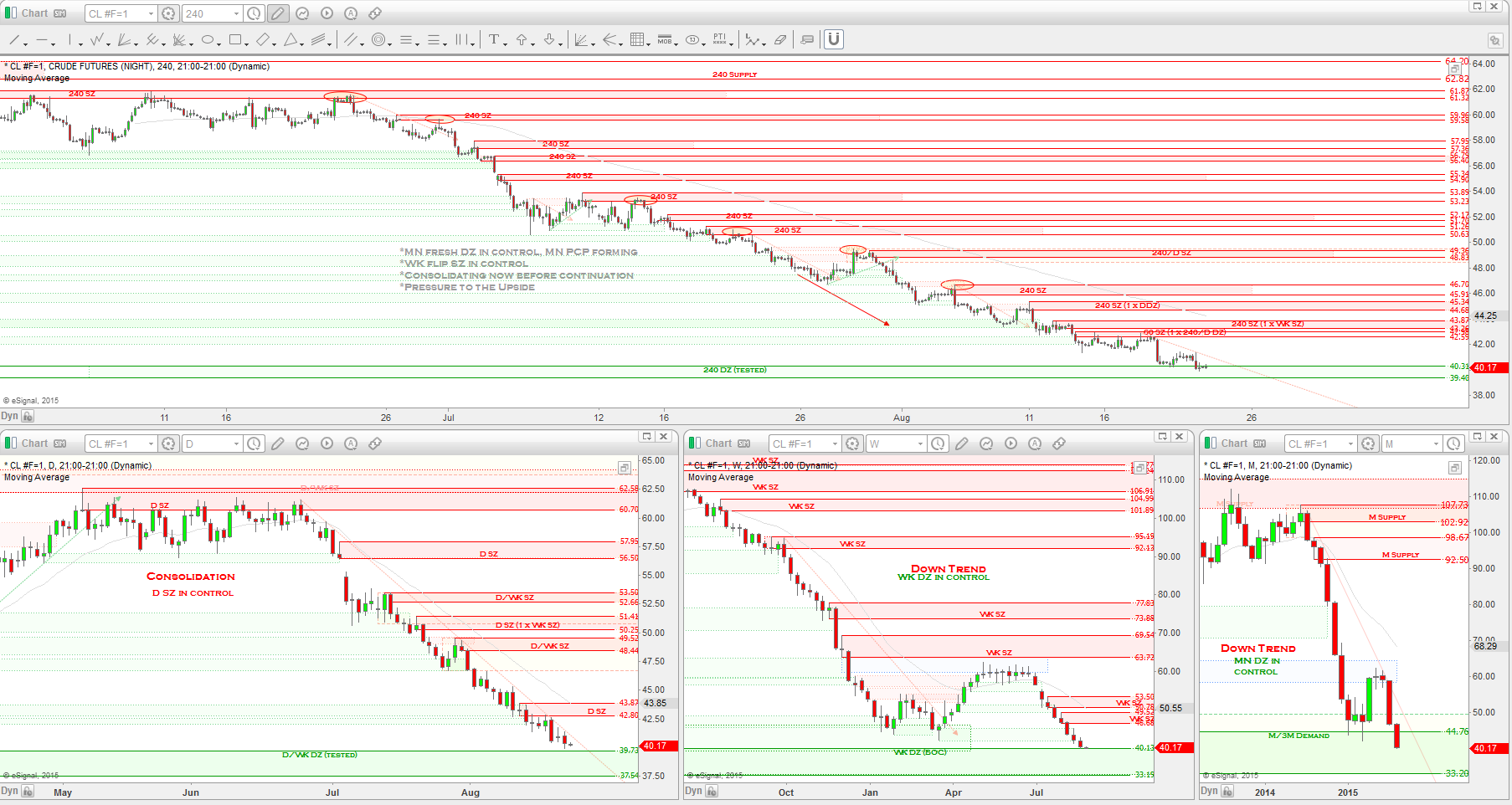

SUPPLY & DEMAND ZONES

Take note of the GREEN demand zones and RED supply zones mapped out below. These are the areas of interest for me because this is where there is a great deal of demand to fill buy orders and supply to fill sell orders from the institutions. SHADED GREEN ZONES = Strong Buy Zones

SHADED RED ZONES = Strong Sell Zones

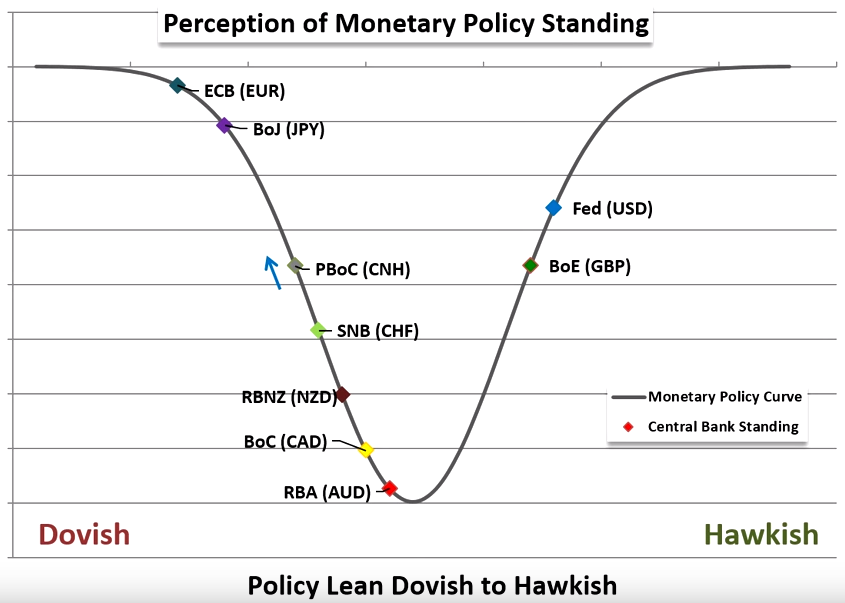

Commitment Of Traders Report: Institutional traders are VERY LONG biased. Perception of Monetary Standing: HAWKISH

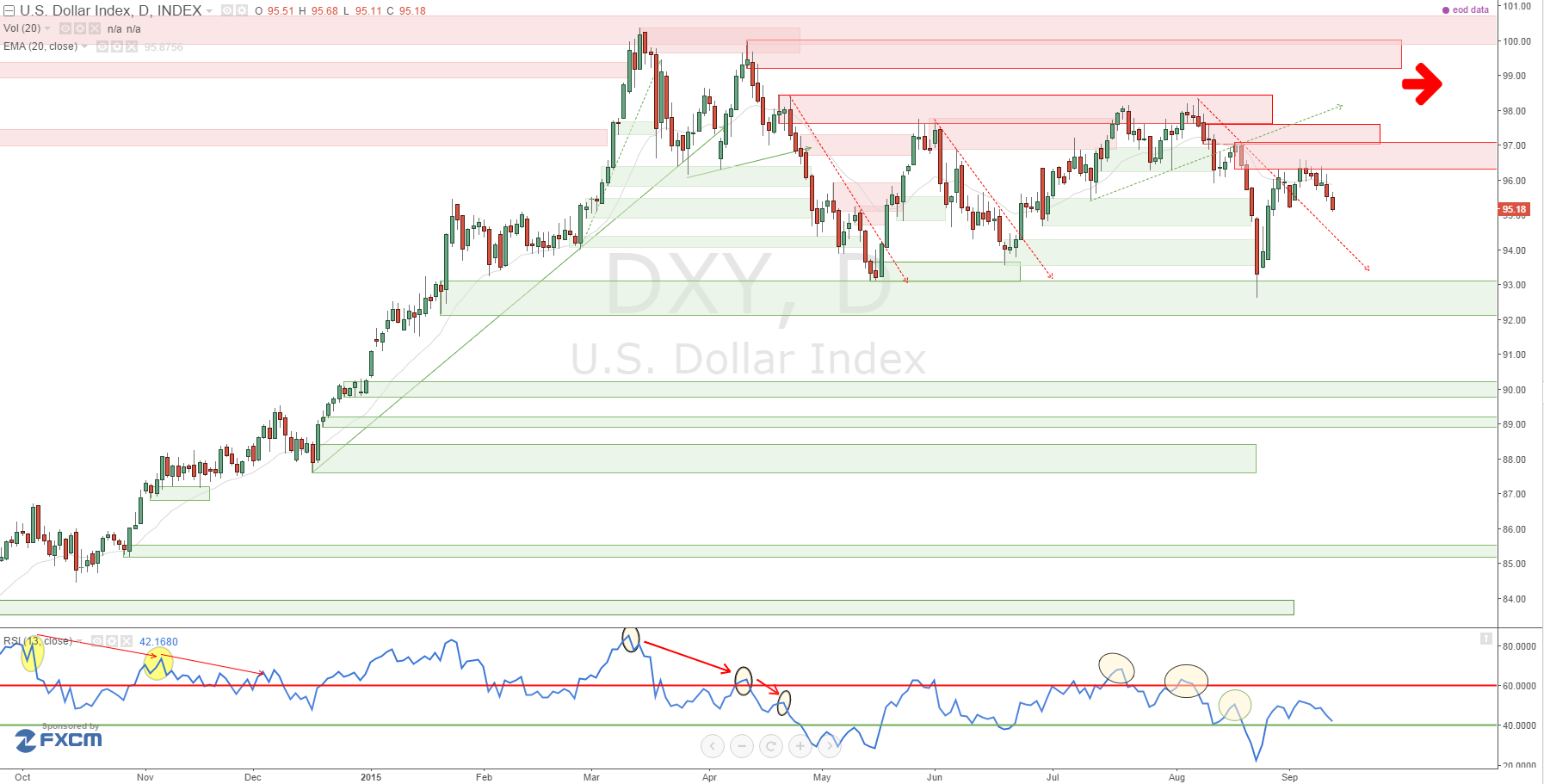

$USD OVERVIEW (DAILY)

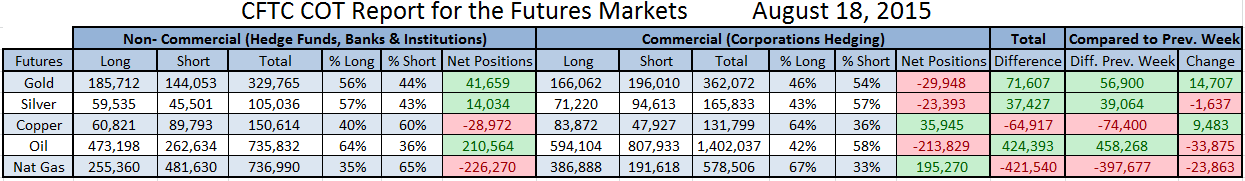

Hey fellow traders, hope your enjoying your weekend! It's the end of another week of trading and as always, the latest CFTC Report was released on Friday. I took the data and plotted it out for us to take a look at and this weeks data shows us that the biggest change was with the USDCHF, with the NZDUSD coming in second. We'll examine what was the move for both of these pairs further below. FOMC statement, as mentioned by Alfonso, really did nothing except move price in the direction dictated by supply and demand. The USD continued to drop from a D SZ it had reacted from, while we saw the EURUSD rally from D DZ. If you take a look at the chart below, you'll notice I've posted arrows, up and down to signify if the figures have gone up or down since the previous weeks report. I have also made an effort to include some of the fundamental data that we all know can have some effect on the currencies. Supply and Demand rules all, but fundamentals are important to. If you like this inclusion, please leave a comment below and let me know, otherwise I'll just keep to the CFTC Report data. So let's now examine the data!

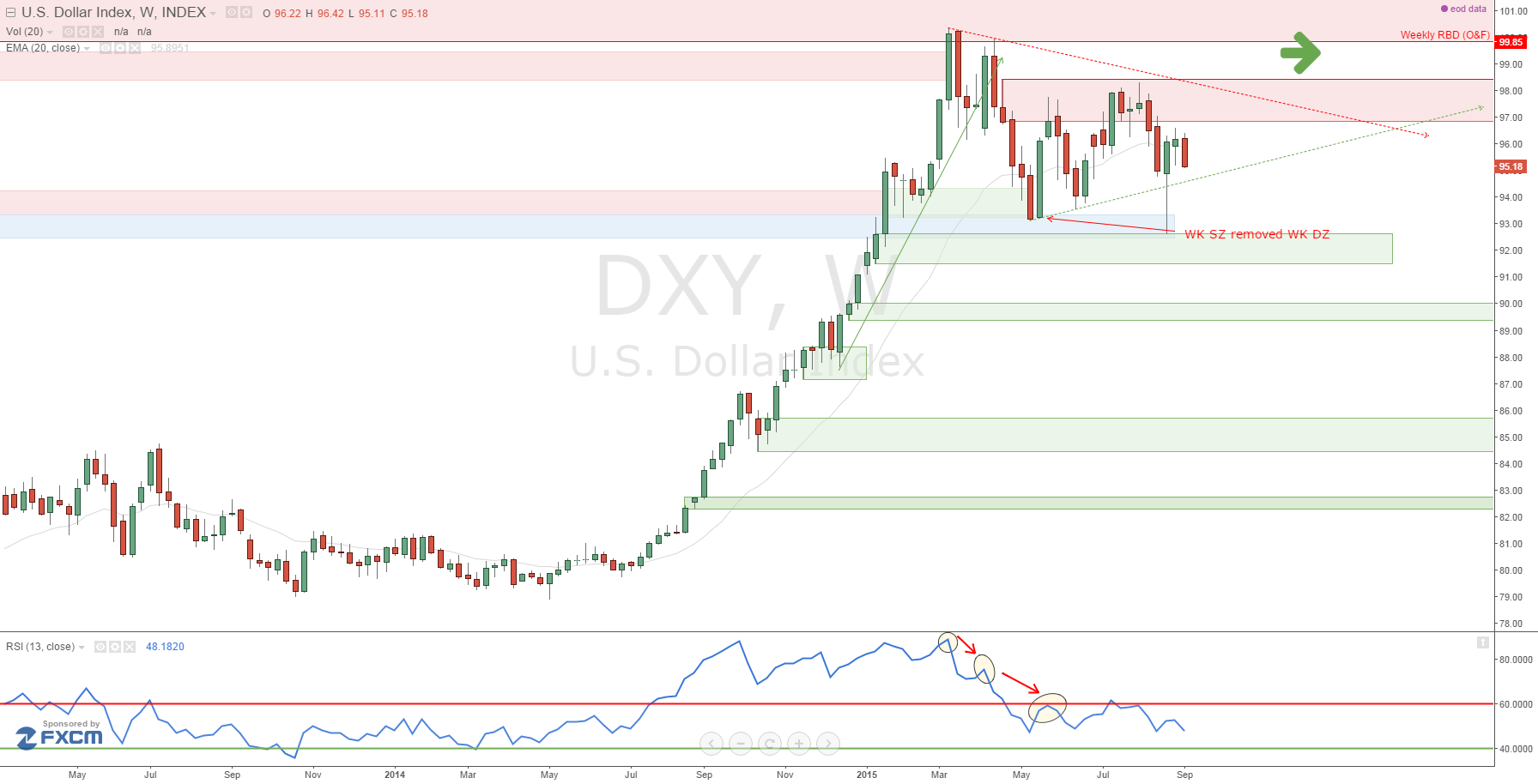

US DOLLAR => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds reduced their longs from 63k to 49k leading into the FOMC announcement and increased shorts by just a tad. So what does this tell us? The Hedge Funds closed about 13k of their long positions for profit when price rallied into the D SZ I mentioned last week. So the drop we saw was profit taking and not the 'BIG BOYS" adding to a short position. Long exposure shifted from 87% to 83% in the process. Bias still is long with net positions sitting at a +39k. Some negative USD data started the week off but lead to positive numbers before the interest rate decision.

On the charts: price dropped from D Supply and fell right into a D WOW DZ @ the 94's. This D WOW long sits at a WK DZ that also sits on a MN flip zone.

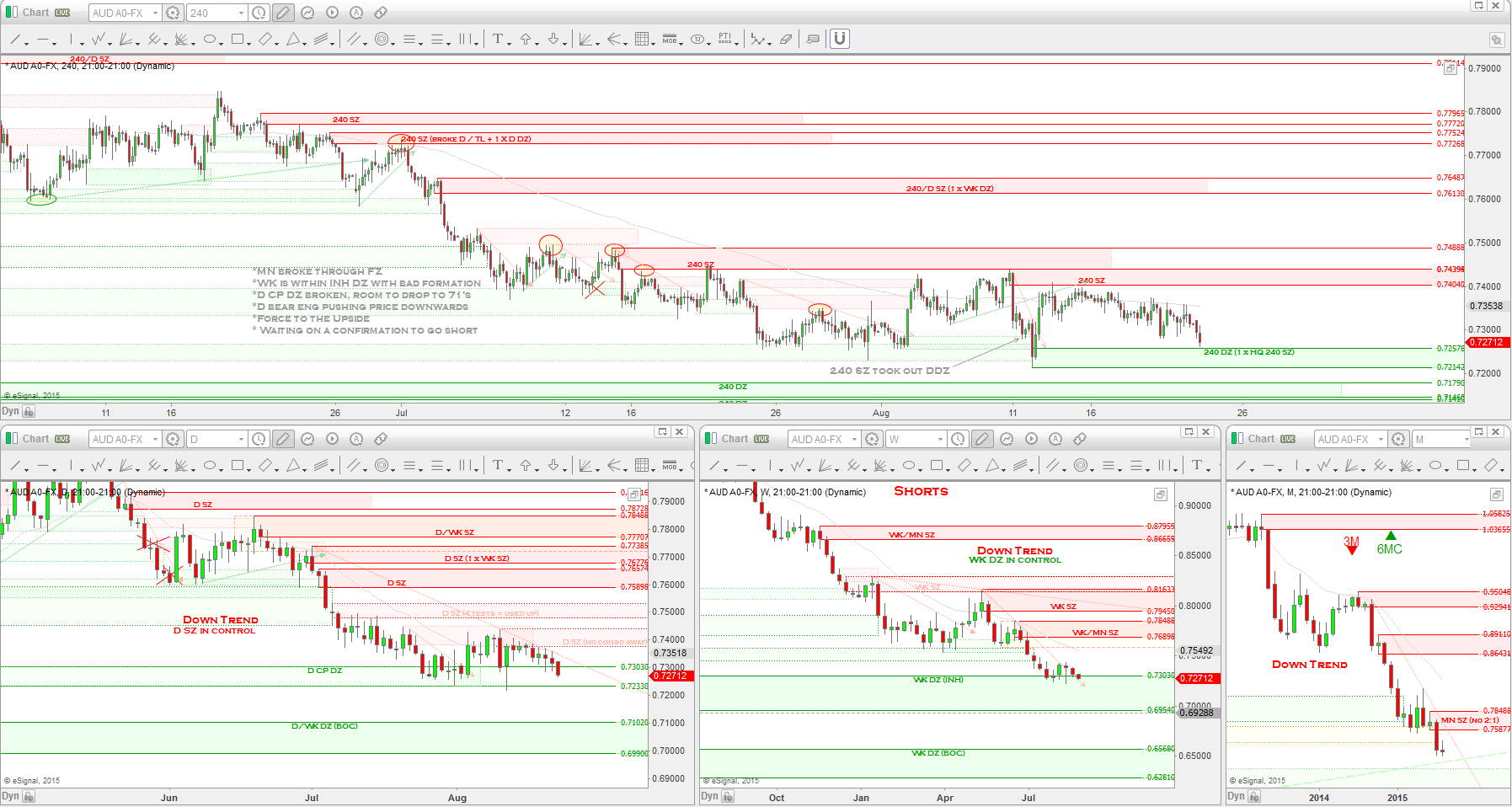

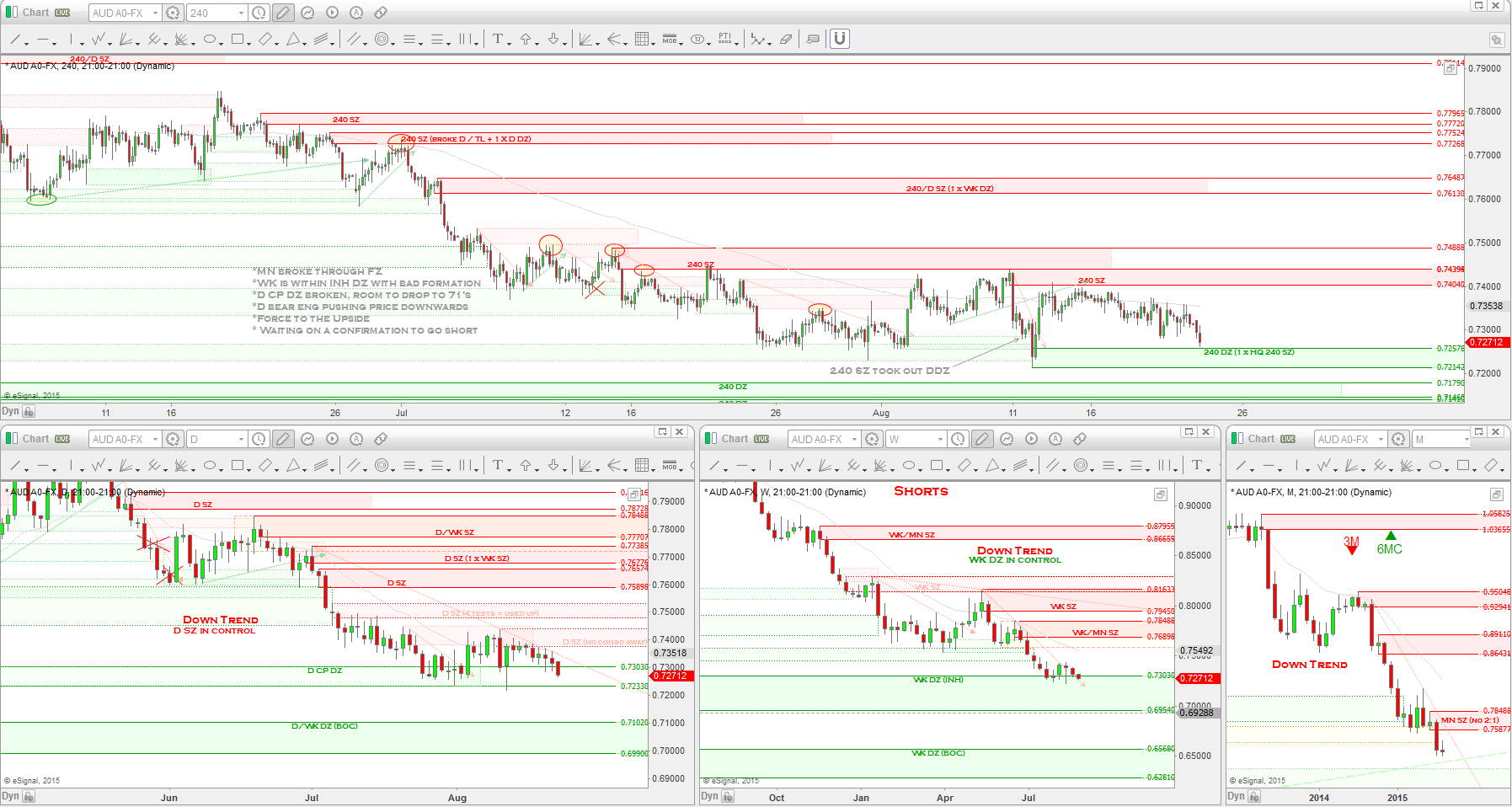

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds, as mentioned last week, did indeed add to their longs from 50k to 59k and reduced shorts from 103k to 99k. Long exposure went from 33% to 37% in the process. Still the net positions sit at -40k favouring the downside.

On the charts: as mentioned a few weeks ago, we are seeing a bounce from the WK CP DZ up to the WK SZ so it was expected to see the hedge funds add to their longs while closing some of their shorts for profits. The bias here still remains short and their positioning as we hit the WK SZ supports the shorting at WK Supply thesis.

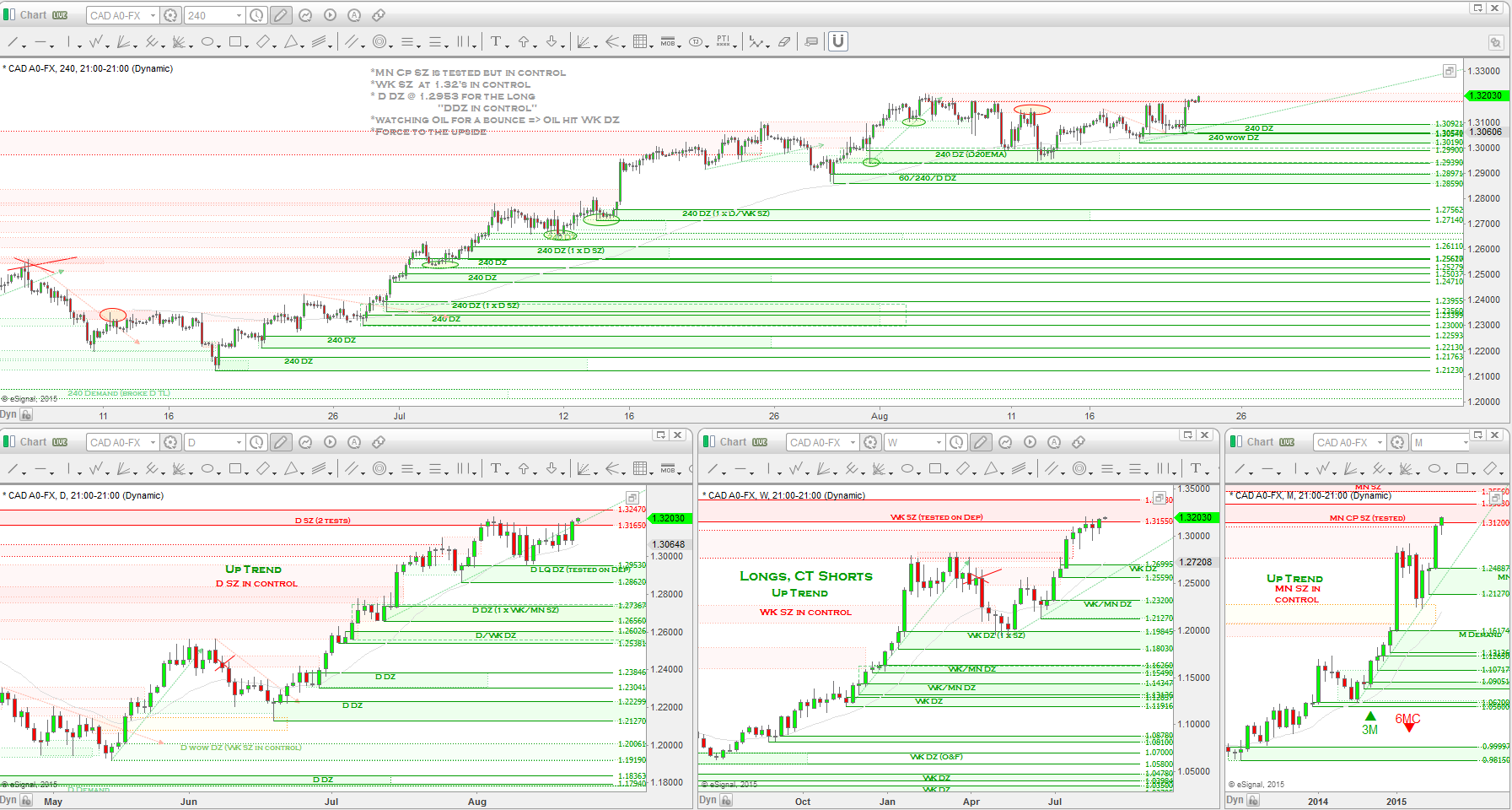

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds reduced longs from 78k to 75k and slightly reduced shorts from 29k to 28k. The overall move was too significant in comparison to what we have seen from the other pairs, but what's interesting to note here is the closing of some of their long positions for profits as we had some positive CAD data released on the 16th.

On the charts: this was represented by the drop we saw from the WK Supply area. Only to rally right back up with the USD.

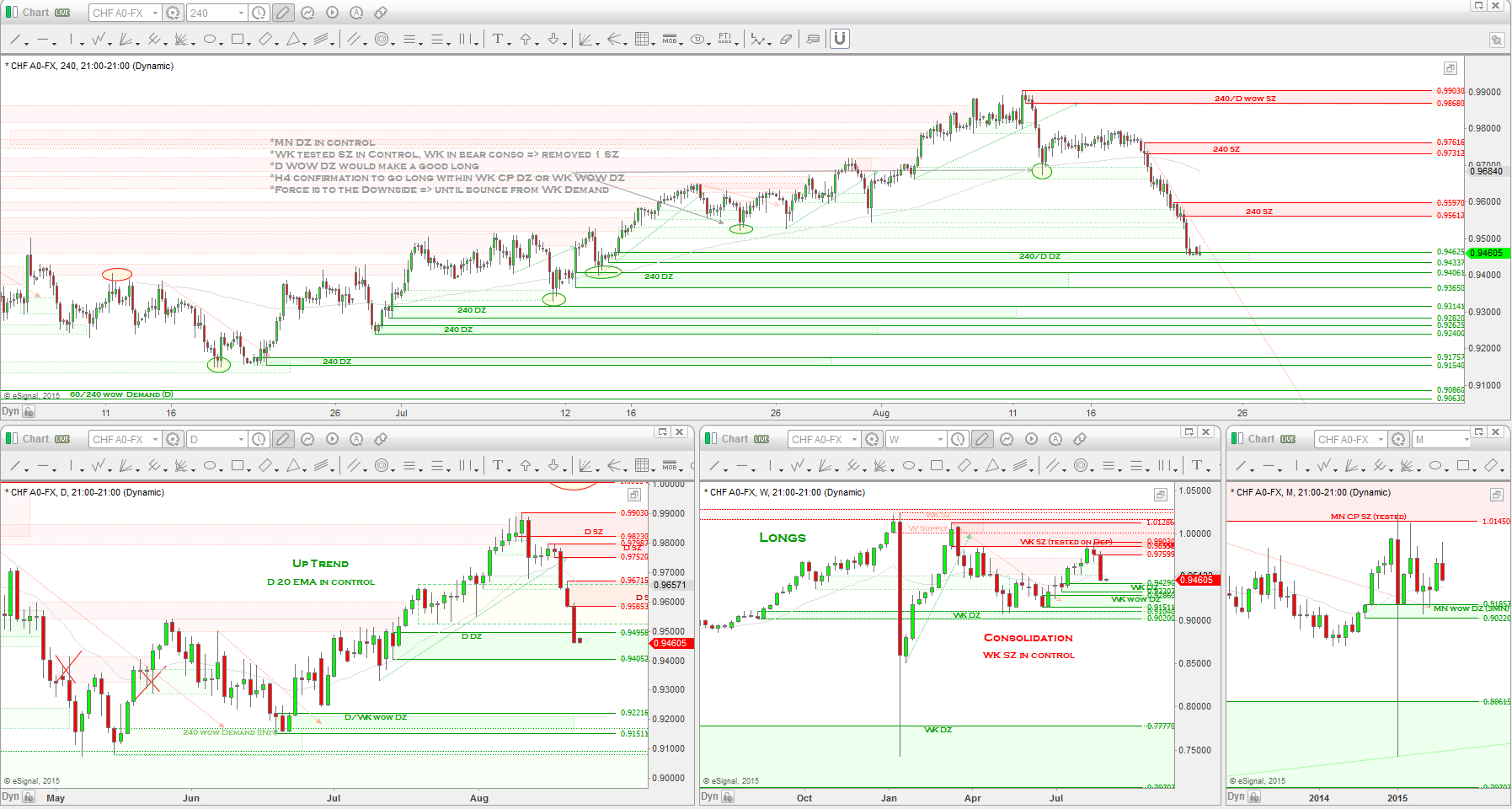

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds slightly increased longs from 12k to 15k but the big move came from the shorts, increasing shorts from 5k to 19k, almost a quadruple move leading into the FOMC announcement and of course the 17th's SNB interest rate decision to keep rates the same.

On the charts: we saw price drop from a D WOW SZ, where I took an H4 WOW short into an H4 DZ that removed a D SZ, it was there we saw a bounce back up following the USD.

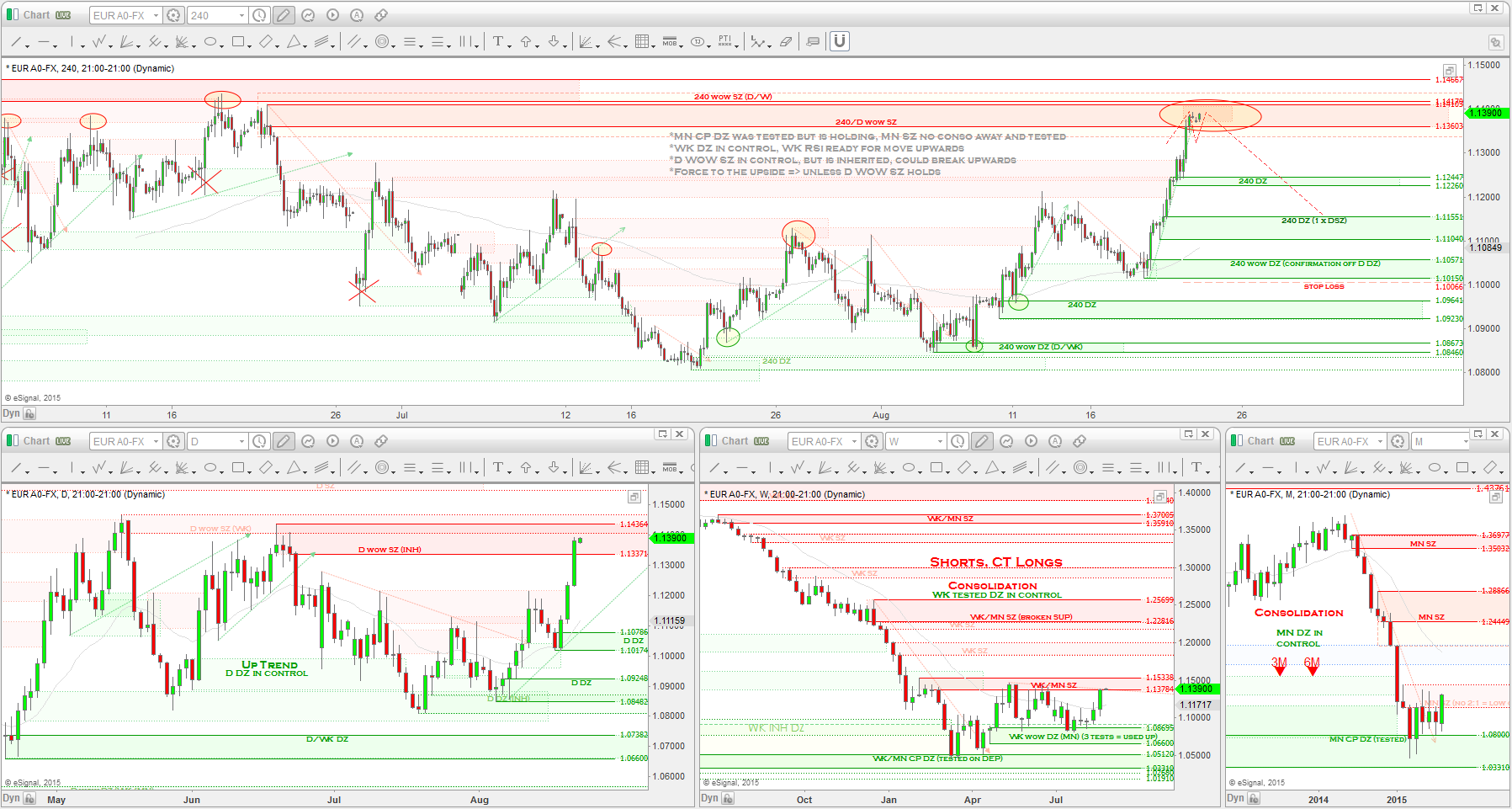

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds decreased longs from 75k to 63k and also shorts from 156k to 147k and in so doing caused their short exposure to rise from 67% to 70%. The overall net positions increased as well from -81k to -84k giving even more reason to believe a continuation to the downside is in the works. Some negative data was released on the 16th that drove price through an H4 DZ I had taken a long entry on.

On the charts: we saw price drop into a D DZ @ the 1.11's and rally up into the 1.14's until negative data caused a drop into the D DZ @ the 1.12's, where we saw another rally up into Daily bearish engulfing territory. D and WK trends are up for the moment so I'm waiting to see how this week plays out.

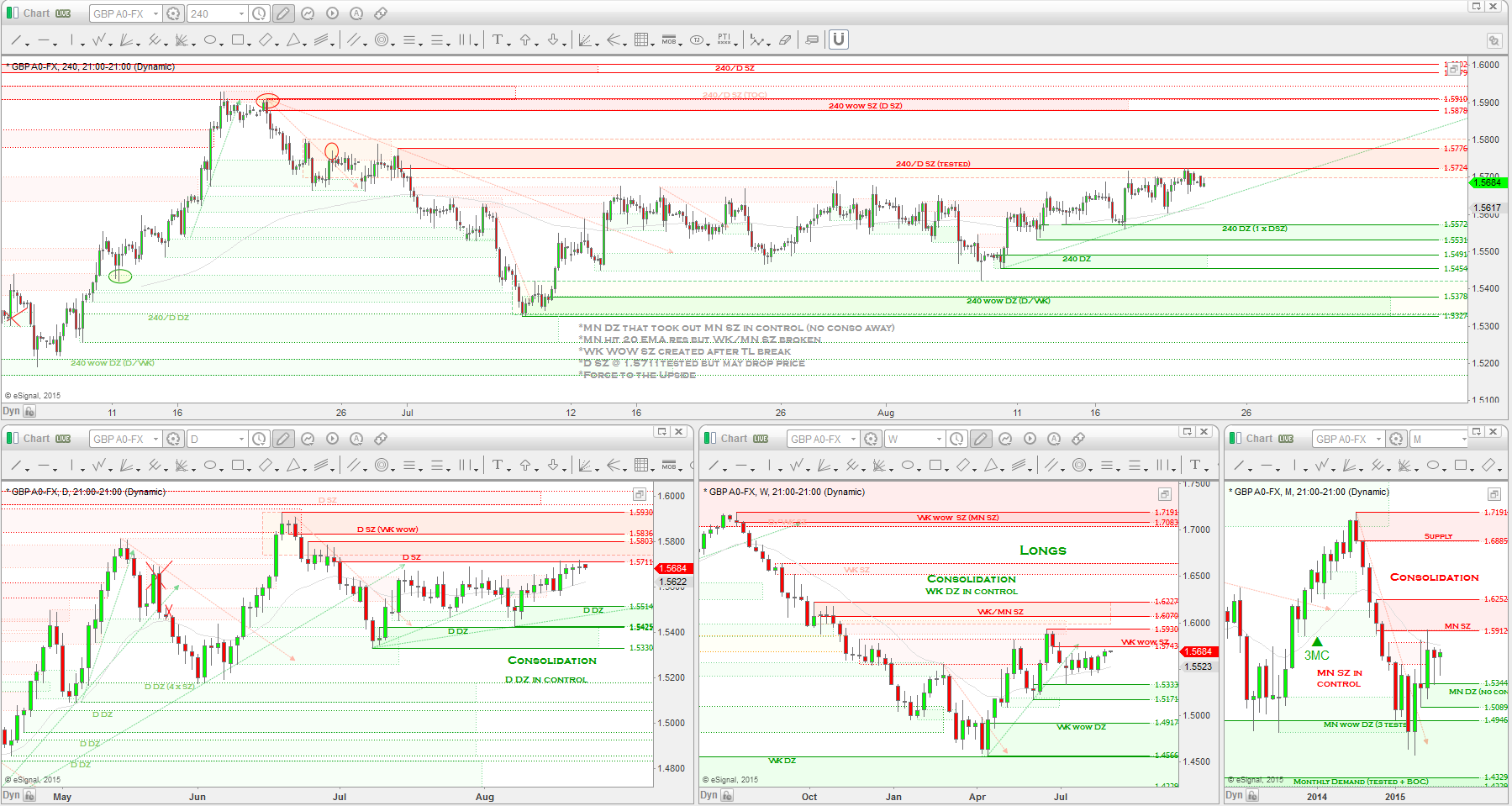

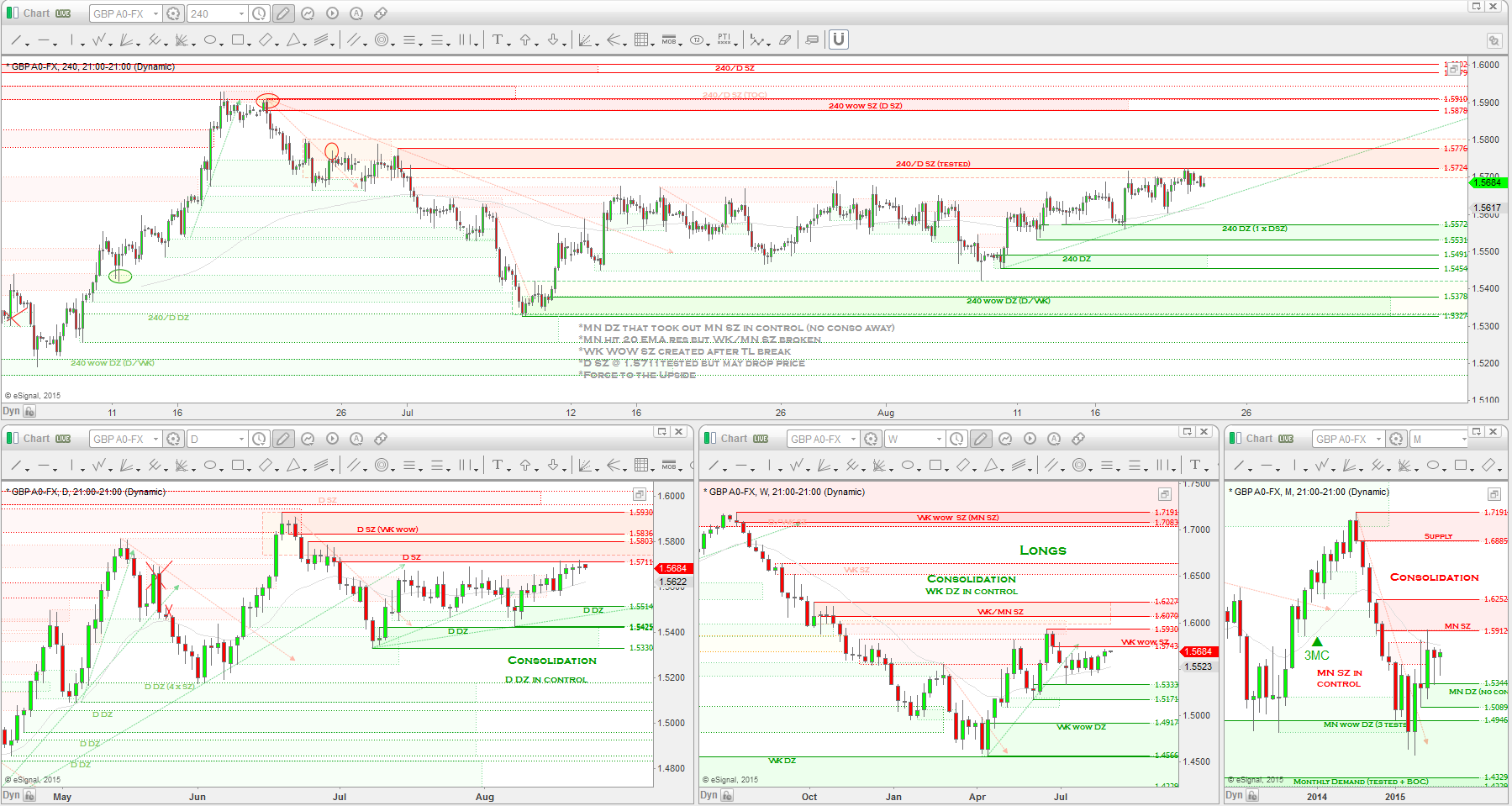

GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds slightly reduced longs but massively reduced shorts from 61k to 46k while increasing the long exposure from 42% to 48%. We are heading back to neutral territory again. Some data was released but didn't cause much volatility.

On the charts: we saw price rally from tested WK Demand right into a WK SZ and we are starting to see the bearish reaction from this area. Most likely continued consolidation is to happen before another move.

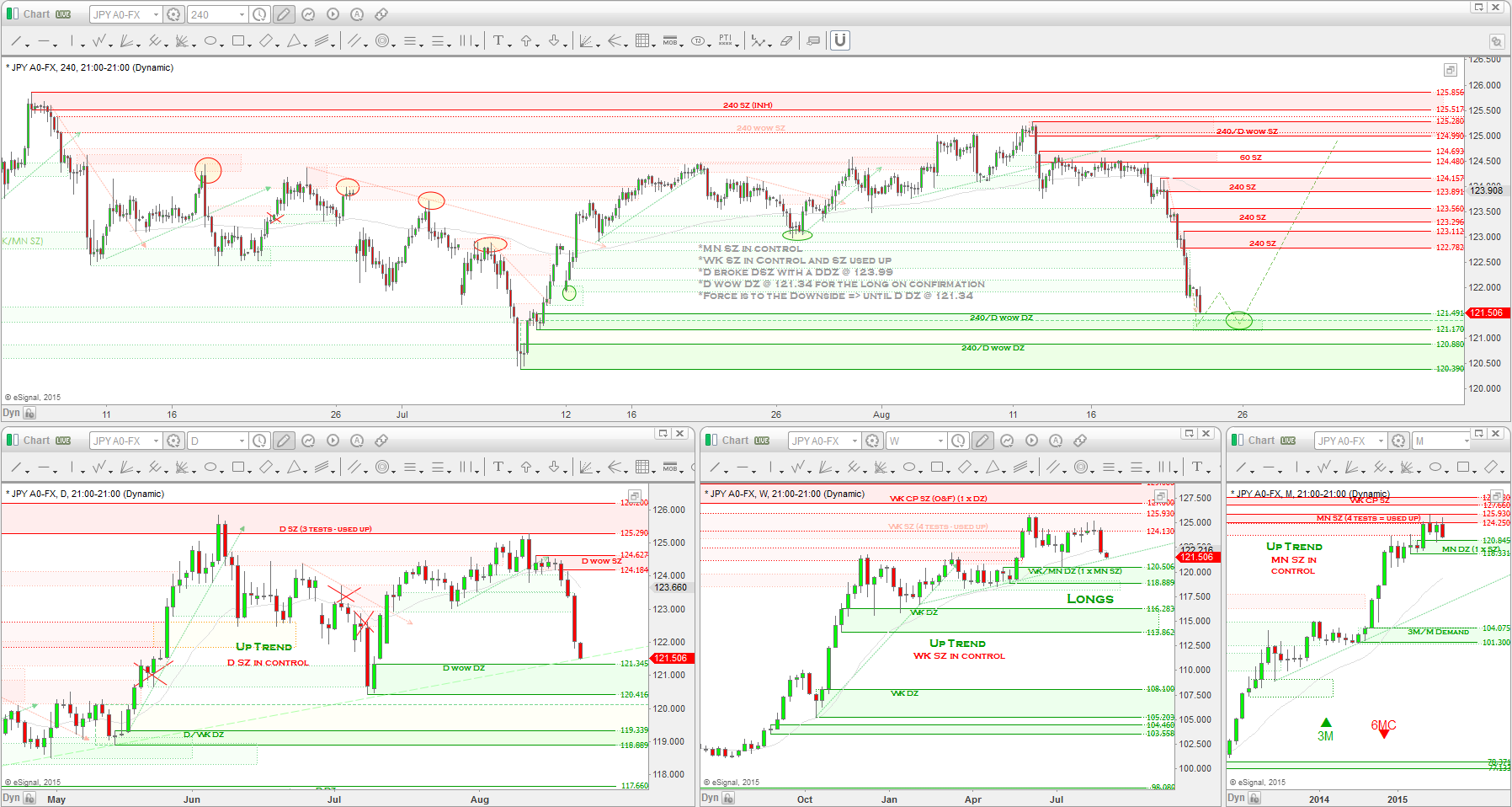

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds reduced longs from 69k to 63k and massively reduced shorts from 63k to 36k, in so doing they shifted their short exposure from 47% to 37%. This move was mostly due to the interest rate decision to keep rates the same on the 14th which created weakness for the JPY. Long exposure has gone up from 53% to 63% increasing the hedge funds bullish stance.

On the charts: we saw a lot of consolidation on this pair mainly because price wanted to rally due to the rate decision but the USD dropping stabilized the move. A continued rally in the USD would most likely see a continuation of a USDJPY move upwards.

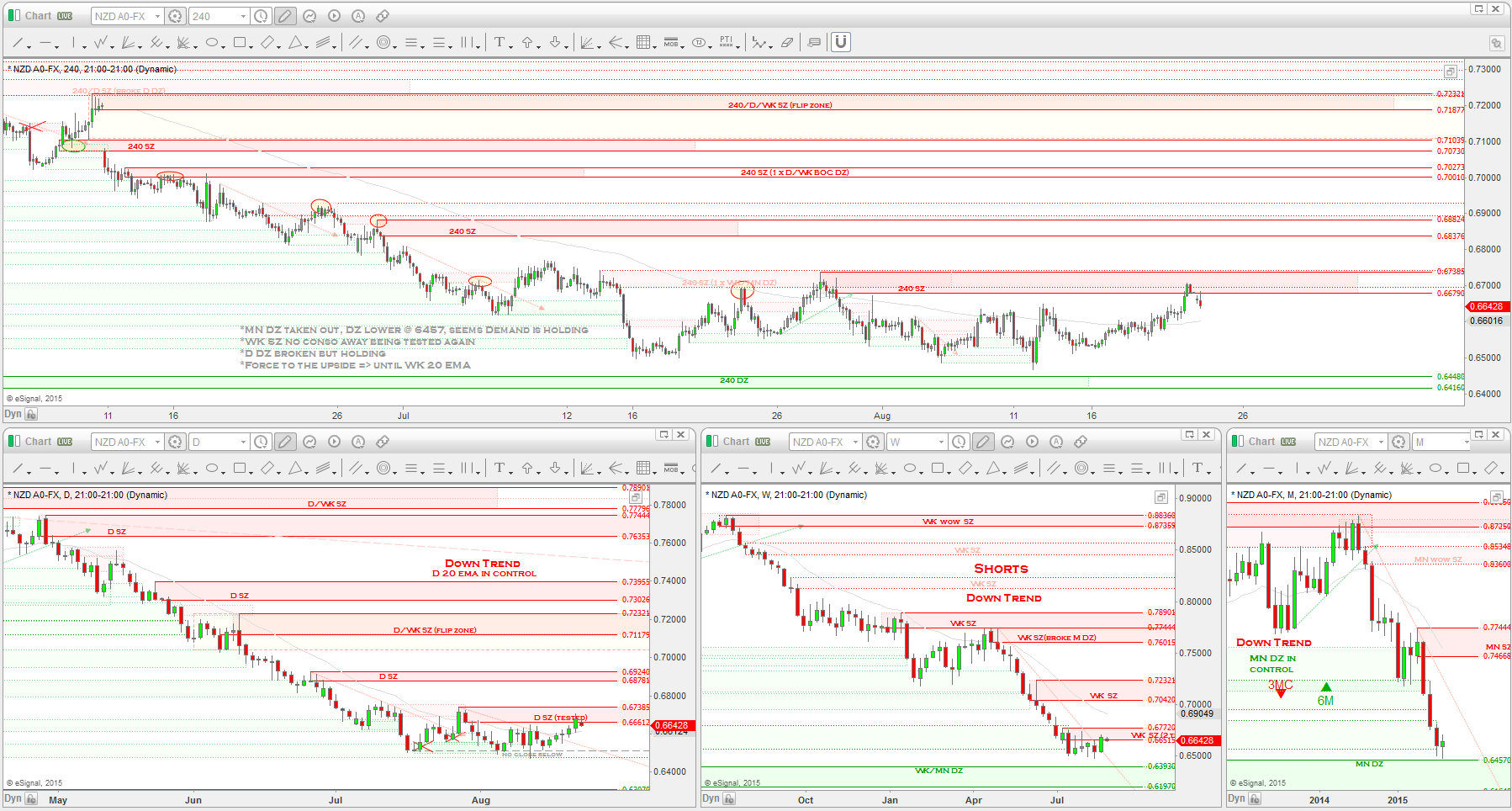

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds doubled their longs from 11k to 22k and increased shorts from 23k to 24k. This comes after the rate decreased on the 9th of the month. Long exposure now sits at 48% up from 33% the previous report. Net positions sit at a -2k giving a slight bias to the downside. Let it be known that the previous report had a net position bias of -11k.

On the charts: price is reacting from a WK/MN CP DZ thats causing price to rally. After they fakes out the retail traders into shorting the pair with the rate drop, the hedge funds double their longs positions and cause the rally we saw the past couple weeks.

So there you have it folks. I have included a lot of information on here to give us the best perspective on the major pairs as possible leading us into the next week of trading. As mentioned above, if you like the included data, please leave me a comment below and let me know. I think understanding the relationship between the fundamentals, data releases and their effects on the charts, the CFTC COT Report data and Supply and Demand hold the key to becoming the best FOREX traders around! I have always enjoyed watching how data releases are used to help push price in the direction the hedge funds need to profit from their positions. So understanding these relationships will only help our own trading as well.

This coming weeks data looks a lot more tame then what we have seen in the past couple weeks, but I think the ball has started rolling and now it's up to us to determine our entries for high probability, profitable trades. This weeks analysis from Alfonso was really good as he pointed out some great set-up possibilities I plan to take advantage of. One little piece of advice I can give to those trying to learn how to analyse the charts using the rules. What I do is I run through all the charts and make my notes and draw my zones etc. When I am done I watch Alfonso's weekly video to see how accurate I am and if I have missed anything. It's a great way to start trusting your abilities in chart analysis and the more you start replicating Alfonso's work, the more confident you will become. Just thought I'd share that with you as it has helped me a lot!

Until next time traders!

US DOLLAR => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds reduced their longs from 63k to 49k leading into the FOMC announcement and increased shorts by just a tad. So what does this tell us? The Hedge Funds closed about 13k of their long positions for profit when price rallied into the D SZ I mentioned last week. So the drop we saw was profit taking and not the 'BIG BOYS" adding to a short position. Long exposure shifted from 87% to 83% in the process. Bias still is long with net positions sitting at a +39k. Some negative USD data started the week off but lead to positive numbers before the interest rate decision.

On the charts: price dropped from D Supply and fell right into a D WOW DZ @ the 94's. This D WOW long sits at a WK DZ that also sits on a MN flip zone.

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds, as mentioned last week, did indeed add to their longs from 50k to 59k and reduced shorts from 103k to 99k. Long exposure went from 33% to 37% in the process. Still the net positions sit at -40k favouring the downside.

On the charts: as mentioned a few weeks ago, we are seeing a bounce from the WK CP DZ up to the WK SZ so it was expected to see the hedge funds add to their longs while closing some of their shorts for profits. The bias here still remains short and their positioning as we hit the WK SZ supports the shorting at WK Supply thesis.

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds reduced longs from 78k to 75k and slightly reduced shorts from 29k to 28k. The overall move was too significant in comparison to what we have seen from the other pairs, but what's interesting to note here is the closing of some of their long positions for profits as we had some positive CAD data released on the 16th.

On the charts: this was represented by the drop we saw from the WK Supply area. Only to rally right back up with the USD.

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds slightly increased longs from 12k to 15k but the big move came from the shorts, increasing shorts from 5k to 19k, almost a quadruple move leading into the FOMC announcement and of course the 17th's SNB interest rate decision to keep rates the same.

On the charts: we saw price drop from a D WOW SZ, where I took an H4 WOW short into an H4 DZ that removed a D SZ, it was there we saw a bounce back up following the USD.

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds decreased longs from 75k to 63k and also shorts from 156k to 147k and in so doing caused their short exposure to rise from 67% to 70%. The overall net positions increased as well from -81k to -84k giving even more reason to believe a continuation to the downside is in the works. Some negative data was released on the 16th that drove price through an H4 DZ I had taken a long entry on.

On the charts: we saw price drop into a D DZ @ the 1.11's and rally up into the 1.14's until negative data caused a drop into the D DZ @ the 1.12's, where we saw another rally up into Daily bearish engulfing territory. D and WK trends are up for the moment so I'm waiting to see how this week plays out.

GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds slightly reduced longs but massively reduced shorts from 61k to 46k while increasing the long exposure from 42% to 48%. We are heading back to neutral territory again. Some data was released but didn't cause much volatility.

On the charts: we saw price rally from tested WK Demand right into a WK SZ and we are starting to see the bearish reaction from this area. Most likely continued consolidation is to happen before another move.

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds reduced longs from 69k to 63k and massively reduced shorts from 63k to 36k, in so doing they shifted their short exposure from 47% to 37%. This move was mostly due to the interest rate decision to keep rates the same on the 14th which created weakness for the JPY. Long exposure has gone up from 53% to 63% increasing the hedge funds bullish stance.

On the charts: we saw a lot of consolidation on this pair mainly because price wanted to rally due to the rate decision but the USD dropping stabilized the move. A continued rally in the USD would most likely see a continuation of a USDJPY move upwards.

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds doubled their longs from 11k to 22k and increased shorts from 23k to 24k. This comes after the rate decreased on the 9th of the month. Long exposure now sits at 48% up from 33% the previous report. Net positions sit at a -2k giving a slight bias to the downside. Let it be known that the previous report had a net position bias of -11k.

On the charts: price is reacting from a WK/MN CP DZ thats causing price to rally. After they fakes out the retail traders into shorting the pair with the rate drop, the hedge funds double their longs positions and cause the rally we saw the past couple weeks.

So there you have it folks. I have included a lot of information on here to give us the best perspective on the major pairs as possible leading us into the next week of trading. As mentioned above, if you like the included data, please leave me a comment below and let me know. I think understanding the relationship between the fundamentals, data releases and their effects on the charts, the CFTC COT Report data and Supply and Demand hold the key to becoming the best FOREX traders around! I have always enjoyed watching how data releases are used to help push price in the direction the hedge funds need to profit from their positions. So understanding these relationships will only help our own trading as well.

This coming weeks data looks a lot more tame then what we have seen in the past couple weeks, but I think the ball has started rolling and now it's up to us to determine our entries for high probability, profitable trades. This weeks analysis from Alfonso was really good as he pointed out some great set-up possibilities I plan to take advantage of. One little piece of advice I can give to those trying to learn how to analyse the charts using the rules. What I do is I run through all the charts and make my notes and draw my zones etc. When I am done I watch Alfonso's weekly video to see how accurate I am and if I have missed anything. It's a great way to start trusting your abilities in chart analysis and the more you start replicating Alfonso's work, the more confident you will become. Just thought I'd share that with you as it has helped me a lot!

Until next time traders!

Notes:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional traders

are SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

THE SETUP:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional tradersare SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

Notes: Trend is up on the monthly, bullish consolidation on the weekly and down trend on the daily chart.

THE SETUP:

THE SETUP:

$GBPUSD -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: HAWKISH

Notes:

THE SETUP:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISHNotes:

THE SETUP:

Video Link ==>

https://gyazo.com/e9f272b57e10e0c405897182e8d39b43

https://gyazo.com/d61632b6308565e4ab3b990c2f9ea4cd

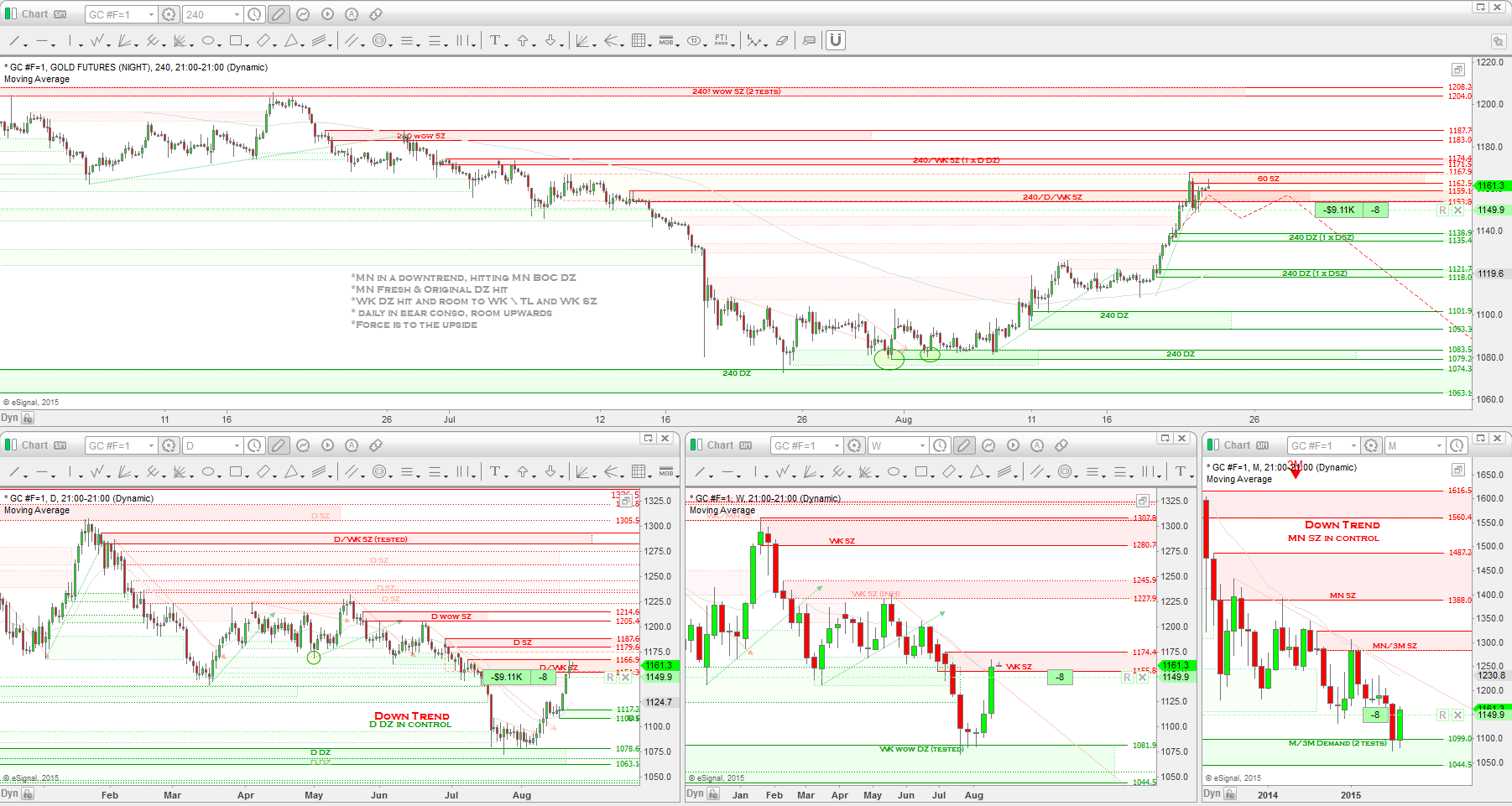

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/d1fd69a1e2d15b5155d61d121fe6a326

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Commitment Of Traders Report: Institutional traders are VERY LONG biased.

Notes:

THE SETUP:

Video Link ==>

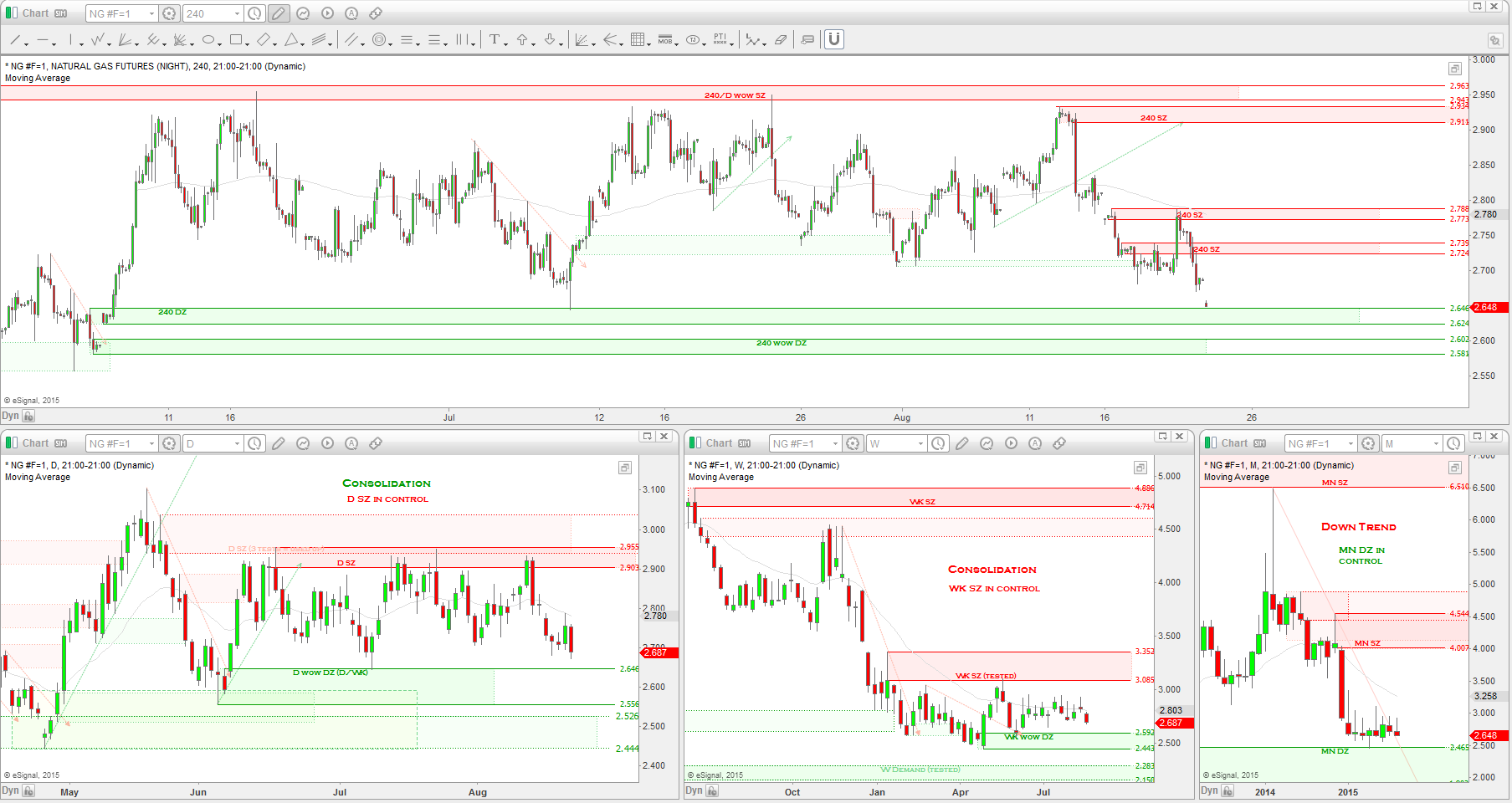

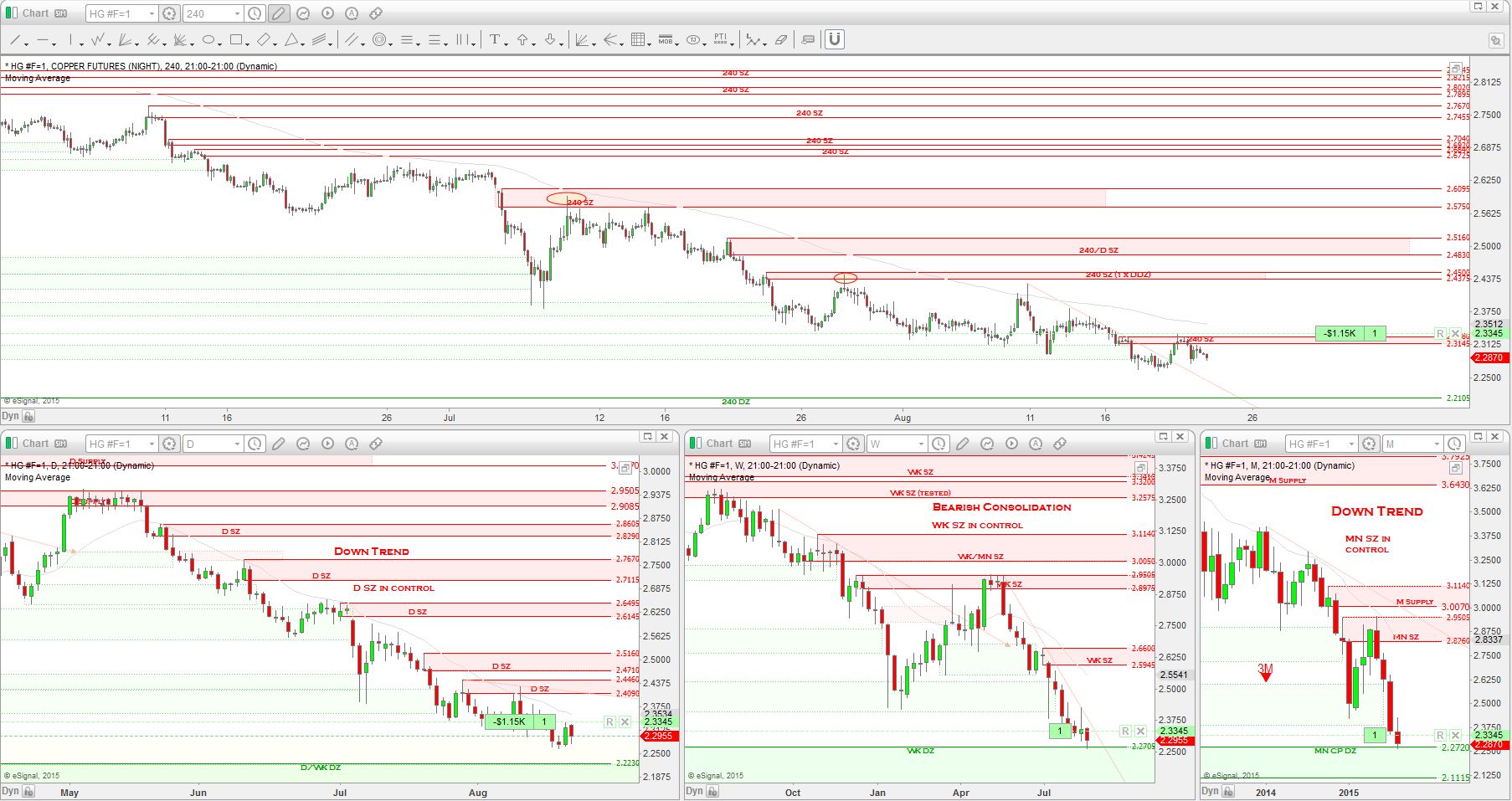

Commitment Of Traders Report: Institutional traders are VERY SHORT biased.

Notes:

THE SETUP:

Video Link ==>

Notes: Trend is down on the monthly, down on the weekly and bearish consolidation on the daily chart.

*WK SZ and WK TL in control

*WK SZ and WK TL in control

THE SETUP: LONG @ 0.7365, SL @ 0.7306, TP - technical stop

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

No comments:

Post a Comment