of a rally in price and turns out I should have stuck with my thinking, everything is always clearer afterwards!

Lesson here, it's great to listen to others for help but eventually trading is about trusting yourself and your own analysis and therefore you have to trust your own set-ups!

Lesson here, it's great to listen to others for help but eventually trading is about trusting yourself and your own analysis and therefore you have to trust your own set-ups!GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds increased their longs from 41k to 52k and short from 52k to 56k with net positions being -3,971k the neutral stance is setting in even stronger. The change from the previous week to this past week was a positive 16k contracts long. Long exposure is now 48% vs 44% previously. On the charts we are reacting from MN Demand and have been in consolidation on the WK. Looks like what we were watching for is starting to happen here, a shift in direction is starting to take place now. Take a look at the inserted chart below to see the shift that has been happening throughout the summer.

https://gyazo.com/2ca38f7a946f536c0ce5cbe2dd126044

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds closed some longs and kept the shorts the same this past week. Longs from 150k to 136k, dropping long exposure from 77% to 75%, still very bullish but some heavy profit taking happening from the "Big Boys". Price now dropping toward a nice D WOW DZ at the 121's. Could be nicely timed with the USD D WOW DZ for longs. We'll see.

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds increased longs while decreasing shorts. Not by any major numbers so still sitting at the same level as before. On the charts, price is reacting from MN Demand so this data could be showing us the buy orders being filed and a possible move to the upside from here. Not too sure on this one, still watching.

So it seems many of the pairs are setting up for potential continuations of the HTF trends, I personally will be looking to go short the AUDUSD and the EURUSD and will be looking to go long the USDCAD, USDCHF, USDJPY and now the GBPUSD. Which pair will turn out to be the highest odds pair to trade will depend on the price action from the USD. But with the COT report showing us that the hedge funds are still very bullish the USD, odds are the USDCHF, USDJPY, EURUSD and AUDUSD will make great trades. Time will tell and I will be watching the charts very closely this coming week for my entries on these pairs. I wish you all a great trading week!

Kevin

Notes:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional traders

are SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

THE SETUP:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional tradersare SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

Notes: Trend is up on the monthly, bullish consolidation on the weekly and down trend on the daily chart.

THE SETUP:

THE SETUP:

$GBPUSD -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: HAWKISH

Notes:

THE SETUP:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISHNotes:

THE SETUP:

Video Link ==>

https://gyazo.com/e9f272b57e10e0c405897182e8d39b43

https://gyazo.com/d61632b6308565e4ab3b990c2f9ea4cd

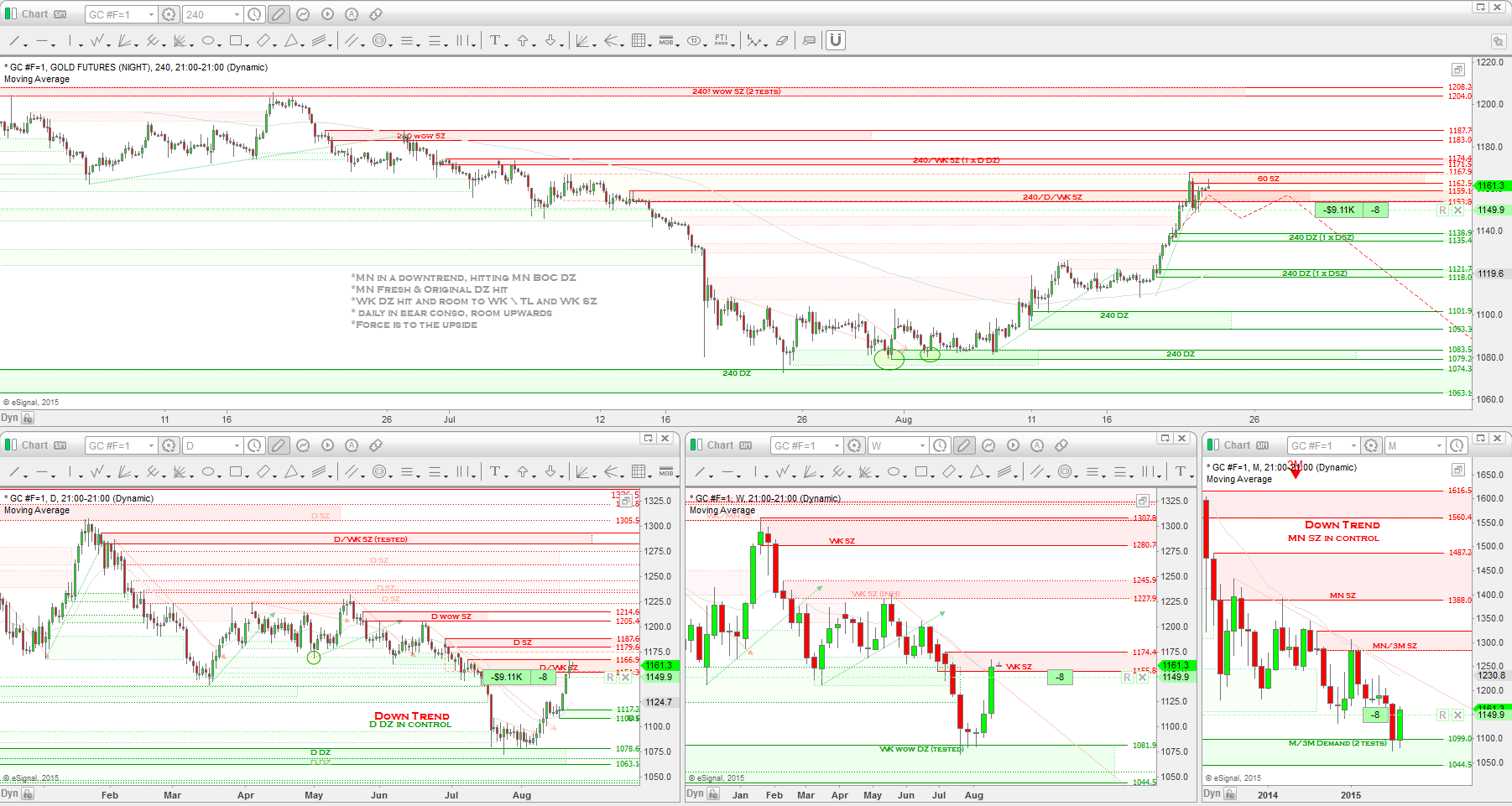

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/d1fd69a1e2d15b5155d61d121fe6a326

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Commitment Of Traders Report: Institutional traders are VERY LONG biased.

Notes:

THE SETUP:

Video Link ==>

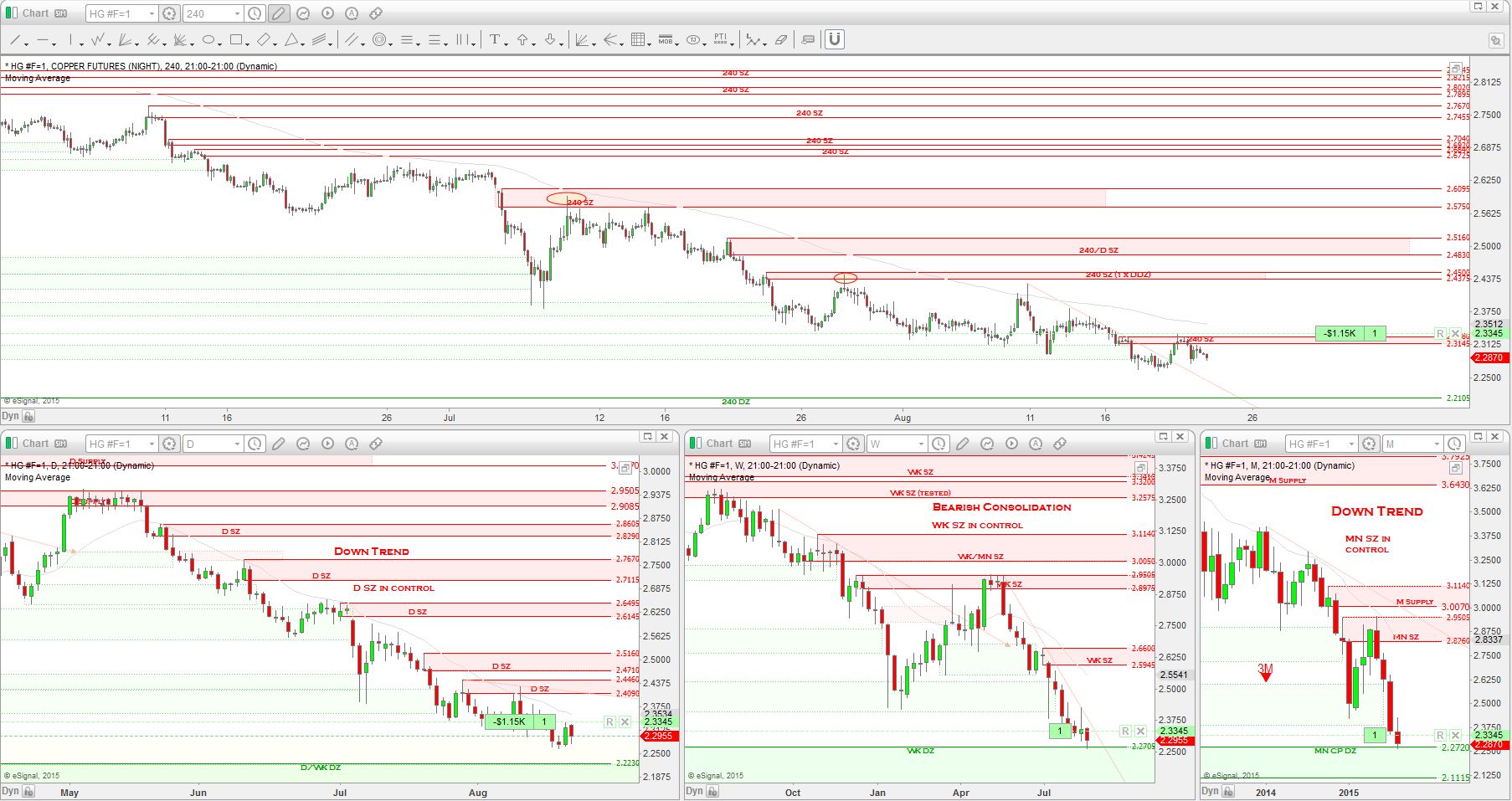

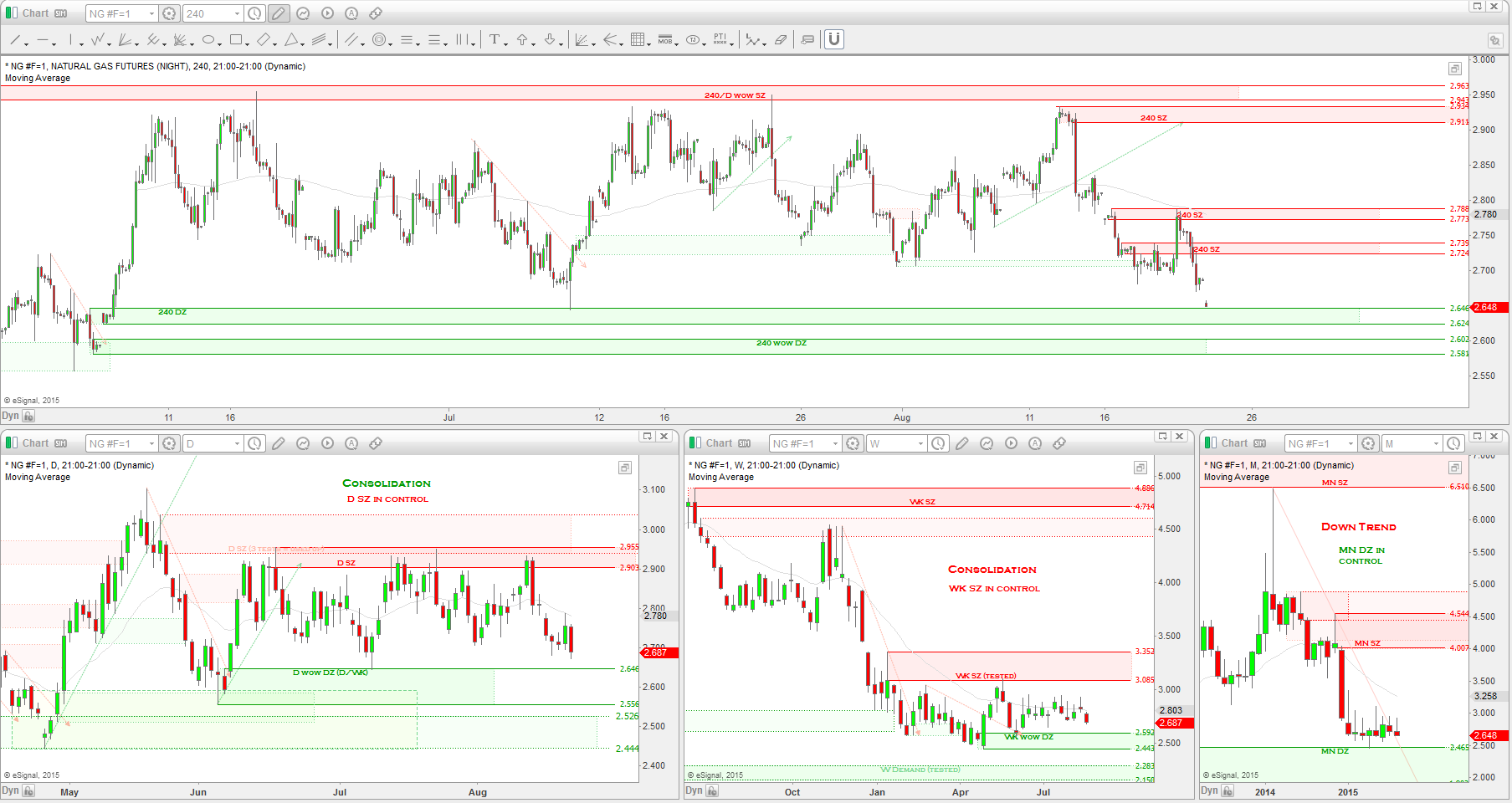

Commitment Of Traders Report: Institutional traders are VERY SHORT biased.

Notes:

THE SETUP:

Video Link ==>

Notes: Trend is down on the monthly, down on the weekly and bearish consolidation on the daily chart.

*WK SZ and WK TL in control

*WK SZ and WK TL in control

THE SETUP: LONG @ 0.7365, SL @ 0.7306, TP - technical stop

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1