SUPPLY & DEMAND ZONES

Take note of the GREEN demand zones and RED supply zones mapped out below. These are the areas of interest for me because this is where there is a great deal of demand to fill buy orders and supply to fill sell orders from the institutions. SHADED GREEN ZONES = Strong Buy Zones

SHADED RED ZONES = Strong Sell Zones

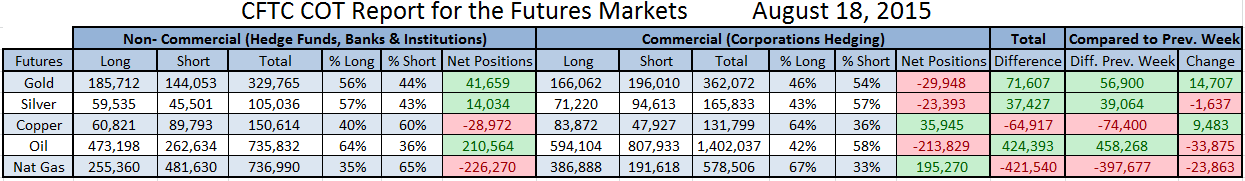

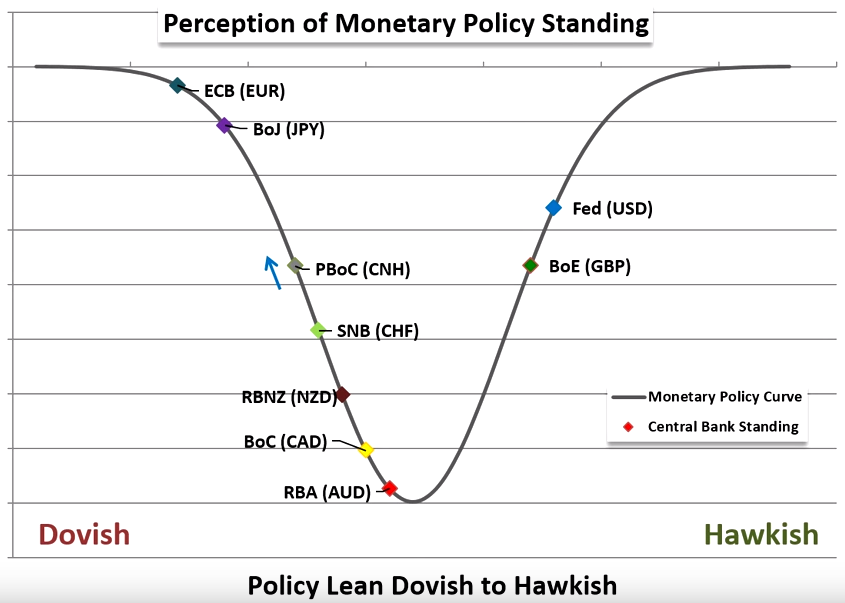

Commitment Of Traders Report: Institutional traders are VERY LONG biased. Perception of Monetary Standing: HAWKISH

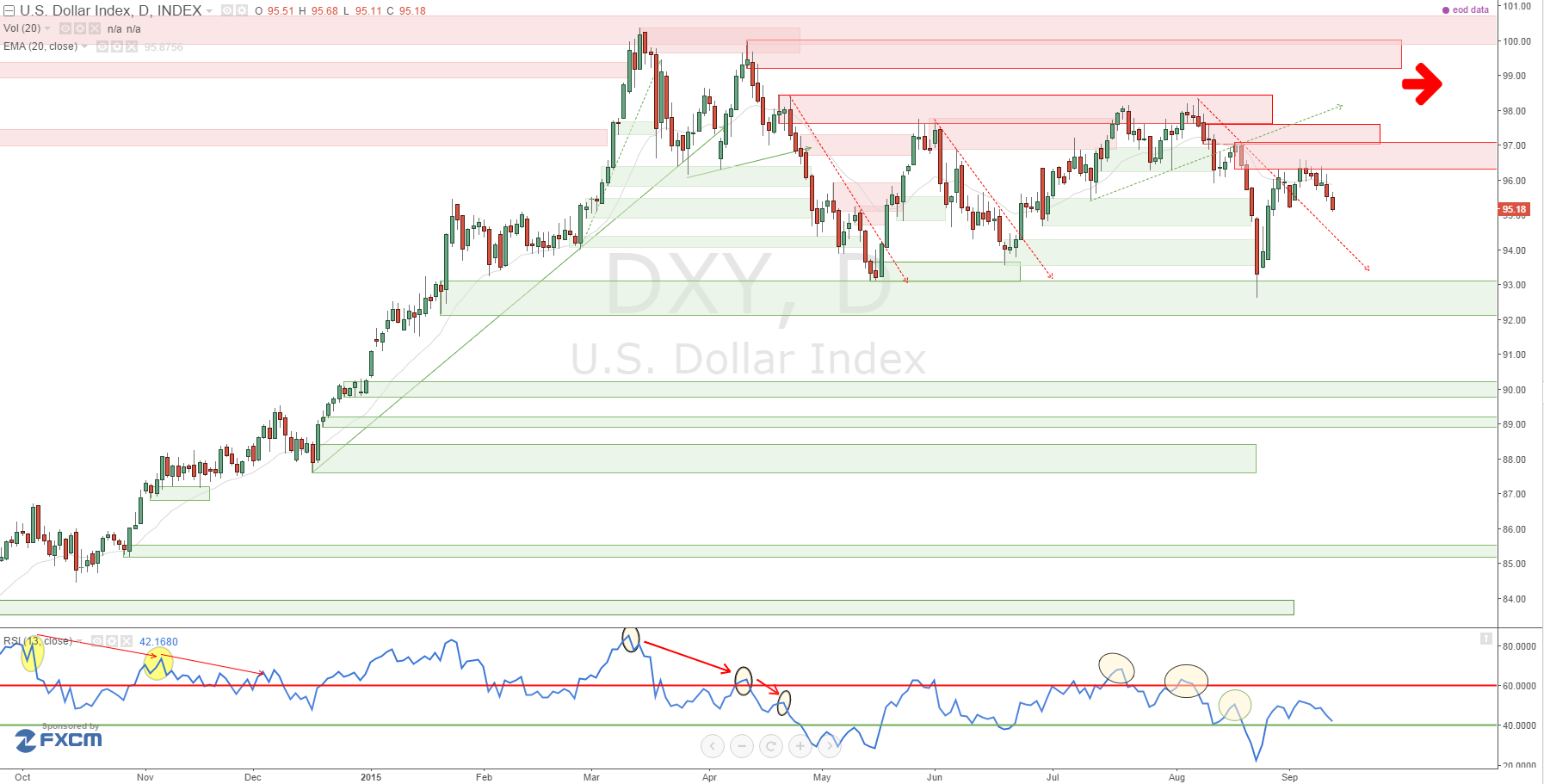

$USD OVERVIEW (DAILY)

What a week we had with the RBNZ lowering interest rates from 3 to 2.75%, while the BOC left rates the same at 0.5% and the BOE left rates at 0.5% as well. The euro rallied, the USD dropped, a whole bunch of movement in the markets and all of it gearing up toward the big news coming this week. A lot of talk about whether or not the Fed increases rates this September or not and finally that time has come to find out. Hey fellow traders, today's we are going to examine moves the Hedge Funds have been making in preparations for this coming week and we are going to take a look at how they use the HTF zones as areas to take profits from, specifically the USDJPY which came is as this reports biggest percentage mover.. So like we always do, lets start by taking a look at the data from the latest CFTC report down below.

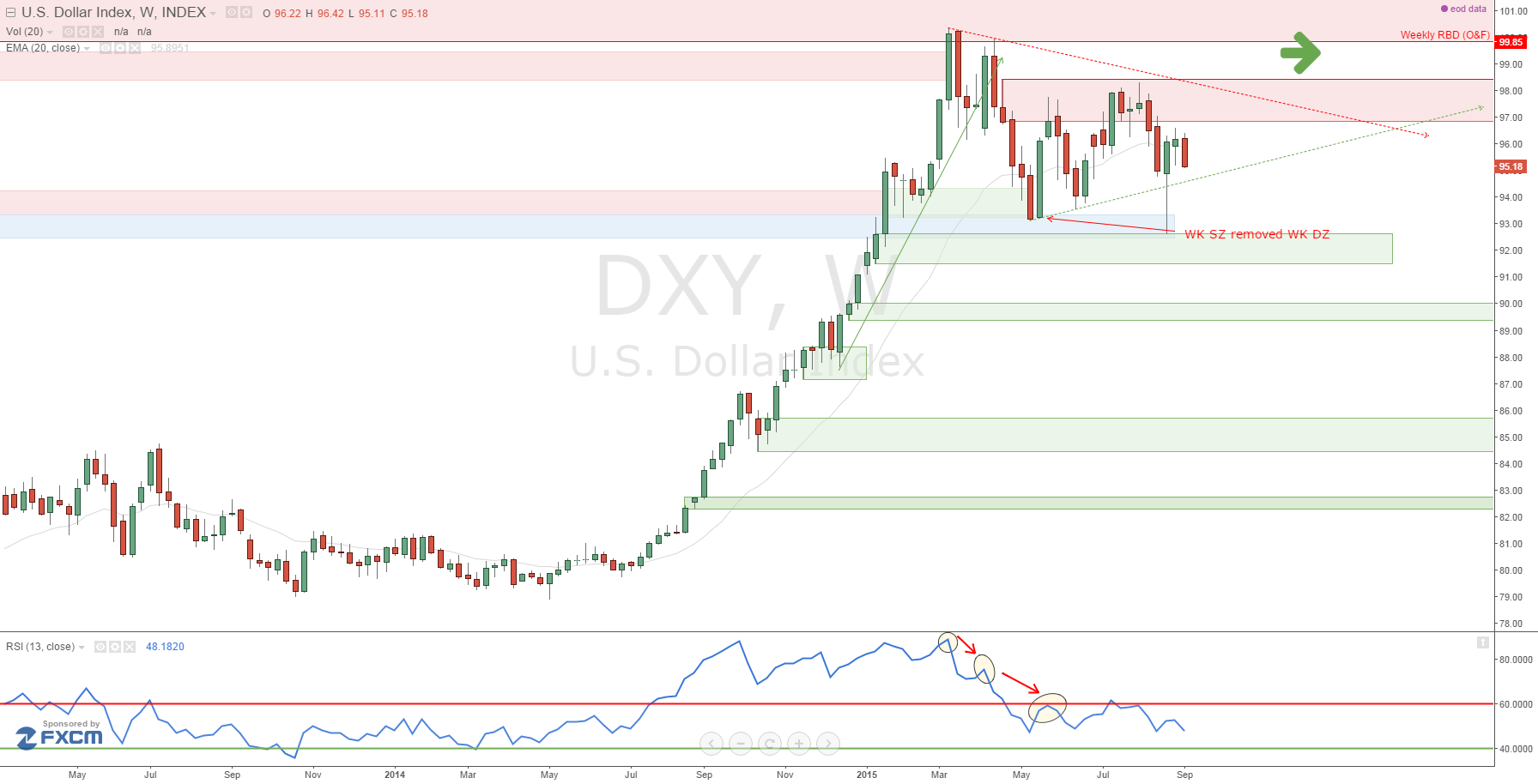

US DOLLAR => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds increased their longs from 60k to 63k and also slightly increased shorts from 9.5k to 9.8k. Total long exposure went higher from 86% to 87%. This comes as price rallied into D Supply, which price has now fallen from. Next weeks report will most likely reflect this drop by an increase in shorts or profit taking. A lot of consolidation has been happening during the last few weeks as a lot of talk has been hyping this coming weeks announcement. It's clear where the hedge funds stand at this point and it's clearly a long bias heading into the FOMC statement.

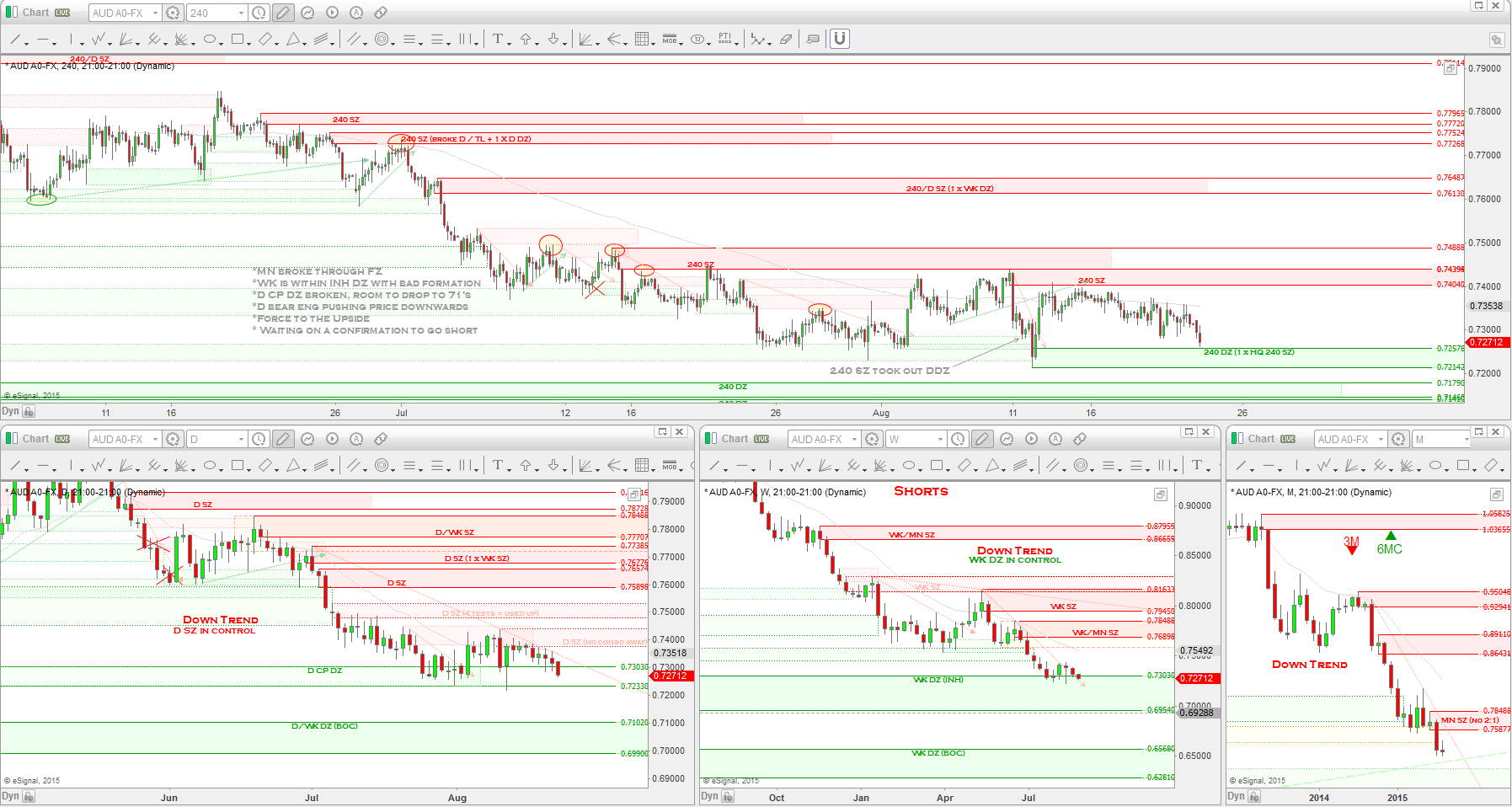

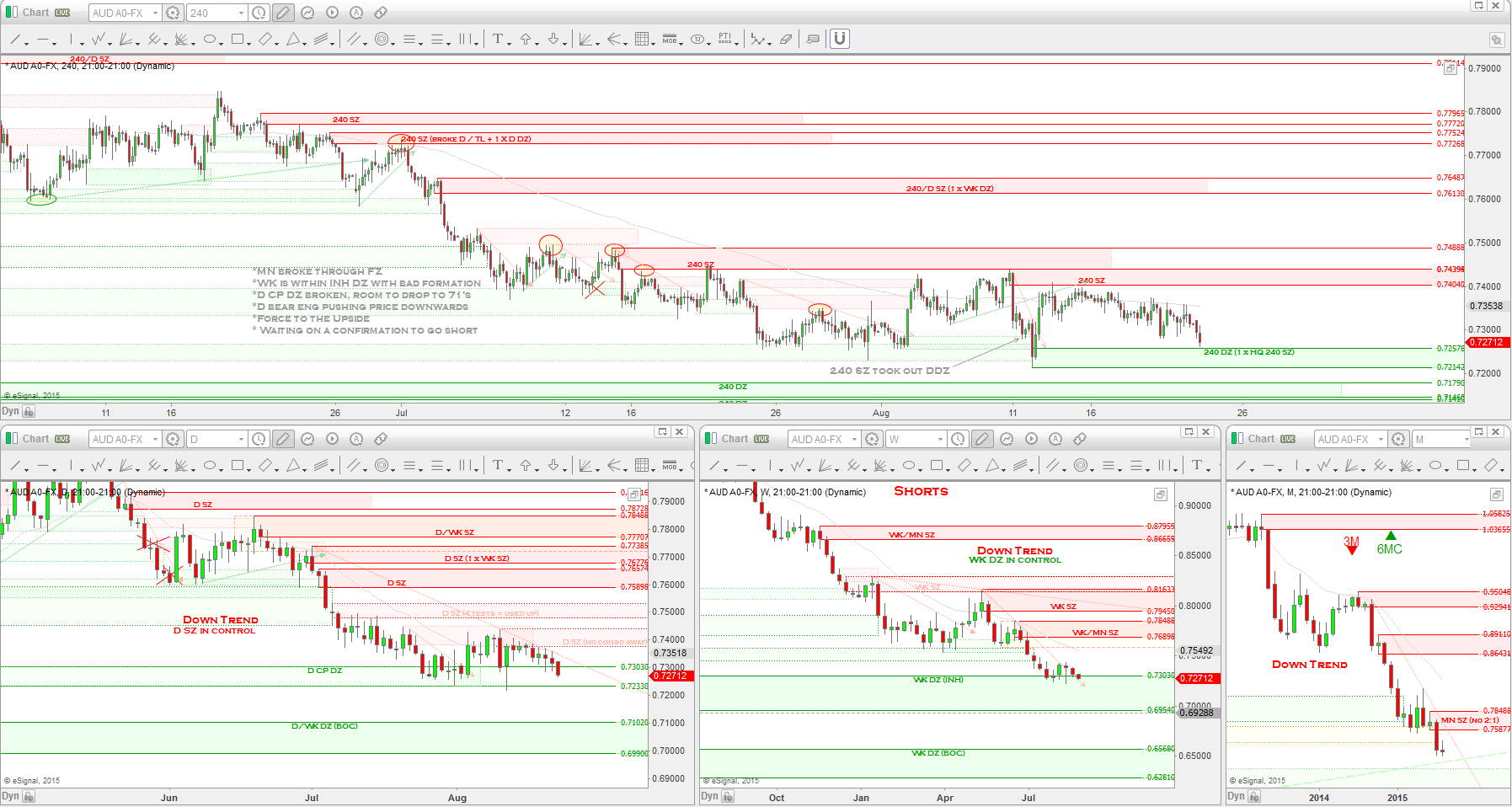

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds hardly made any adjustments to their positions this past week and last, but next week, on the report, I am sure we will see either their longs being added to or shorts being covered. At this point it seems as though shorts are being covered as the short position continue to slowly decrease. Good AUD employment data was said to be cause of the rally from this pair, but in fact it was caused by a WK DZ as we can see by the chart below. I'm still waiting for a short set-up to unfold as everything is pointing to a further move down.

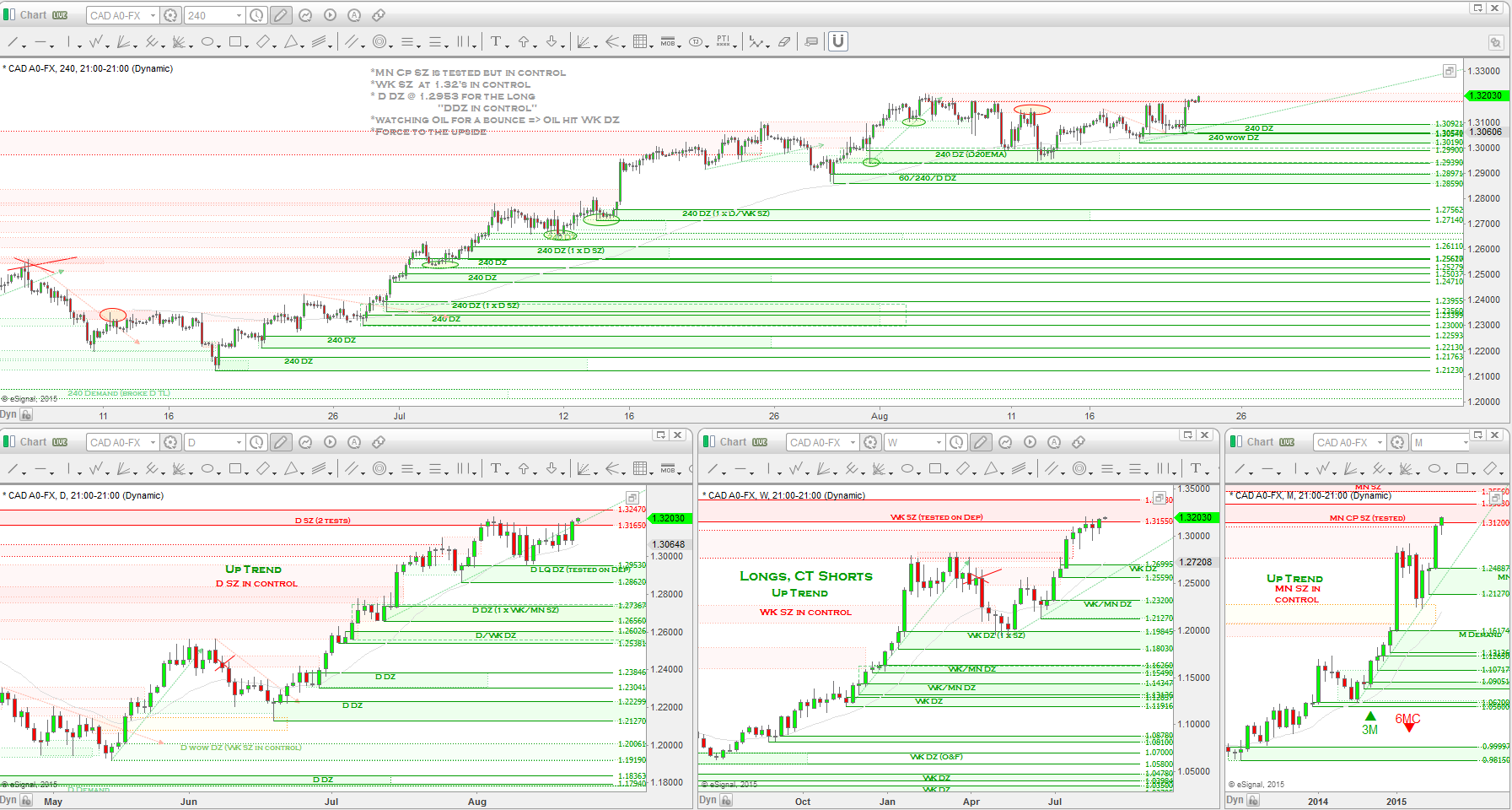

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds reduced longs and slightly increased shorts this past week as they continued to take profits on their long held long positions. The Last three weeks in fact have been all profit taking and since short positions have barely made any changes, a reversal of trend is not likely at this point. On the charts, we are sitting within tested 3MN Supply that is a CP against the MN up trend. Still monitoring Oil as a potential bottom could be forming now. Until that happens, a continued rally in the USD would most likely cause this pair to continue it's strength to the upside, especially after watching is consolidate this week while the USD dropped from D Supply.

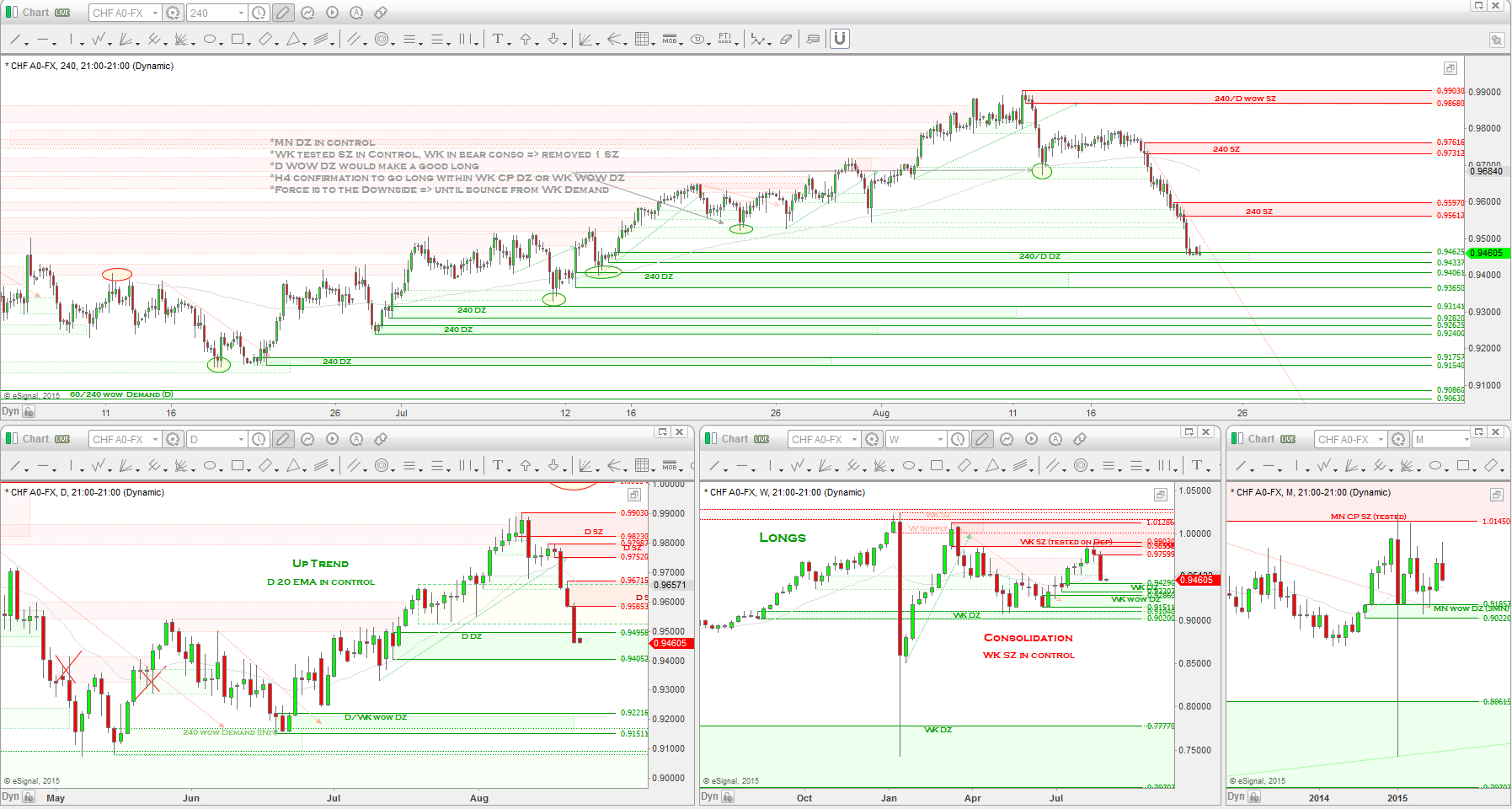

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds continued to reduce longs and increase shorts this week as price rallied straight into D and WK Supply and began to drop. Last week I mentioned how we were into supply territory as the USD consolidated and it would make sense to see long positions be closed out and that it exactly what we are seeing happen now. About 1500 long contracts were closed as WK Supply came into effect. On the charts, we may see some consolidation now as the pairs begins to coil up between WK Supply and WK Demand after the massive volatility we have experience this year for this pair.

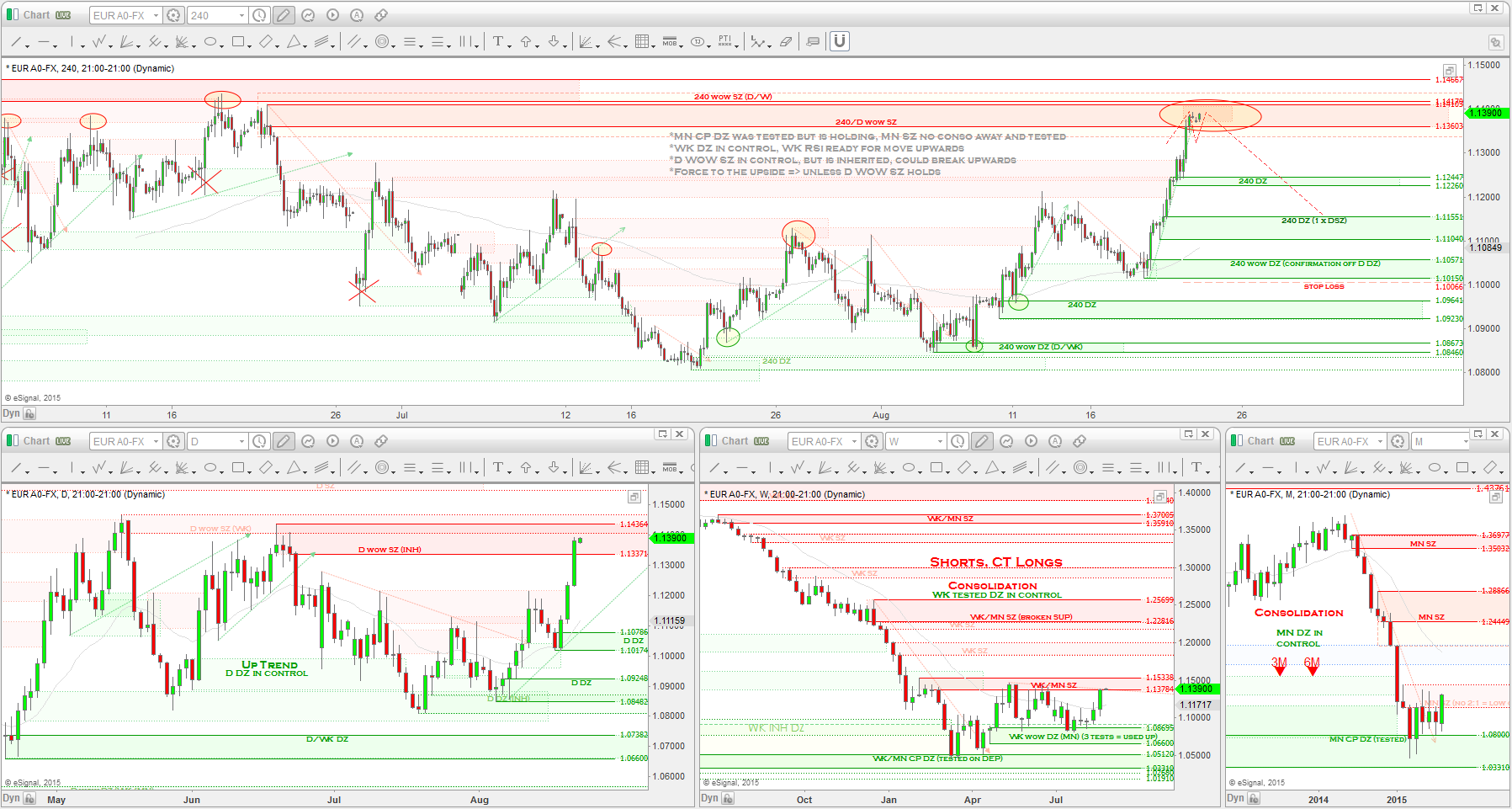

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds increased longs from 74k to 75 and increased shorts from 142k to 156k and in doing so increased short exposure from 66% to 67%. This all came as we saw price rally up into the 1.17's and then just as quickly drop to the D DZ responsible for removing a WK SZ. So although the D ascending TL had been broken and the drop in price came after hitting D SZ/WK flip zone, the pressure downwards not being cause by WK Supply made the "important D DZ" hold well and therefore cause a really nice spike in price. As mentioned, this is a scenario I have become all to familiar with as I have testing these scenario's out in order to determine some solid stats to included new rules into my trading plan.

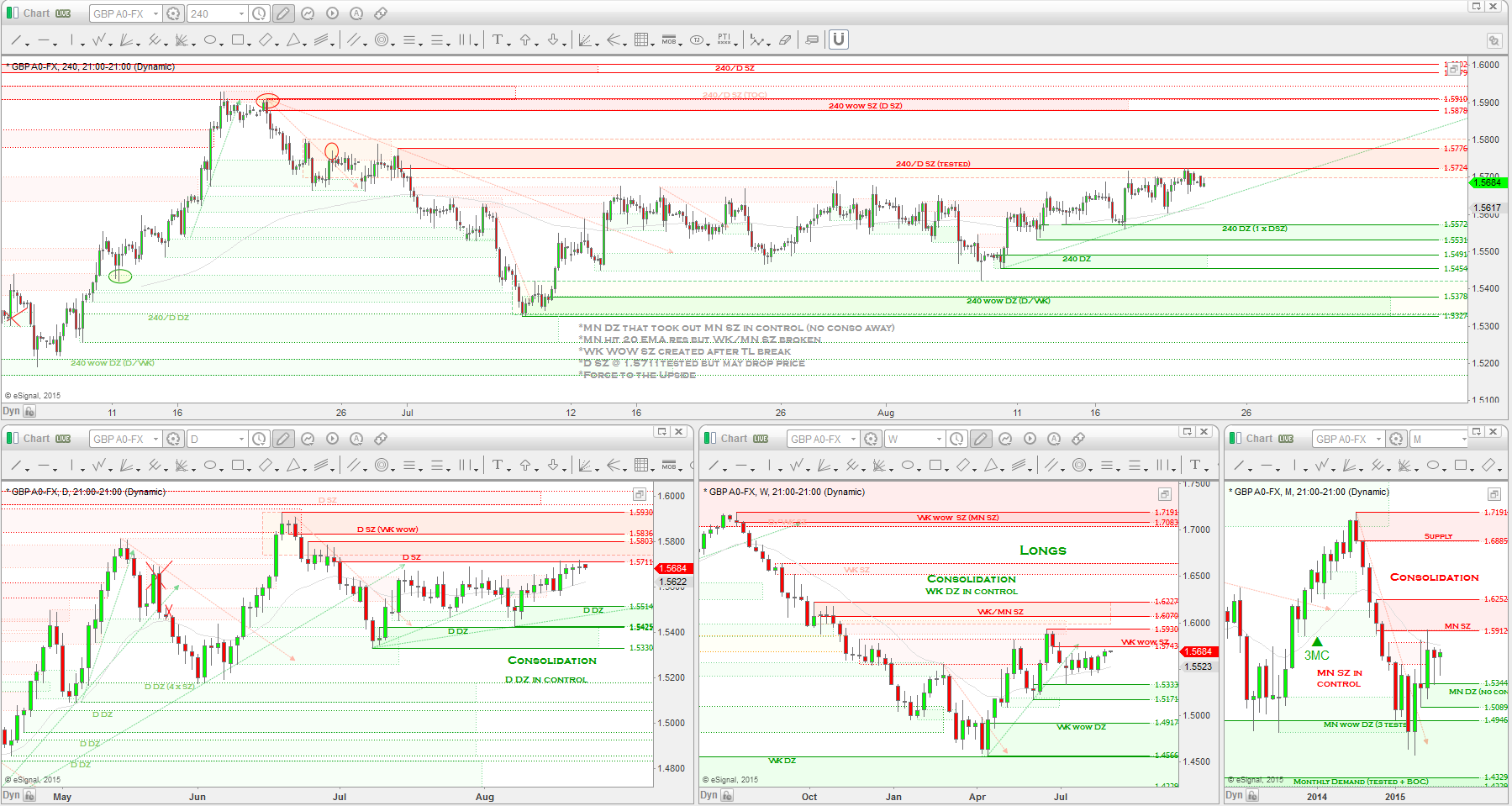

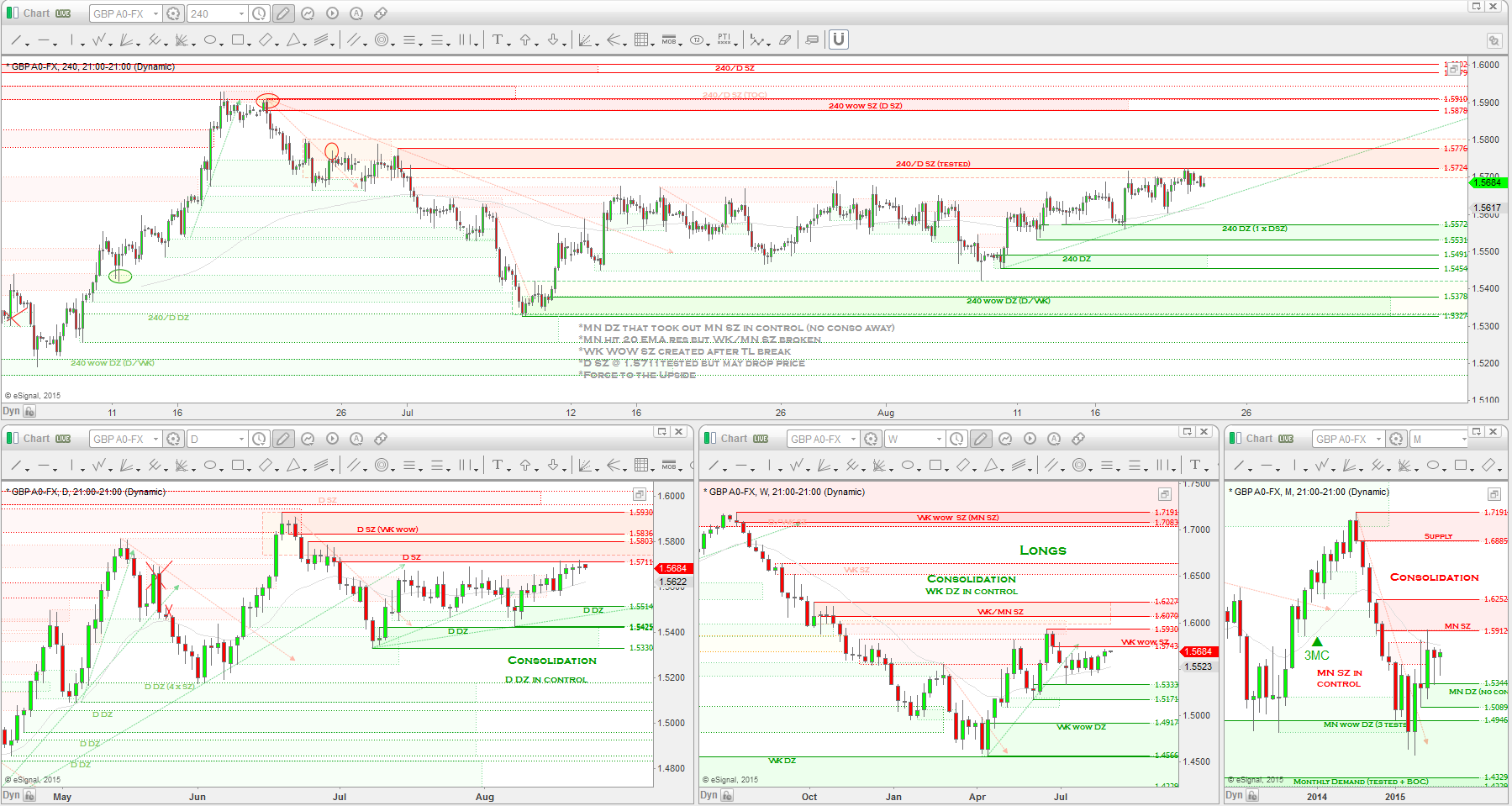

GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds reduced their longs from 47k to 43k and increased shorts from 59 to 61k as they continue with the short bias once again. Short exposure is up 3% to 58% in the process. On the charts, we saw price drop from a WK WOW SZ and bounce off a tested WK DZ. Again, as mentioned last week, the charts suggest the force is to the downside and this weeks data helps support this theme. After seeing the bias switch from short to long and now short once again one wonders, what could possibly be going on in the heads of those institutional traders? Has there been a switch of sentiment regarding the BOE increasing rates in the future? Possibly!

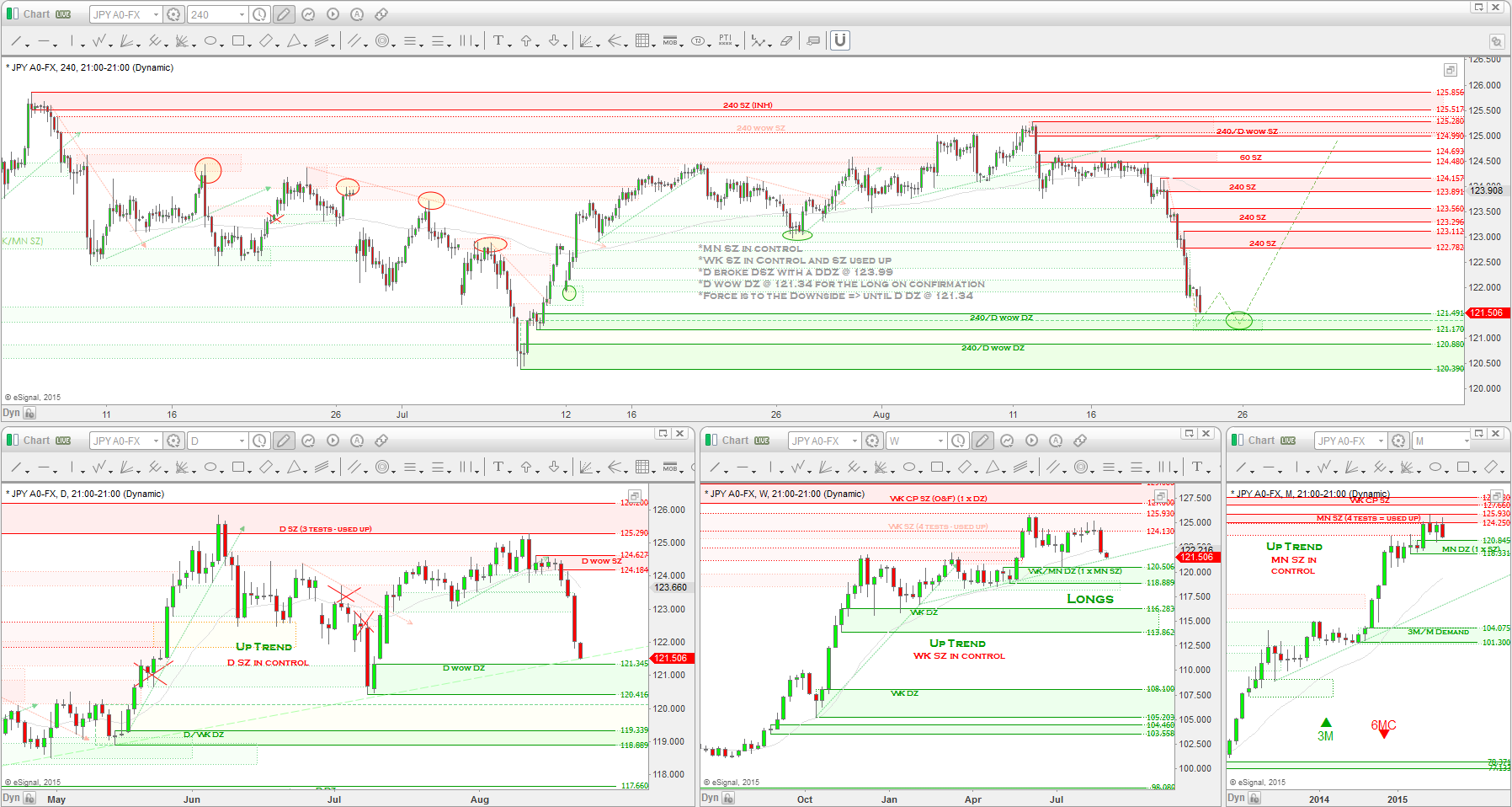

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds reduced longs from 83k to 69k and also short from 68k to 63k. So once again the hedge funds continue to take profits from their long positions and now their short positions. Since mid August we have seen them close out a total of around 81,000 contacts long as price created a double top at a MN SZ. Since then, a MN DZ has been taken out and a case for a trend reversal is starting to take shape. On the charts, WK and MN is in bullish consolidation and the Daily just broke a down trend as price began to consolidate. The bias on the Yen is becoming neutral as position exposure now sits at 53% long and 47% short. The next few weeks will be very telling for sure, but if the charts are any indication of what's to come, I think we'll start to see short exposure continue to break through the 50% threshold and continue higher. Just my opinion.

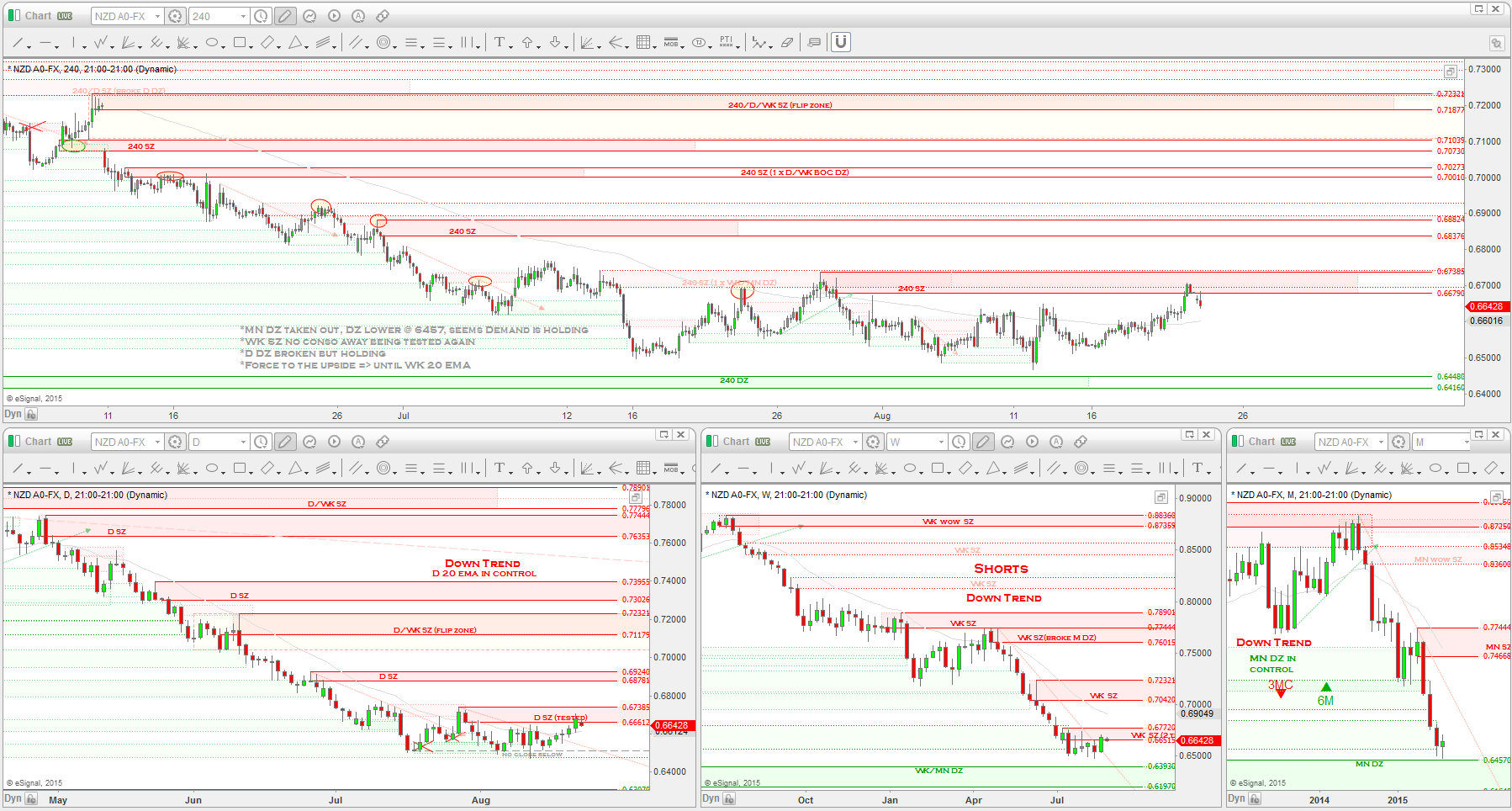

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds reduced their longs and increased their shorts this past week as the RBNZ decided to decrease rates. Short exposure sits at 67% right now, an increase from 62% the previous week. On the charts, we saw price drop back into MN inherited CP Demand but not yet breaking through the D or WK DZ's. Seems it's going to take a lot more than a rate cut to drop the Kiwi through this area of demand. With a WK SZ that removed a 3MN DZ in control, the bias remains short and I think if we see the USD continue it's rally higher, it'll be what we will need to see these levels break.

That's it for this week traders! I am pumped to see what happens this week. I don't personally see the Fed raising rates just yet, but what do I know, anything is possible. What I do know is the USD charts looks like it could use a breather and that the Hedge Funds are still heavily long the currency. The USD is sitting at a Monthly flip zone at 92.50 after attempting to break up past this area back in 2004 and then in 2005. Now in 2015 it has happened and we are sitting right at the point of the breakout. This consolidation could be perceived as the breather that was needed and now the hedge funds are revving the USD engine in preparation to take off once again. Odd's suggest just that.... and that is all I go by!

US DOLLAR => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds increased their longs from 60k to 63k and also slightly increased shorts from 9.5k to 9.8k. Total long exposure went higher from 86% to 87%. This comes as price rallied into D Supply, which price has now fallen from. Next weeks report will most likely reflect this drop by an increase in shorts or profit taking. A lot of consolidation has been happening during the last few weeks as a lot of talk has been hyping this coming weeks announcement. It's clear where the hedge funds stand at this point and it's clearly a long bias heading into the FOMC statement.

AUDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: NEUTRAL

Notes: The hedge funds hardly made any adjustments to their positions this past week and last, but next week, on the report, I am sure we will see either their longs being added to or shorts being covered. At this point it seems as though shorts are being covered as the short position continue to slowly decrease. Good AUD employment data was said to be cause of the rally from this pair, but in fact it was caused by a WK DZ as we can see by the chart below. I'm still waiting for a short set-up to unfold as everything is pointing to a further move down.

USDCAD => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: NEUTRAL

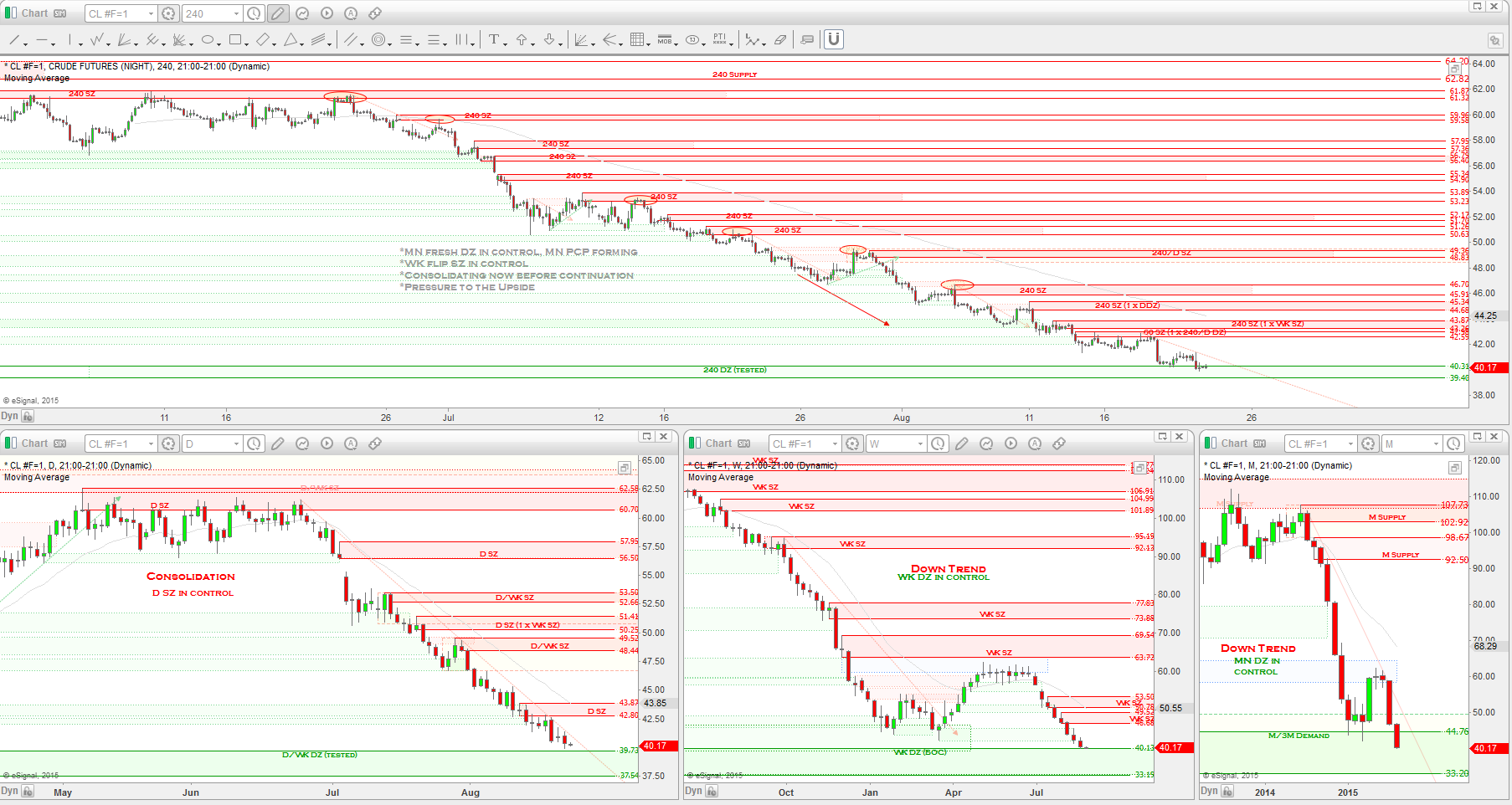

Notes: The hedge funds reduced longs and slightly increased shorts this past week as they continued to take profits on their long held long positions. The Last three weeks in fact have been all profit taking and since short positions have barely made any changes, a reversal of trend is not likely at this point. On the charts, we are sitting within tested 3MN Supply that is a CP against the MN up trend. Still monitoring Oil as a potential bottom could be forming now. Until that happens, a continued rally in the USD would most likely cause this pair to continue it's strength to the upside, especially after watching is consolidate this week while the USD dropped from D Supply.

USDCHF => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds continued to reduce longs and increase shorts this week as price rallied straight into D and WK Supply and began to drop. Last week I mentioned how we were into supply territory as the USD consolidated and it would make sense to see long positions be closed out and that it exactly what we are seeing happen now. About 1500 long contracts were closed as WK Supply came into effect. On the charts, we may see some consolidation now as the pairs begins to coil up between WK Supply and WK Demand after the massive volatility we have experience this year for this pair.

EURUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds increased longs from 74k to 75 and increased shorts from 142k to 156k and in doing so increased short exposure from 66% to 67%. This all came as we saw price rally up into the 1.17's and then just as quickly drop to the D DZ responsible for removing a WK SZ. So although the D ascending TL had been broken and the drop in price came after hitting D SZ/WK flip zone, the pressure downwards not being cause by WK Supply made the "important D DZ" hold well and therefore cause a really nice spike in price. As mentioned, this is a scenario I have become all to familiar with as I have testing these scenario's out in order to determine some solid stats to included new rules into my trading plan.

GBPUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: HAWKISH

Notes: The hedge funds reduced their longs from 47k to 43k and increased shorts from 59 to 61k as they continue with the short bias once again. Short exposure is up 3% to 58% in the process. On the charts, we saw price drop from a WK WOW SZ and bounce off a tested WK DZ. Again, as mentioned last week, the charts suggest the force is to the downside and this weeks data helps support this theme. After seeing the bias switch from short to long and now short once again one wonders, what could possibly be going on in the heads of those institutional traders? Has there been a switch of sentiment regarding the BOE increasing rates in the future? Possibly!

USDJPY => COT REPORT: Institutional traders are LONG biased.

Perception of Monetary Standing: VERY DOVISH

Notes: The hedge funds reduced longs from 83k to 69k and also short from 68k to 63k. So once again the hedge funds continue to take profits from their long positions and now their short positions. Since mid August we have seen them close out a total of around 81,000 contacts long as price created a double top at a MN SZ. Since then, a MN DZ has been taken out and a case for a trend reversal is starting to take shape. On the charts, WK and MN is in bullish consolidation and the Daily just broke a down trend as price began to consolidate. The bias on the Yen is becoming neutral as position exposure now sits at 53% long and 47% short. The next few weeks will be very telling for sure, but if the charts are any indication of what's to come, I think we'll start to see short exposure continue to break through the 50% threshold and continue higher. Just my opinion.

NZDUSD => COT REPORT: Institutional traders are SHORT biased.

Perception of Monetary Standing: DOVISH

Notes: The hedge funds reduced their longs and increased their shorts this past week as the RBNZ decided to decrease rates. Short exposure sits at 67% right now, an increase from 62% the previous week. On the charts, we saw price drop back into MN inherited CP Demand but not yet breaking through the D or WK DZ's. Seems it's going to take a lot more than a rate cut to drop the Kiwi through this area of demand. With a WK SZ that removed a 3MN DZ in control, the bias remains short and I think if we see the USD continue it's rally higher, it'll be what we will need to see these levels break.

That's it for this week traders! I am pumped to see what happens this week. I don't personally see the Fed raising rates just yet, but what do I know, anything is possible. What I do know is the USD charts looks like it could use a breather and that the Hedge Funds are still heavily long the currency. The USD is sitting at a Monthly flip zone at 92.50 after attempting to break up past this area back in 2004 and then in 2005. Now in 2015 it has happened and we are sitting right at the point of the breakout. This consolidation could be perceived as the breather that was needed and now the hedge funds are revving the USD engine in preparation to take off once again. Odd's suggest just that.... and that is all I go by!

Notes:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional traders

are SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

THE SETUP:

THE SETUP: ->

Video Link ==>

https://gyazo.com/321531d744dd883e3fb4133608f596c3

$USDCAD -> Commitment Of Traders Report: Institutional traders

$USDCAD -> Commitment Of Traders Report: Institutional tradersare SHORT biased. Perception of Monetary Standing: NUETRAL

Notes:

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

$USDCHF -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: DOVISH

Notes: Trend is up on the monthly, bullish consolidation on the weekly and down trend on the daily chart.

THE SETUP:

THE SETUP:

$GBPUSD -> Commitment Of Traders Report: Institutional traders are SHORT biased. Perception of Monetary Standing: HAWKISH

Notes:

THE SETUP:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/e6462b808e0760e6142f501397fa9fda

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISH

$USDJPY -> Commitment Of Traders Report: Institutional traders are LONG biased. Perception of Monetary Standing: VERY DOVISHNotes:

THE SETUP:

Video Link ==>

https://gyazo.com/e9f272b57e10e0c405897182e8d39b43

https://gyazo.com/d61632b6308565e4ab3b990c2f9ea4cd

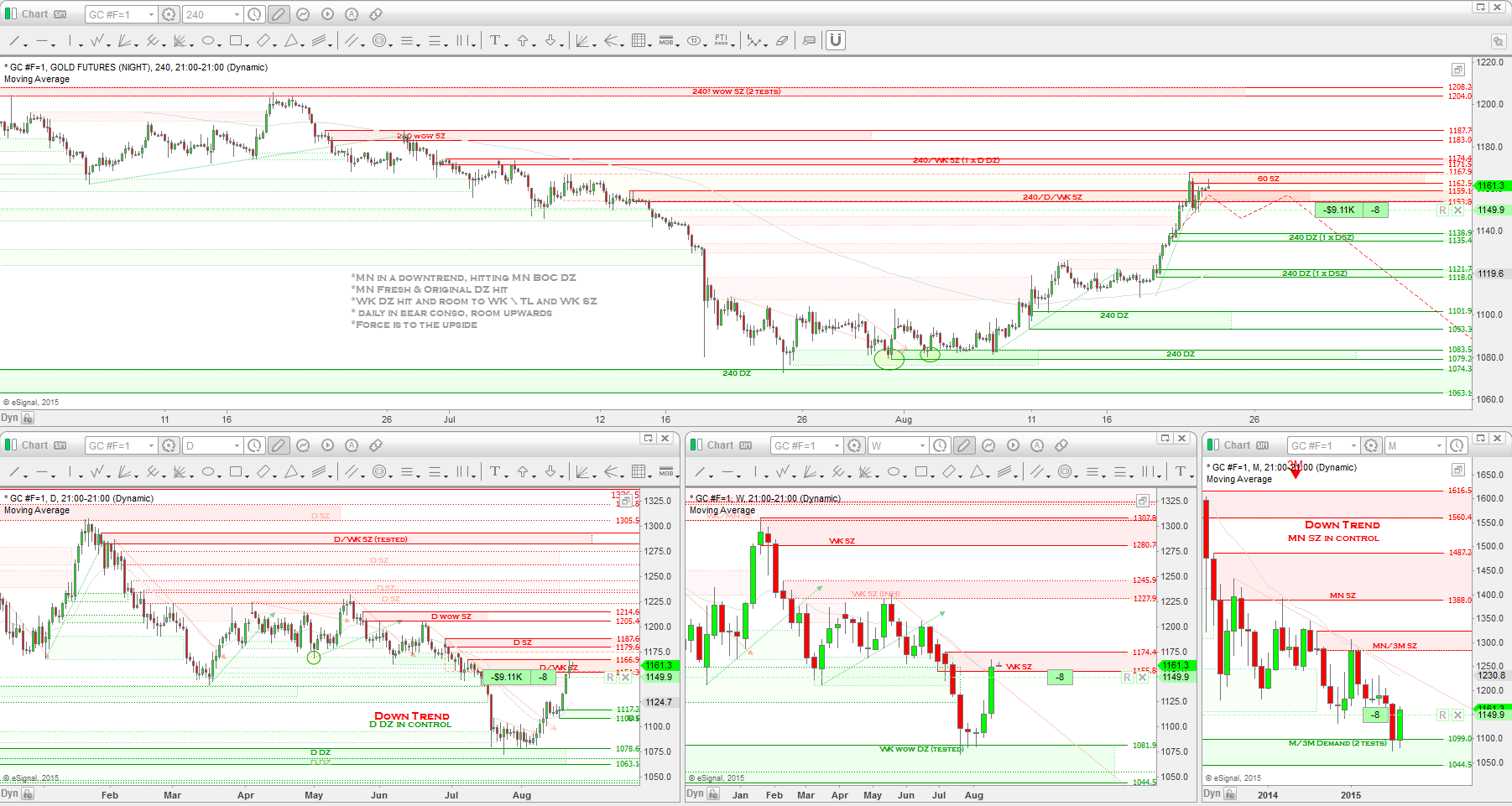

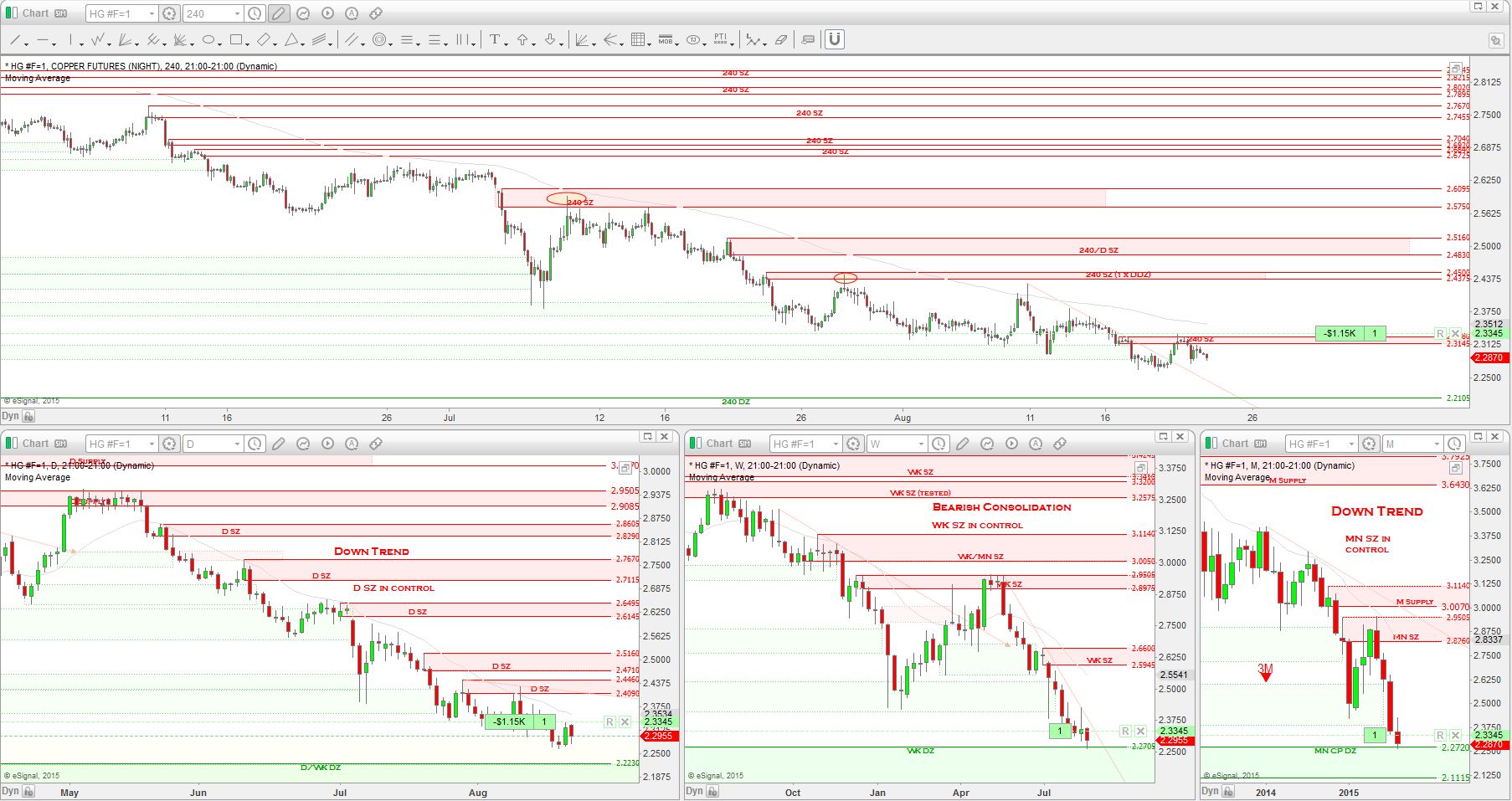

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Video Link ==>

https://gyazo.com/d1fd69a1e2d15b5155d61d121fe6a326

Commitment Of Traders Report: Institutional traders are LONG biased.

Notes:

THE SETUP:

Commitment Of Traders Report: Institutional traders are VERY LONG biased.

Notes:

THE SETUP:

Video Link ==>

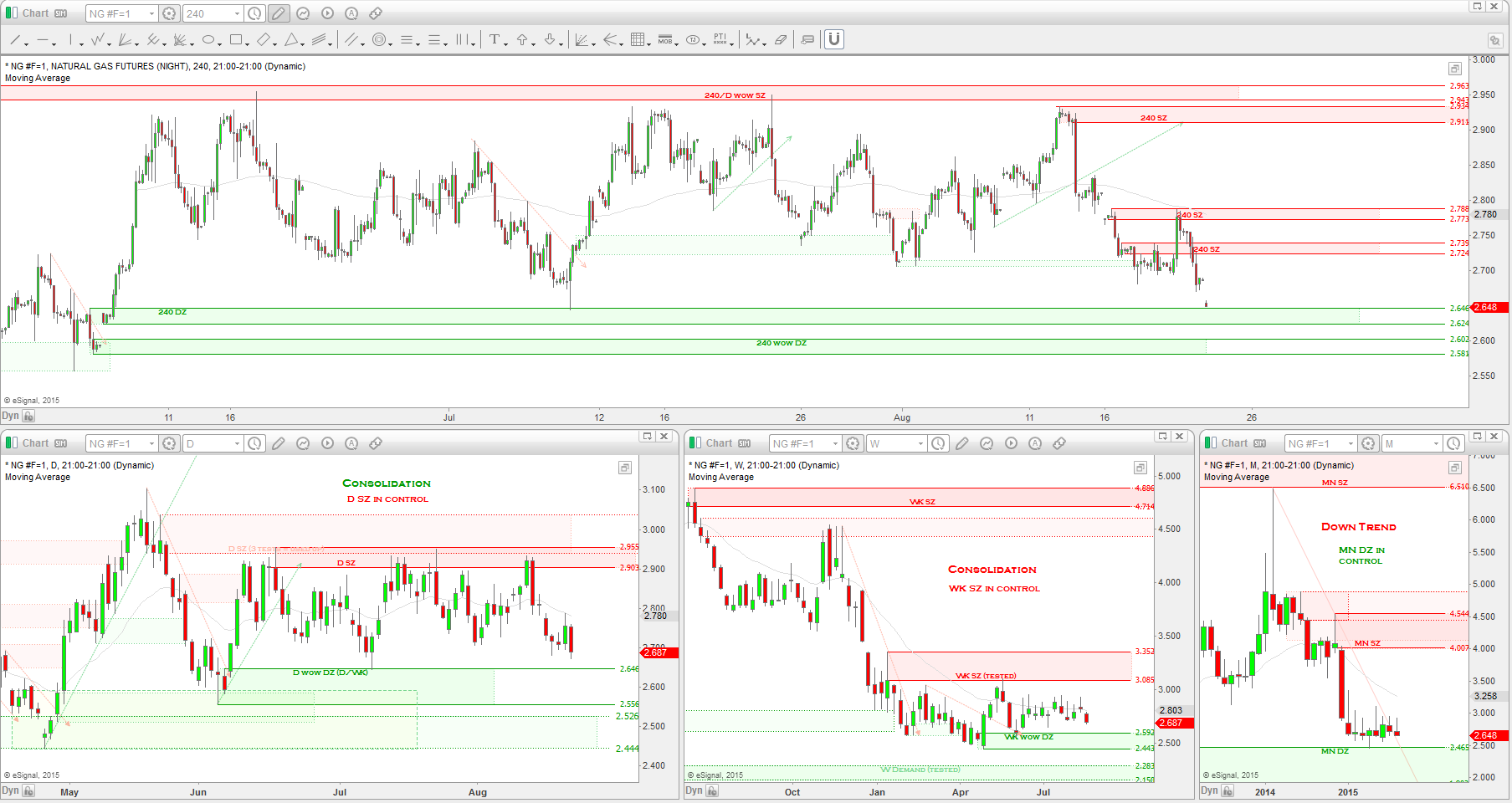

Commitment Of Traders Report: Institutional traders are VERY SHORT biased.

Notes:

THE SETUP:

Video Link ==>

Notes: Trend is down on the monthly, down on the weekly and bearish consolidation on the daily chart.

*WK SZ and WK TL in control

*WK SZ and WK TL in control

THE SETUP: LONG @ 0.7365, SL @ 0.7306, TP - technical stop

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

Video Link ==>

May 18 (10:15pm) -> Trade Activated.

May 20 (9:30am) -> Trade Closed early for small loss.

Trade Review -> https://www.tradebench.com/share_trade/c09da628ffcf32f27aaae7ac4f6a29f1

No comments:

Post a Comment